Summary

- Gold has risen about +30% since fall of 2023 through a series of spikes, some of which were not easy to connect with specific events or fundamentals. A combination of factors actually played out. Essentially, the rise in gold could signal a transition to a new phase of the economic cycle that might not look the same as the post-GFC era that has prevailed so far.

- For now, markets remain busy assessing when central banks will start to cut rates. Beyond temporary doubts regarding the pace of disinflation, they are pricing that rates being held at elevated levels for a while longer will ensure that the economy returns to normal.

- The surging gold price appears to disagree. With rates structurally higher than in the last decade, a shallow ‘repair phase’ looming in the absence of any serious economic dislocations, an end to the China-led global trade expansion, and shorter economic cycles will all be sources of continued uncertainty, calling for hedges.

- The uncertain medium-term inflation equilibrium, in a tug of war between inflationary pressures (including stalling globalisation and ballooning debt) and deflationary factors (including AI driven productivity and below-par economic growth), will also require hedges.

- Additionally, waning confidence in fiat currencies and a growing defiance against the dollar are supporting gold. Though a major currency crisis looks unlikely in the near term, profligate fiscal policies and diversification away from dollar transactions will steadily draw new fans to gold.

- A structural rise in geopolitical risk and domestic instability will also lead investors to rethink portfolio diversification – aiming to factor in a greater variety of risks with uneven timeframes, amid scarcer liquidity, richer valuations, crowded allocations. Gold will be part of the solution.

- Because of its liquidity, diversification features, appeal as an investment and to mitigate the implicit portfolio exposures to fiat currencies, gold will likely be granted a higher allocation.

A false sense of security as the economic cycle appears to be returning to ‘normal’. It’s not.

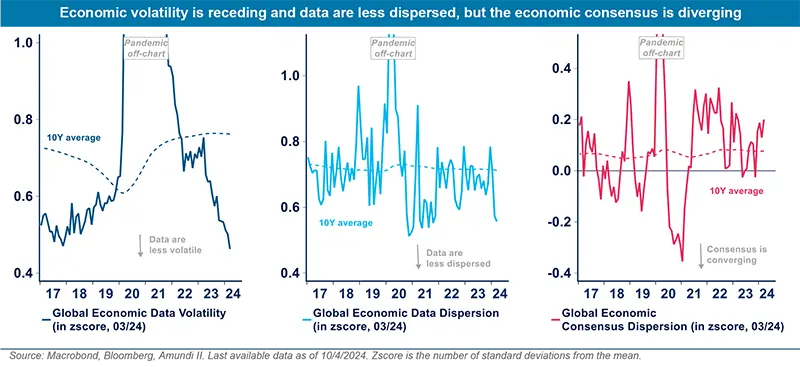

While markets are currently pricing in some delays in monetary easing, their base case implicitly remains that of a return to economic normality. After all, the imbalances stemming from the pandemic and the Ukraine invasion supply shocks are receding. Inflation is normalising, central banks’ balance sheets are being shrunk, natural gas and energy prices are way off their peaks, and the volatility of economic data is back to cruise level.

Unfortunately, we do not believe the global economy is close to finding a new balance, and is even less likely to be reverting to an ‘old normal’. Surging gold and a dichotomy between gold and other precious metals that are primarily driven by industrial demand also reflect scepticism.

- First, rates are bound to stay substantially above the last decade’s average with scarcer liquidity, as emphasised by intensifying doubts about the true level of the neutral rate, seen settling around 2%+ in Developed Markets (DM) countries up from 1%. Once bitten by surging inflation, central banks will likely be twice as shy going forward. As a result of less expansionary liquidity, cyclical assets might be more constrained than they have been used to over the last decade.

- Second, global growth proved to be more resilient than expected to surging rates. The absence of widespread economic dislocations (except in commercial real estate) implies that a ‘repair phase’ would lack impetus.

- Third, following its spectacular rise over the last two decades, China now has to fix its excess capacities, especially in the property sector. Its contribution to global growth will be structurally lower, with multiple implications for commodities, investment and inflation. Given the weakness of its domestic consumption, China will likely focus on exports, further straining its partners’ current accounts. The contribution to world trade from other Asian countries is likely to expand, but their climb in global supply chains will take time.

- Fourth, the supply of resources (supported over the last decade by the US’s shale discoveries and commodity price wars, amid limited geopolitical tensions) will be a greater source of struggle, with surging demand from decarbonisation.

