Summary

Emerging Market bonds, including Indian bonds, may offer attractive opportunities for investors in search of higher yields as inflation slows and the Federal Reserve is approaching its first rate cut.

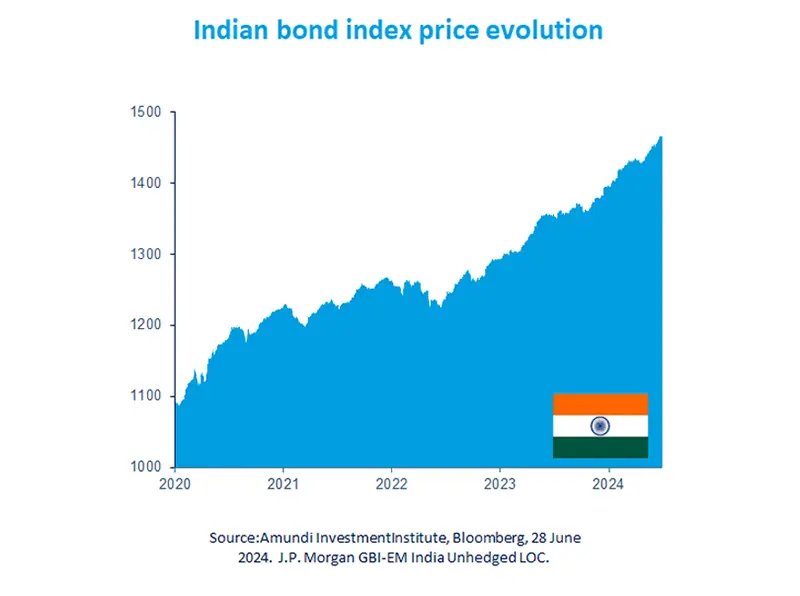

- The inclusion of Indian bonds in a prominent emerging markets index has sparked renewed investor interest.

- India is a structural growth story, supported by a prudent government spending approach.

- Emerging Market bonds may provide opportunities for yield-seeking investors.

Indian government bonds have gained attention recently due to their inclusion in a leading emerging markets bond index starting from 28 June. This key milestone has sparked renewed interest from global investors.

India is expected to be the fastest-growing economy among the G20 in 2024 and it is currently undergoing a significant transformation driven by increased investment and favourable demographics. With expectations of strong economic growth for the country, we believe the government is likely to broadly maintain a prudent fiscal stance.

On monetary policy, the Reserve Bank of India is vigilant on inflation and appears committed to bringing inflation down to its 4% target.

Actionable ideas

- India bonds

For global investors, Indian bonds may offer diversification1 benefits and attractive yields (around 7%*).

- Emerging market bonds

The macroeconomic environment, with the easing of monetary policy, should support for Emerging Market bonds in the second part of the year.

*Source:Bloomberg, 28 June 2024. Yield on the 10-year India government bond.

This week at a glance

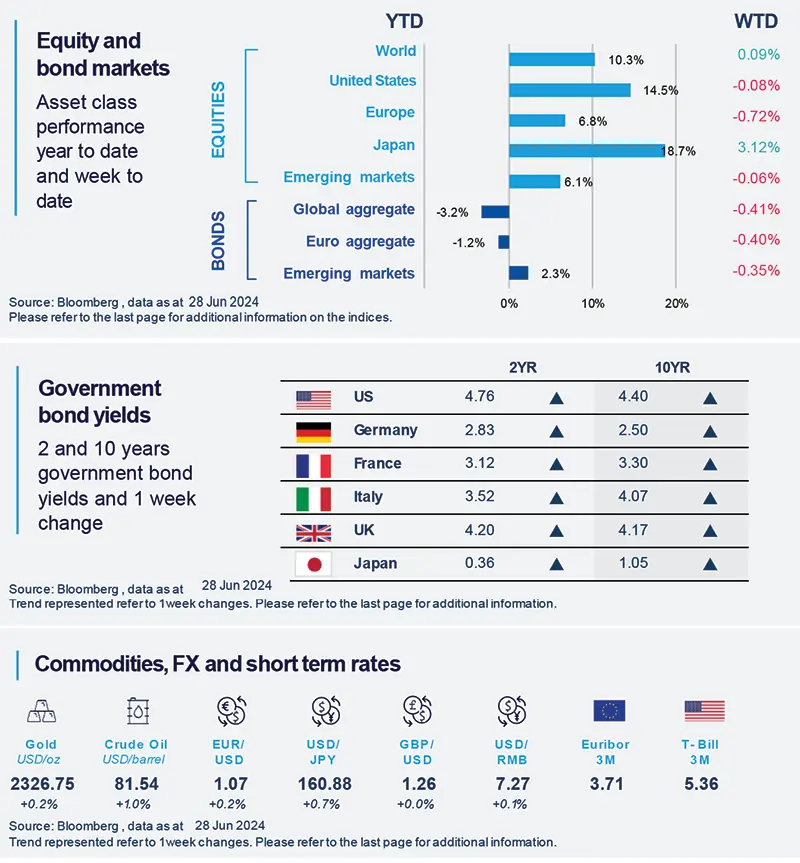

In Japan, the Topix index reached its highest level since 1990, driven by strong performance in banks and positive economic data. Other major equity indexes were stable during the week. Long-term government bond yields slightly rose due to recent economic data and political newsflow.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 28 June 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

1 Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

United States: downside surprise on core durable goods orders as high rates bite

In the second quarter, business spending on equipment showed signs of weakening, as non-defence capital goods orders excluding aircraft (which serve as a proxy for business spending plans) declined by 0.6% in May. This decline indicates that US companies are facing pressure from higher interest rates and softer demand for goods, which is impacting their willingness to invest.

Europe

Euro Area consumer confidence continues its gradual recovery.

The consumer confidence indicator edged up further in June, on better financial situation and intentions to make major purchases while expectations on future financial situation and the general economic situation remained unchanged. The index reached the highest level since February 2022, yet still falling slightly short of its long-term average.

Asia

Japan consumption on track of a rebound

Japan's retail sales growth in May exceeded economist expectations, with a strong increase of 1.7% compared to April. This data supports our view that Japan's private consumption is rebounding in the second quarter, following four consecutive quarters of decline.

Key Dates

|

2 Jul EZ CPI estimate |

3 Jul US PMI, US ISM, UK PMI, CaixinChina PMI, Minutes of Fed’s June FOMC meeting |

5 Jul US labour markets |