Summary

Real interest rates in the US and Europe have reached negative levels that are unprecedented in recent history. We have to go back to the 1970s to find similar levels, and only a handful of past examples since WWII can be used as reference points. We think the journey back to zero could be one of the key drivers of crossasset relative returns and volatility. The move could hurt bonds’ risk adjusted returns and credit IG; it should weigh on equities, favour Value over Growth stocks and cyclicals vs defensives; and it should be negative for gold.

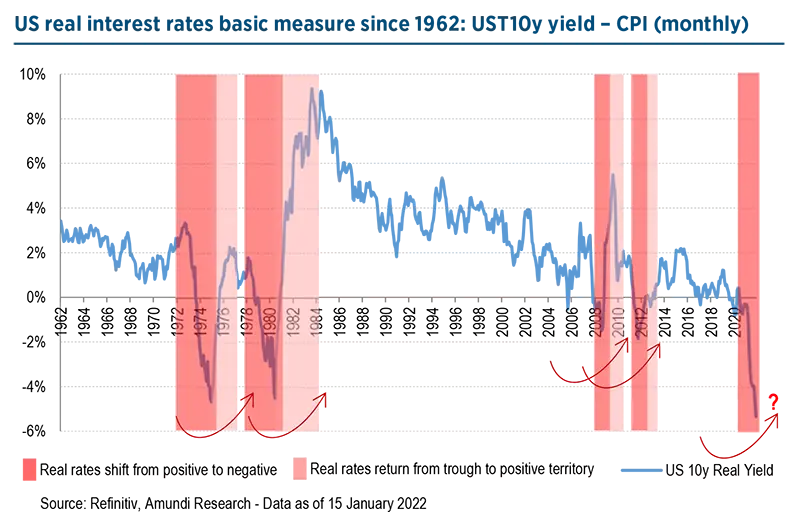

Inflation is raging across the globe and has reached record levels in the US and Europe. Low policy interest rates and central banks’ asset purchase programs have kept nominal interest rates at low levels, while headline and core inflation keep rising. This brought real interest rates first below zero and now deeply into negative territory, to levels unseen since the 1970s.

According to Amundi’s scenario, real bond yields should bottom out in the first quarter of 2022 in the US and Europe. The Federal Reserve could make more hikes than anticipated and implement quantitative tightening faster – or more aggressively – than expected. The European Central Bank could also be pressured to stop its negative interest rate policy and end its asset purchase program sooner. Assuming that inflation does not rise much further from today’s levels, we could even see real yields move faster towards zero than expected by the market. Significant changes in real interest rates have macroeconomic consequences, particularly in the assessment of capital investment trends, savings real returns, and public debt sustainability, just to name a few.

Assessing the impact of real interest rate moves across the asset classes

The journey back to zero will have significant implications for cross-asset relative returns and style rotation. Although one variable cannot alone explain all assets returns and co-movement, studying asset class behaviour in a rising-real-yield environment should be helpful for implementing the right investment strategies in 2022.

- The first finding is that moving up real yields from their negative trough is not a progressive trending move, but more an abrupt upward move towards zero. Indeed, real yields are far more volatile when they are in negative territory than not. The sharp move back to zero happens because both parameters are moving in opposite directions at the same time, i.e., nominal rates are moving up while inflation is moving down. The speed is a function of the initial level of inflation and the breakevens’ embedded pricing premium.

- The second important impact of rising real interest rates is that bond volatility should rise on both the front and the long end of the curve. TIPS are more volatile, too, during those phases. Higher bond yield volatility combined with tight monetary conditions; rising real yields could be headwinds for credit markets in the US and elsewhere.

- Third, the impact on equities is more complex and unclear than usually described. Indeed, the correlation between equity index returns and changes in real bond yields is not stable and is close to zero over the long term. The outcome is a function of the underlying positive or negative growth trend. Changes in real yields are a key driver of sector and style rotation. In a nutshell, the journey back to zero should lead to an outperformance of value stocks versus growth stocks, and an outperformance of financials and some cyclical sectors. Because of sectors’ relative weights, Europe should benefit in relative terms.

- Finally, rising real interest rates should supportive for the USD and in particular versus the EUR, as long as the ECB keeps its existing policy. Changes in gold prices are highly correlated with the level of real interest rates1. The price of gold in dollar terms has historically risen when real interest rates are entering negative territory and tend to fall when real interest rates are returning back to zero.

Timing the way back to zero

Real interest rates being the difference between nominal and inflation (realised or expected), they can increase because of higher nominal rates or lower inflation (and expectations) or a combination of both. Looking at previous periods when real interest rates turned (significantly) negative, and using our macroeconomic scenario and interest rates assumptions for the US, we believe the movement will mainly come from lower inflation and last between 12 to 18 months.

Where can real interest rates go?

The long-term drivers of real interest rates are monetary policy, the savings/investment balance, the relative demand for safe assets, and output relative to potential. According to IMF studies2, monetary policy was the main driver of real rates in the 1980s and 1990s, by the sharp rise of savings in EM while global investments declined in the 2000s, and the demand for safe assets since the Global Financial Crisis due to the volatility of equities. The factors maintaining real interest at low levels are still at play post-Covid, particularly the relative riskiness of equities vs bonds, and excess savings. Therefore, we should expect real interest rates to revert back to the range of the last decade, but they are unlikely to move further up at least over the medium term.

Diverging real interest rates as a source of diversification

Over the previous decade, real interest rates have increasingly moved together to the extent that market participants and economist have been forecasting a “global interest rate”. Post-Covid, the asynchrony of business cycles, and monetary and fiscal policies between regions is such that we are more likely to see a variety of real interest rates, impacting asset prices and valuations in a different way. The most obvious case today is the comparison between Europe and the US. Therefore, we should expect a temporary divergence of real interest rates on both sides of the pond. The People’s Bank of China, on the other hand, is done with tightening policies and is starting to reduce nominal interest rate and real rates, too. Therefore, real interest rates could become a source of portfolio diversification.

“In or out ” of negative territory are important steps or critical zones for markets, but so is the bottoming-out process. The impact on markets comes more from the rate of change rather than the actual level, although starting from a very low negative real interest rate should make the adjustment more brutal and push market volatility even further.

Defining real interest rates |

| There are many ways to define real interest rates, using actual inflation (headline or core) or inflation expectations from market participants (forward inflation or TIPS), or short or long-term maturity bonds. To highlight some of the key market moves, we use the simple measure of the US 10-year Treasury yield compared with actual CPI on a monthly basis. In a more detailed study to be published we show a more sophisticated measure, adjusting for the liquidity premium to assess the “pure” real rate. We have noticed that under the extreme circumstances that we are going through now, both measures provide a similar outcome. |