- Fifth, changes in labour markets and consumption behaviour (from goods to services) induced by the pandemic will imply more uncertainty in economic modelling, as well as the rebalancing of credit from the private sector to governments’ balance sheets (limiting public spending, giving room for private investment).

- Finally, economic cycles could be shorter than they used to be, probably 3-5 years compared to 7-10 years in the past, due to less fluid trade and supply chains, more volatile inventories, demand frequently changing, and faster information/capital flows.

For all of these reasons, once monetary pivots have started, we expect the next phase of the cycle to be a source of multiple uncertainties, leading investors to seek a haven in gold. The magnitude of AI productivity gains, how the energy transition unravels and potential private sector releveraging will be key markers to monitor.

The uncertain medium-term inflation equilibrium will require hedges

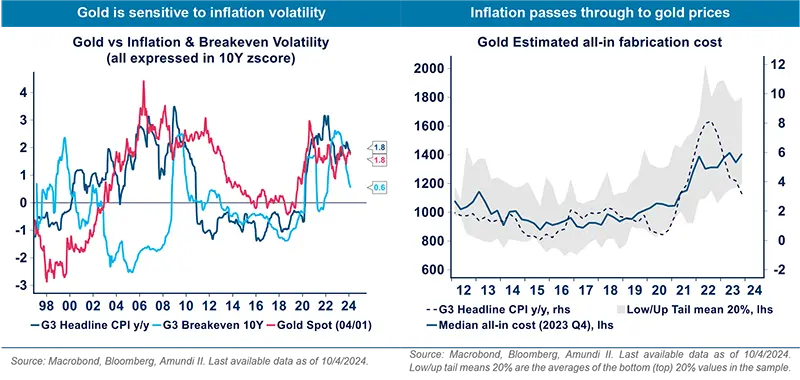

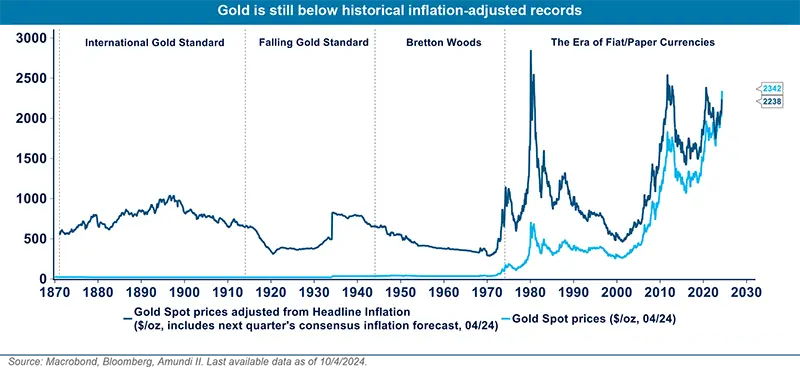

Gold provides a strong hedge against inflation when at extreme levels (hyperinflation, stagflation, or deflation) and for as long as policy responses remain unconvincing. Hence the elevated gold correlation with inflation volatility. In the short-term, healthy US consumption, expanding global liquidity and resilient global growth are spreading doubt regarding disinflation, especially in the US, which is mixed news for gold as it also delays monetary pivots.

In the longer run, a tug of war between inflationary pressures (stalling globalisation, re-onshoring, greater supplychain buffers, bubbling public debt and potential private sector releveraging) and deflationary factors (AI-driven productivity, below-par economic growth, and mixed inflation implications from demography and the energy transition) will require hedging, boosting gold.

Debasement risk is accelerating and will impose painful adjustments in the long run

