Summary

Despite its historically high price, we believe that gold remains a safe haven and a good diversification tool at a time of high geopolitical tensions and excessive government debt.

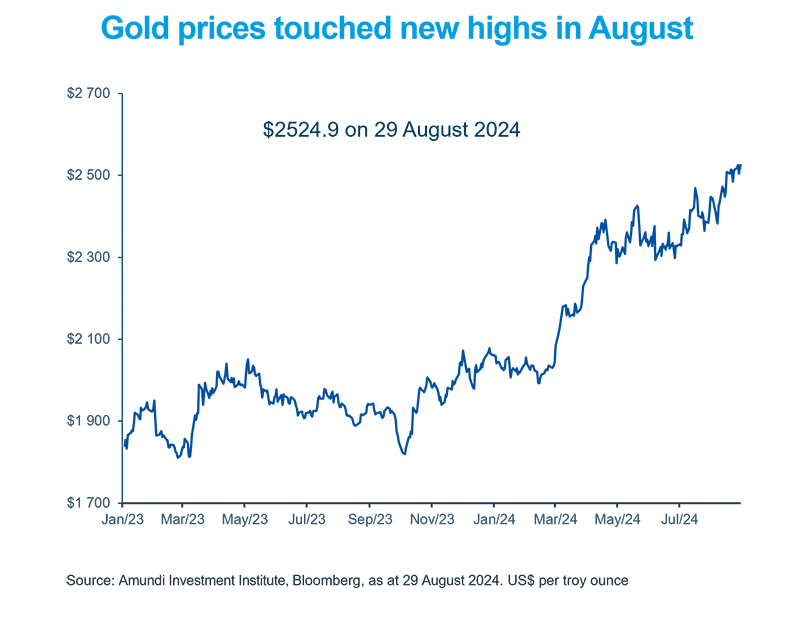

- Gold prices touched record highs in August, outperforming the S&P 500 year to date (as of 29 August).

- This is driven by multiple factors such as geopolitical tensions, expectations of Fed rate-cuts and demand from China.

- We could see near term volatility given gold’s high valuations, but from a long term view it remains attractive.

Gold touched new highs in August on the back of its safe haven appeal amid continued geopolitical tensions in the Middle East and the Russia-Ukraine war. In addition, recent weakness in the dollar (gold is priced in this currency) and expectations from the Federal Reserve to reduce interest rates, also boosted sentiment. Falling yields on US Treasuries provides additional incentive to hold the metal, which is a nonyielding asset. A long term support for gold prices is likely to come from high public debt and excessive fiscal deficits (government spending more than its income) in the US and Europe. Both these factors put pressure on government-backed currencies. Consequently, investors are encouraged to seek shelter in the safety of the precious metal as a store of long term value.

Actionable ideas

- Gold investing

Precious metals such as gold may provide stability to portfolios when geopolitical tensions are high.

- Multi Asset

Multi asset investing that allows diversification through access to assets such as gold, could help generate sustainable long term returns.*

This week at a glance

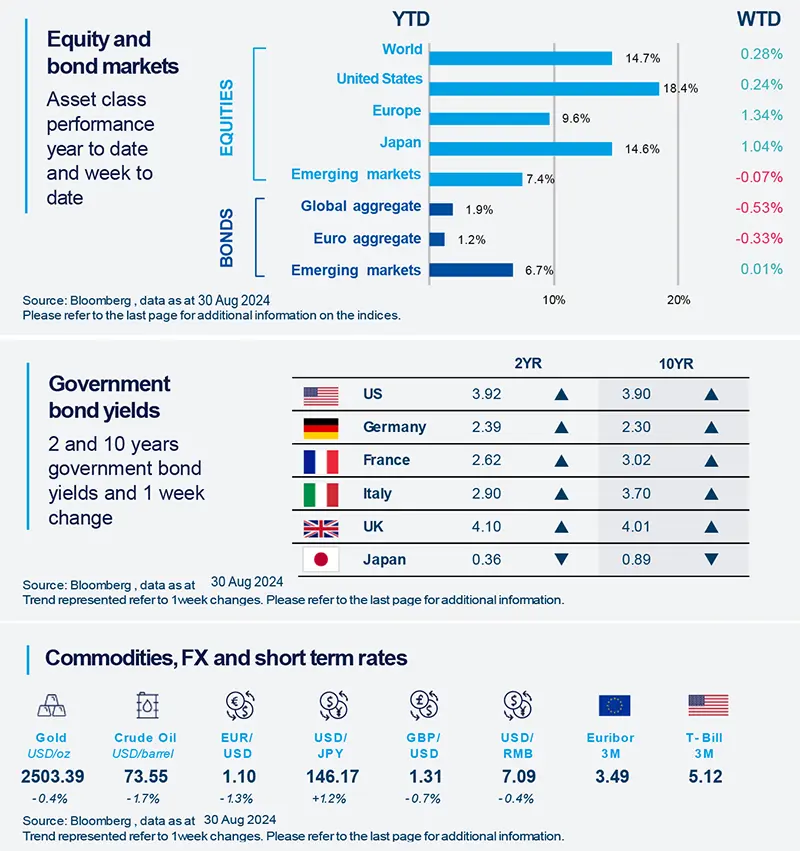

Global stocks rose on the back of expectations of rate cuts by the Fed and the ECB. An upgrade of US economic growth in the second quarter drove yields higher. In commodities, oil prices fell on concerns over excess supply from OPEC+ and weak demand from China.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 30 August 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US consumer confidence improves, at a first glance

The Conference Board consumer confidence rose in August. Although consumers’ views on current business conditions and future expectations also improved, these indicators still remain at subdued levels overall. Underlying components also show an ongoing deterioration in perception of labour markets. There was an increase in respondents saying jobs were harder to get, whereas those saying jobs were plentiful declined.

Europe

Eurozone bank lending in July came in weak

Bank lending in the Eurozone was muted for the month of July. This indicates a weak footing for overall domestic demand in the region for the third quarter. While both consumer credit and mortgages saw improvement in July, new loan volumes remained well below pre-pandemic range. Even lending to companies doesn’t point to robust credit creation. The picture in long term loans, however, has been improving, a tentative sign of a pickup in investments.

Asia

Indonesia’s external basic balance deteriorated

The basic balance deteriorated in the three months ended 30 June 2024, owing to slower growth in foreign direct investments. Current account deficit (excess of imports over exports) saw a slower widening. However, portfolio investments rose significantly over the period. As a result the rupiah appreciated, highlighting a return of investors’ appetite towards select Asian currencies.

Key Dates

|

4 Sep Euro area PPI, |

5 Sep South Korea GDP, |

6 Sep US labour markets, |