Summary

A summer of reality checks on market expectations

When central banks are cutting rates and risks of a US recession are limited, we remain disciplined and mildly positive on risk assets.

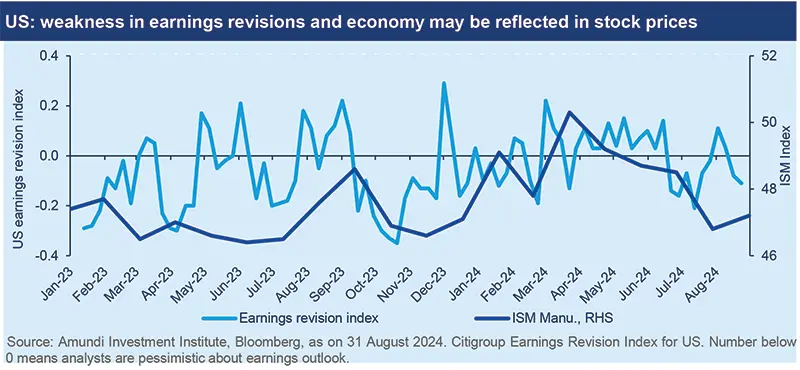

Market moves over the summer have served as a reminder that, at a time of high valuations, any mismatch on corporate earnings or monetary policy expectations and any scare on growth could be triggers for sudden falls. While most major markets have recovered from the volatility seen in early August owing to the Fed put, we cannot ignore the fact that some segments are still priced for perfection. This points to corporate earnings and policy actions coming under the spotlight even more, particularly as inflation cools, economic activity weakens and the noise around US elections increases.

- US soft landing, no-recession scenario in the US is confirmed. Slowing but not collapsing labour markets and weak fixed investments all point to a mild deceleration. For the UK, we marginally upgraded growth forecasts for this year but there are still question marks on domestic demand.

- Disinflation trend confirmed in US and Europe. We revised down our Q4 2024 headline consumer price inflation projections for the US due to weakness in unit labour costs and the employment cost index. An improvement in labour productivity should also foster disinflation. In Europe, the speed of disinflation is linked to services inflation, which could be sticky.

- The phase of central bank divergences may be coming to an end, with Japan an outlier. We expect three rate cuts from the Fed, and three each from the ECB and the Bank of England for the remainder of year.

- China is facing a difficult road to recovery. Support for the housing markets has been short lived even as labour markets deteriorated. Corporate profitability is being affected by worsening consumer confidence.

Markets are likely to remain range bound in the short term, without any strong directionality. However, there are areas of value to be explored across a broad range of assets:

