Summary

- Election outcome: Narendra Modi is on course for his third mandate as a Prime Minister, but the results were much more subdued compared to the exit polls. The first big change is that Modi would have to govern, without his party BJP having a majority on its own. He will depend on NDA allies to form a government. One of the main question marks is whether the reduced parliamentary majority will allow enough stability to carry on with the political agenda.

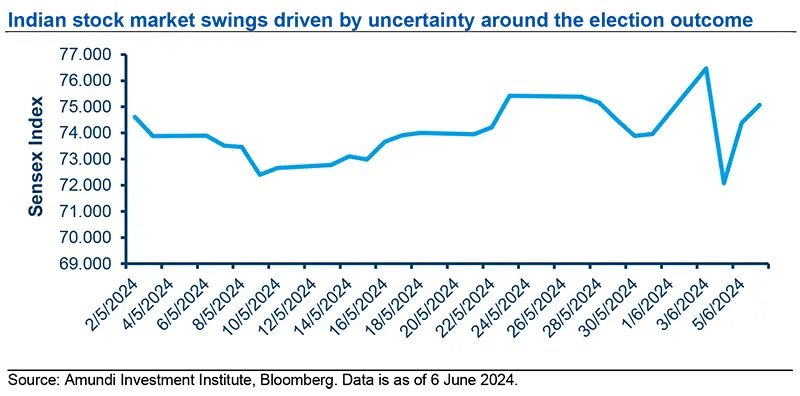

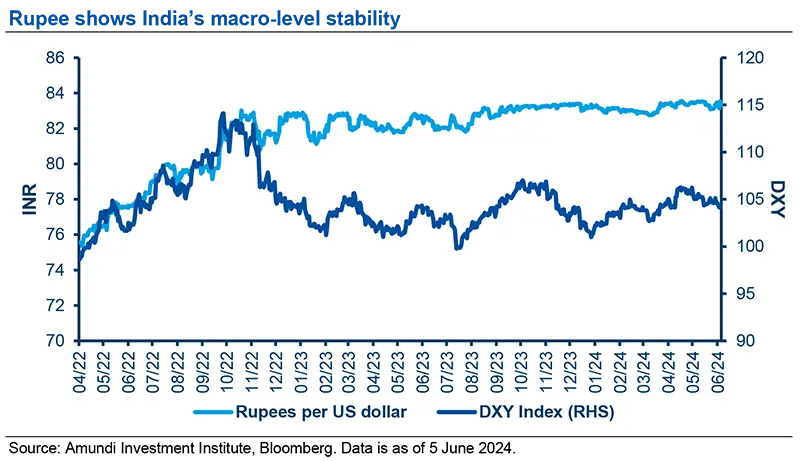

- Market reaction: markets reacted negatively to a thinner majority for Prime Minister Narendra Modi-led alliance. The Indian equity market declined sharply, bond yields spiked, and the rupee depreciated. Despite the widespread sell-off on Tuesday, Indian equity indices have recovered post-election losses and have experienced a remarkable surge, standing at closing levels of last week in a highly volatile market.

- Macro overview: the economic outlook remains robust, with a very strong economic performance led by domestic demand and committed to fiscal consolidation. While there is a buffer to accommodate more social expenditure, fiscal indicators should be carefully monitored. With an orthodox Monetary policy, inflation is gradually cooling. We don’t see any material change in RBI1 stance: no rush to cut and the room to ease is limited, thanks to the Indian growth-inflation mix.

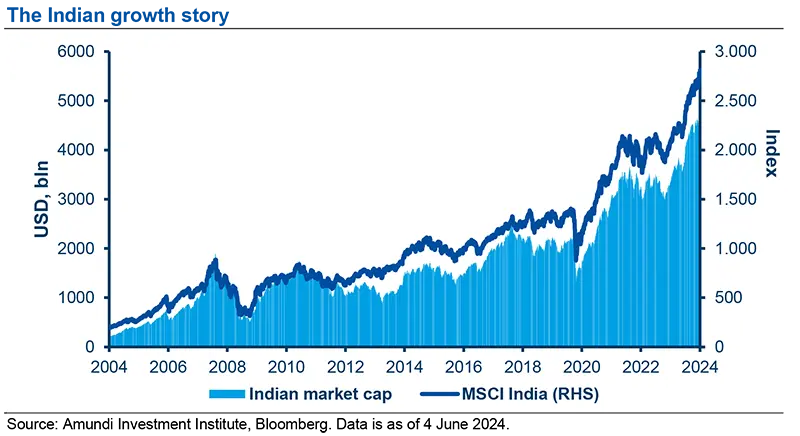

- Investment implications: we are positive on Indian assets driven by economic growth, macro stability and strong demand. Solid earnings dynamics and favourable long-term structural tailwinds make India’s equity markets attractive, with a potential bigger place in global investment portfolios.

1.Reserve Bank of India

What is the overview of India's national election?

India has recently concluded a national election, one which has taken place over the past six weeks and has seen nearly 650 million people flock to the polls to elect India’s political leadership over the next five years. The country officially announced its elections results on 4 June, the turnout was quite high with 66.3% of voters participating. The outcome fell short of the exit polls expectations for the incumbent National Democratic Alliance coalition (NDA), led by the Bhartiya Janta Party (BJP). It was also short of the BJP’s performance in 2019 elections. The BJP, led by Narendra Modi, secured 240 parliamentary seats on its own this time, compared to 303 in the 2019 elections. In order to form a government the NDA coalition needs a minimum of 272 seats. Hence, to form a government for the third consecutive term, Modi will need to rely on his other coalition partners.