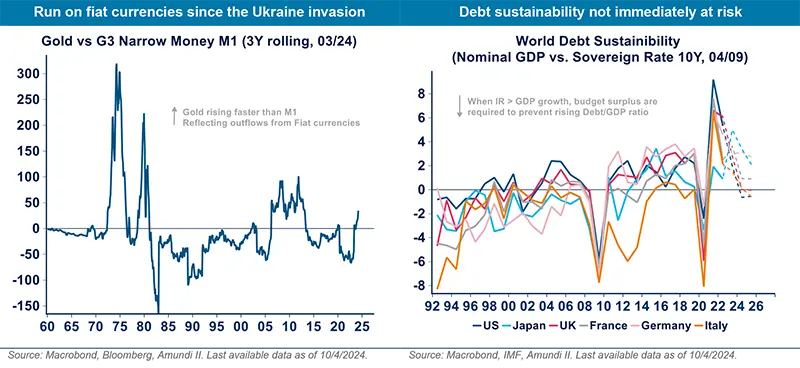

With global debt running north of $300tn and 3.3x world GDP, the recent rush to gold and cryptos does not seem that surprising. Outflows from fiat currencies started by fall of 2022, shortly after inflation reached its peak, at a magnitude last seen in the late 70s-early 80s and around the GFC. We do not expect a pending meltdown, however, considering i) tighter current monetary policies and moderating macro liquidity, ii) quantitative tightening for a few more months and a gradual increase in the longer-term duration funding of US deficits, iii) debt sustainability not under immediate pressure as inflation is easing debt metrics, with no apparent stress in EU periphery countries, iv) only a few currencies facing serious devaluation, and v) limited threat to the dollar for the foreseeable future, given its largely unchallenged role in the global financial system and the relative appeal of US assets and growth prospects.

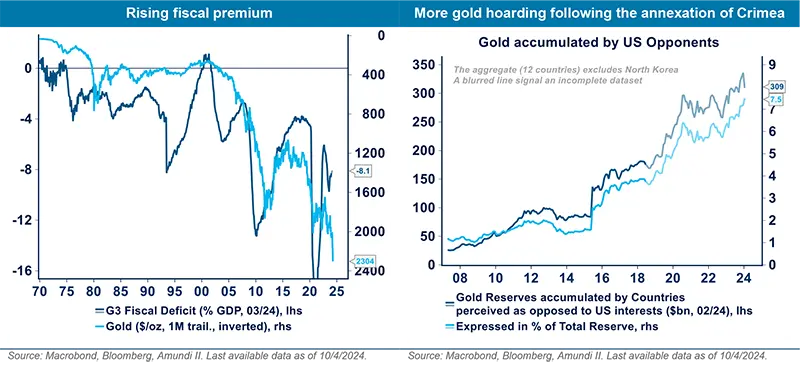

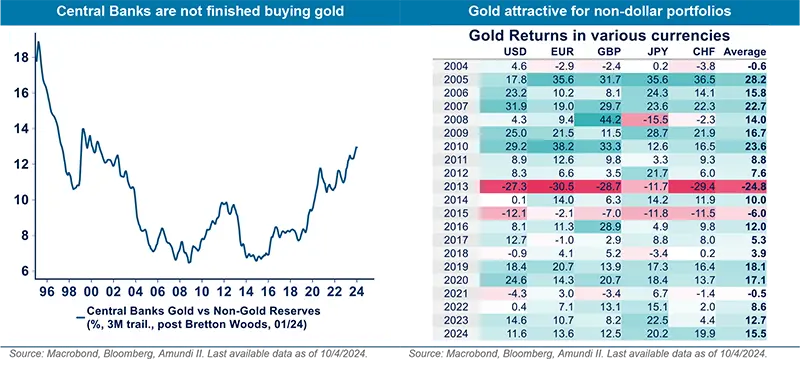

Instead, we expect gold to factor in debasement risk via fiscal deficits that may continue to beat their own records ahead of the US elections and as the energy transition accelerates. The growing reluctance to store reserves in Western currencies is providing strong extra support. In particular, countries perceived to be US opponents have been hoarding gold since the annexation of Crimea in 2014. The US’s recent pledged attempts to seize $285 billion in Russian assets, that were frozen in 2022, likely contributed to the recent spike in gold and bitcoin.

Rising geopolitical risk and domestic instability should favour gold

The world order is changing and geopolitics will likely be a lasting variable for markets. The intensifying US-China rivalry, more versatile power alignments, an uncoordinated response to global issues, the declining Western model influence, an accelerating arms race, more protectionism and regional blocks, the struggle to secure supplies of base resources, and the tech/semiconductor war are all well-known ingredients. Ballooning debt has often also been a powerful transmission channel for conflict. In addition, domestic stability is eroding, fuelled by an unsustainable distribution of wealth, resulting in increased political fragmentation and a weakening social pact in Western democracies. Several key disruptions may also place increased pressure on societies, including the challenges and cost of climate change, AI’s fast revolution, the intensifying cybersecurity threat, ageing populations, and migration flows. The gold’s current steep “contango” (a situation where the futures price is higher than the spot price) usually signals mounting medium-term risks.