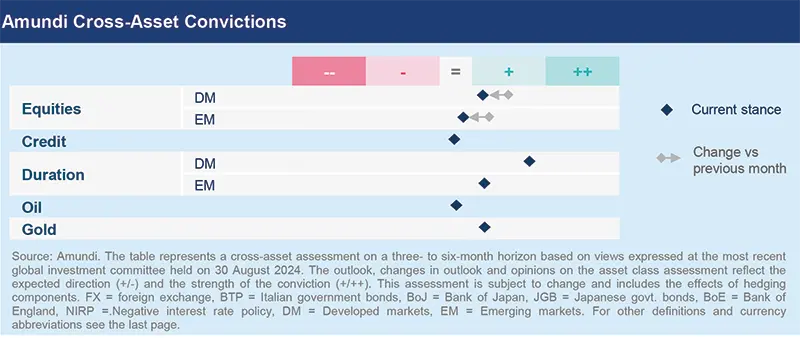

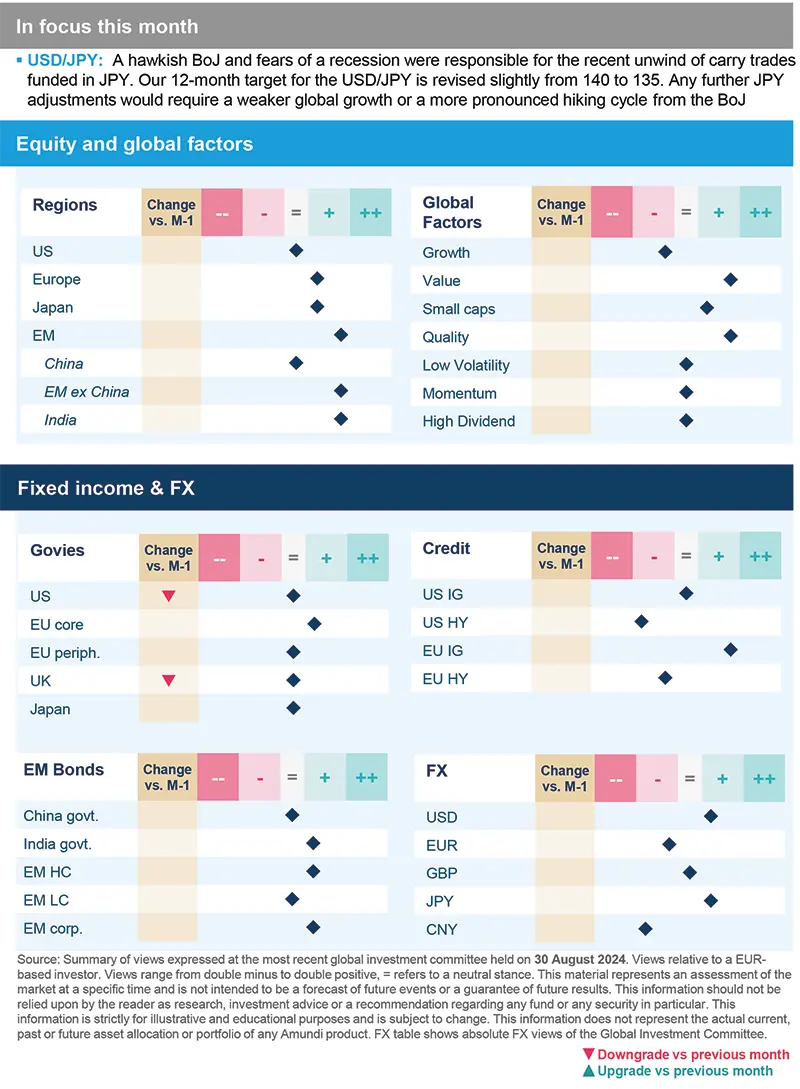

- Cross asset. A mild US economic deceleration, vulnerabilities to European growth and inflated valuations in select segments call for a prudent adjustment to risk but not for a structural de-risking. Hence, we tactically reduced our stance on the US, European small caps and EM. We remain slightly positive on equities overall through the UK and Japan. Elsewhere, although we continue to be positive on EM debt, we think volatility around US elections could affect some currencies and local debt. US Treasuries and European bonds continue to offer attractive yields, but investors should consider raising safeguards. Geopolitical tensions and the safehaven allure of gold induce us to stay positive on the metal.

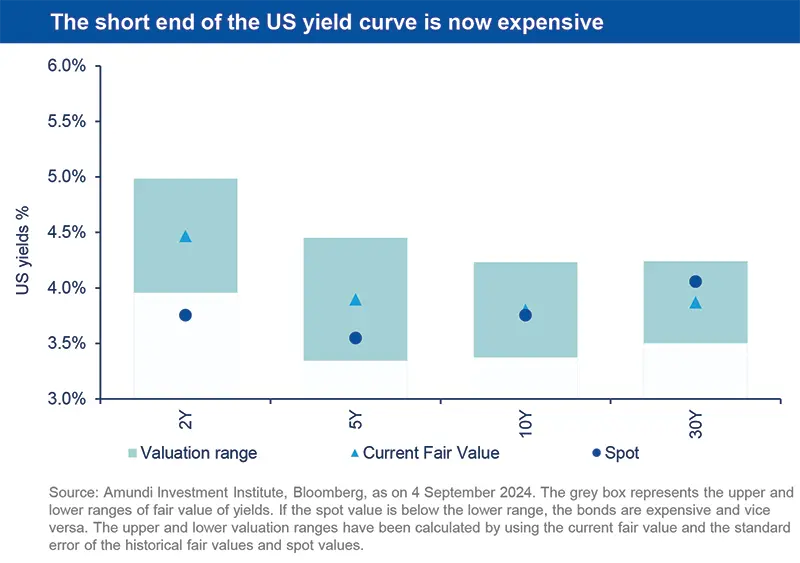

- The sharp yield movements over the summer call for a flexible/active stance on duration. We are positive on US Treasuries from a long-term view but we have tactically reduced our stance slightly. We think the short end (2Y) of the curve is now expensive but there is still value in the intermediate parts. In coreEurope, our constructive stance is maintained but we downgraded UK to neutral. Elsewhere, the US securitised market looks attractive but we are selective. We like auto ABS and believe a dovish Fed is supportive of agency MBS spreads. Corporate credit offers opportunities and we prefer IG to HY, in both the US and Europe.