Collectively, the BJP and the NDA, which have dominated the country’s politics since 2014, won a third consecutive mandate with 293 seats, a number still above the simple majority of 272. So, although Modi won the mandate again this time, the BJP failed to secure a majority on its own.

Modi won the elections with a much narrower victory than in 2019, and would need to rely on allies to form the government for the third consecutive term.

What should we expect from the next government’s political agenda?

The narrower-than-expected majority for the major ruling party means that the BJP needs to accommodate more of the coalition partners' requests. Markets were expecting a strong result in favour of the incumbent government and hence continuity in current policies. However, the actual results are much weaker than expected for the present government.

A major implication of this election will be whether government policy continues at the same pace in regards to capital spending or whether this will encourage a loosening of the fiscal purse towards social spending. The new government may be encouraged to increase minimum support price for agricultural products, subsidies for farmers, and allocation for rural employment guarantee scheme etc; Also, the key reforms that were expected like land, labour or judiciary might take a backseat. Some of these structural reforms and the most ambitious economic/political targets, such as the agriculture/land and power reforms, are relevant to unlocking the country’s potential. However, we should not underestimate the progress already made in the direction of ease of doing business or micro-reforms (digital transition and labour) and the continuity that even a smaller majority allows.

In recognition of that, last week S&P revised the Credit Outlook to positive from stable (Sovereign Rating at BBB-), regardless of the elections results. The move also recognised India’s long-term journey in terms of growth performance and policy adequacy.

A thin majority for Prime Minister still allows him to carry out major economic reforms, but there is an increasing risk for the new government to engage in unproductive expenditure.

What has been the market's reaction to Modi’s reduced majority?

After an initial positive market reaction last Monday, due to the exit polls showing that Prime Minister Narendra Modi's ruling party could easily win the election, a closer-than-expected outcome has impacted Indian markets. Equity indices declined by 6%, marking their largest decline in more than four years. Indian bond yields spiked by around 10 basis points, and the very stable rupee experienced its worst drop in a year. After the biggest fall since March 2020, Indian stocks have recovered partially amid the potential support to form a coalition government. However, the volatility may continue if the thin majority erodes further as the date for government formation gets closer.

The fiscal policy consolidation coincides with an orthodox monetary policy. A good sign of this long-term positive trend is the recent upgrade of India's sovereign rating to 'positive' by S&P.

What are our current views on the Indian economy and the macro-economic outlook going forward? Are there any risks that investors should watch out for?

India has benefitted from robust GDP growth in recent years led by domestic demand, becoming a key contributor to global economic growth. The IMF forecasts the country to deliver a 6.1% real growth rate over the next 5 years, a trajectory that would catapult India to become the world’s third largest economy. We believe this trend is set to continue thanks to a number of favourable factors:

- A number of business initiatives and policy reforms to encourage investments and improve efficiency;

- A digital transformation promoted via various government initiatives.

Fiscal policy in recent years has proven much more orthodox at the central government level, with a very strong starting point this year owing to INR 1.3 trillion of extra dividend transfer by RBI. In the July Budget revision, it’s important to see a confirmed pledge of commitment to the FY25 Budget, that seeks to sustain growth and offer a stronger fiscal consolidation. At the same time the current account deficit has moderated since the Taper Tantrum episode, improving external conditions and insulating India from a hypothetical external shock.

The main risk to monitor is the diversion towards unproductive expenditure vs capex. The fiscal policy consolidation coincides an orthodox monetary policy that has anchored inflation expectations. Thereby, we expect the RBI to be on hold in the short term and with limited room to ease due to the growth-inflation mix.

Where do you see opportunities for foreign investors?

Beyond the short-term volatility, we maintain a constructive view on Indian equity market, supported by strong growth conditions, with inflation well anchored and policy stance remaining neutral to accommodative. A robust economic cycle helps mitigate slightly higher valuations, and strong earnings dynamics also remain positive for the asset class. The Q4 FY 2024 earnings results slightly exceeded expectations, driven by strong performances in the banking and automobile sectors. The long-term earnings outlook also remains positive.

Corporate profits as a proportion of GDP in India have reversed the downtrend of the past decade and have been reverting higher for the past three years. This suggests we are in the early stages of an earnings expansion cycle and bodes well for long-term investors. At a sector level, industrials, capital goods, construction and other manufacturing-oriented sectors along with public sector enterprises that were well placed to benefit from the government’s thrust of capital spends, were the primary beneficiaries in this bull run.

Fixed Income space is attractive, with the highest nominal sovereign yields among Asian IG countries. Furthermore, there are a couple of positive points for foreign investors:

- The volatility in the Rupee is reducing, and depreciation is quite contained.

- Financialisation of savings is leading to huge inflows towards pension funds and insurance, collectively investing two-thirds of their AUMs in Fixed Income. This is structurally positive for demand for this asset class.

We keep a constructive view on Indian equity, supported by a robust economic cycle and strong earnings dynamics.

What does the inclusion of Indian bonds in benchmarks mean for Indian markets?

Indian bonds are set to be added to global indices, becoming a clear sign of their macro stability and potential as long-term investments. The inclusion of Indian government bonds into the JPM GBI EM Index on 28 June and Bloomberg’s EM Local Currency Index in September should drive passive inflows of around $25 billion into the asset class over the next 15 months. India is expected to be among the highest weighted countries in the GBI-EM, with a capped weight of 10%.