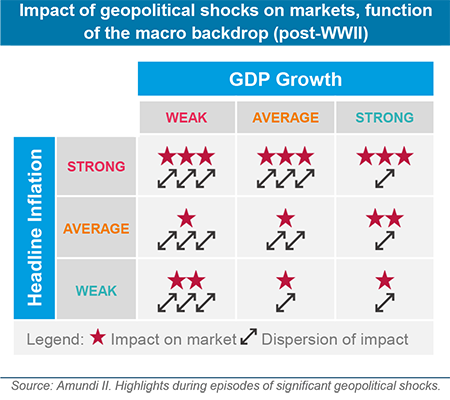

How geopolitics impacts markets varies greatly over time though, it is a function of the geography and contagion risks, near- and longer-term geostrategic and economic implications, as well as countries’ uneven ability and resources to navigate these risks.

Among the significant shocks post-WWII, we find that the impact from geopolitics on gold, volatility or oil was the easiest to isolate when markets were not distracted by weak macro conditions.

Furthermore, these shocks tended to be the most impactful for markets when triggering or contributing to a surge in inflation. In contrast, the impact was more diluted and heterogeneous at times of weak growth or low inflation. As medium-term inflation uncertainty is likely to stay above par, we expect gold’s sensitivity to geopolitics to grow.

Seven reasons why Gold should be granted a sizeable allocation in diversified portfolios

First, it’s a liquid market with limited counterparty risk. The most traditional way of investing in gold is by buying bullion bars or coins. Investors can also purchase gold exchange-traded products (including ETCs) or gold certificates, to avoid the risks and costs associated with the transfer and storage of physical bullion. Investors can alternatively invest in gold via derivatives, such as forwards, futures and options. The indirect way to have exposure to gold is through shares of gold mining companies – these appear cheap overall (P/E forward at 16), deliver an appealing relative dividend yield (1.8%), enjoy improving operating margins, and have room to improve their ROE.

Second, gold is a particularly attractive diversifying tool. The golden age of diversification is over: the equity/bond return correlation – now in positive territory – will likely gradually revert to neutrality, providing limited statistical comfort. Furthermore, portfolio managers are facing a wider variety of risks with uneven timeframes, as a return to the last decade’s normal seems improbable amid scarcer global liquidity, richer valuations and more crowded allocations. Investors will thus have to rethink diversification, using a broader combination of tools that include relative-value arbitrage, hedge funds’ alpha, tactical trading… and gold, which is likely to play out in the big leagues too. The alternative obvious safe havens (the US dollar and the Swiss franc to some extent) are themselves fiat currencies subject to growing defiance. Other hedging tools come with strings attached: options and volatility are short-term strategies, real assets are illiquid, and cryptos are not mature enough and face key questions regarding supply control and cybersecurity.

Third, gold offers protection against a wide range of risks regardless of their nature, geographic location, or timing, provided they have global fallout: a nice substitute for complex customised hedging strategies. Importantly, as buy-and-hold investors (including monetary institutions and pension funds) are dominant market players, gold usually tends to price risks long in advance, thus putting less emphasis on spotting the optimal entry point.

Fourth, gold is not only an insurance but also an investment vehicle. Inflation-adjusted gold prices are still away from their past highs and gold remains under-owned (less than 5% in diversified allocations, 13% of world FX reserves, the majority of which held by DM central banks; ETF inflows should also resume once rate cuts have started). The opportunity cost to hold gold will improve when rates have pivoted (historically gold jumps around +10%) while the embedded geopolitical premium remains mild. All in all, gold has further upside potential in our view. Our fair value models suggest $2,300/oz as an initial milestone and a medium-term equilibrium around $2,500/oz, which represent our 3M and 12M targets, respectively.

Fifth, at a time when most investors are raising their bond allocation, gold can mitigate the higher resulting exposure to fiat currencies. Gold is also particularly attractive for non-dollar portfolios, avoiding gold returns being offset by a rising dollar at a time when investors are seeking a safe haven.

Sixth, in relative terms gold is attractive compared to mainstream assets, a majority of which are currently priced for perfection while delivering smaller yields (net of cash and adjusted for risk) than usual.

Lastly, thanks to its benefits in terms of diversification and hedging characteristics we believe gold deserves a 5-10% allocation within a global diversified portfolio1.

1 See “Gold in central banks' asset allocation”, March 2019.