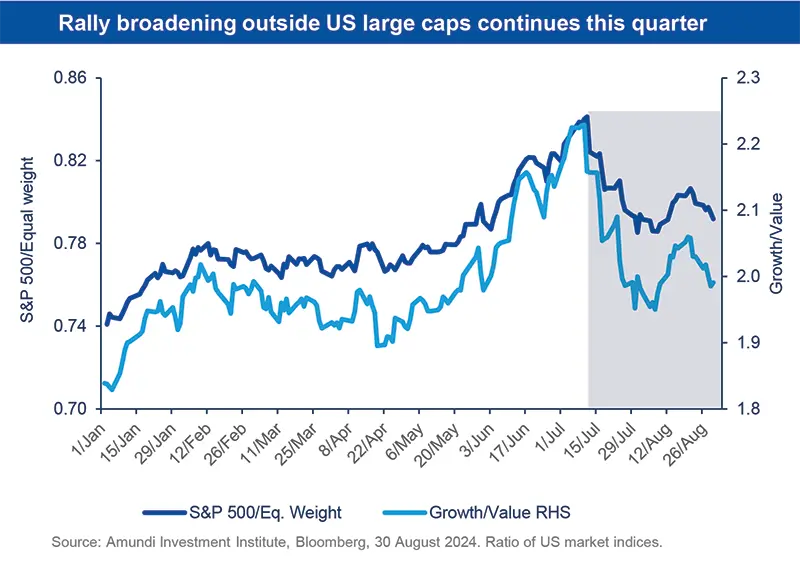

- Stay balanced and play market anomalies. The market stress in the beginning of August supported the broadening of the rally outside of US large caps. We believe as earnings outside these segments catch up, the broadening is likely to continue but it may not be linear. Hence, we stay cautious on expensive names, US growth and large caps. In contrast, we favour an equal weighted approach and US value. In Europe, where valuations are cheaper, we stay balanced with positive stances on cyclicals and defensives.

- Emerging markets growth remains on a solid footing but there could be near-term pressures from protectionism, given the US elections. In China, although the government is implementing piecemeal efforts to boost the real estate market, we remain vigilant. Instead, we like equities in markets such as Indonesia, India and Brazil. The carry in EM debt is robust but we are selective and are monitoring any headwinds to local currency debt.

Three hot questions

|

Monica DEFEND |

The Fed seems to be in no fear of inflation and is more focused on preventing a deterioration in labour markets. This has allowed us to raise our rate cut expectations from two to three for this year.

1| How do you see central bank policies evolving this year?

Earlier, we pointed out temporary divergences in central bank policies. Now, we notice these divergences are ending. We expect a total of three rate cuts (25 bps each) from the Fed this year, and three each from the ECB and the BoE in addition to the rate cuts already implemented. While markets are pricing in slightly more than four Fed cuts, we think this is too dovish and may be questioned if the last mile of inflation comes in sticky. Slowing wage growth and inflation in the EZ would support the case for ECB easing. The BoJ, however, is an exception. It is likely to consider wage growth, inflation and financial market stability before taking further decisions. We think the bank should refrain from raising rates this year, but we do expect a hike in the second quarter in 2025.

Central bank rates forecasts :

- Year end forecasts: Fed (upper bound) 4.75%, ECB (deposit facility rate) 3.00% and BoJ 0.25%.

2| What’s your view on the US economy and labour markets?

A lot is being said about the US economic activity. Our view has not changed over the summer and we still believe a recession is unlikely at this stage. We do see, however, a mild slowdown concentrated in the second half of the year as labour markets continue to weaken. Labour markets are the key variable for assessing US consumption and economic growth. At this stage, permanent layoffs, which we think are especially relevant, are under control. Overall, our real GDP growth expectations are unchanged at 2.5%, year-on-year, for 2024. On the inflation front, a sustainable downward trajectory is likely to be maintained.

Investment Implications:

- Close to neutral on US equities.

- EUR/USD: 1.15 for Q2 2025.

3| Do you think gold prices can maintain the upward trajectory seen so far this year?

Gold prices have been boosted by a weak dollar, geopolitical tensions and expectations of a Fed pivot. In addition, from a long-term view, fiscal profligacy and ballooning public debt could pressure fiat currencies, which improves the appeal of gold as a store of value. Hence, we stay positive on the precious metal. On copper, economic activity matters more for cyclical commodities than a Fed pivot. But a lot of the uncertainty on global growth deceleration and Chinese demand appears to be priced into commodities such as copper. Thus, we maintain a slightly constructive stance.

Investment Implications:

- 12 month target: Copper $10000/tonne; Slightly upgraded gold to $2,700/ounce.

MULTI-ASSET

Recalibrate risks as markets sail choppy waters

|

Francesco SANDRINI |

John O'TOOLE |

The summer volatility allowed us to downgrade our stance on equities for risk management purposes as we await more clarity on the economic direction.

Markets are shifting their focus to economic growth, as inflation continues to decline. The primary reason for this shift seems to be weakening consumption, which is now extending to wider sections of the economy. In the EZ, a multi-speed recovery with divergences across countries is the main theme. In addition, fiscal policies could be a drag on growth in the medium term. Collectively, these factors call for a more prudent stance, and a tactical, incremental risk reduction rather than a structural de-risking. Overall, we are marginally positive on risk assets and stay well-diversified.

The spike in volatility in early August led us to revise downward our views on equities mainly through US, European small caps and a basket of EM stocks due to an uncertain growth environment and a need to minimise idiosyncratic risks. We remain vigilant for any pullbacks in the near term. We stay slightly constructive on DM through UK and Japan. The former displays attractive valuations, a strong dividend-potential and should benefit from policy easing by the Bank of England. Japan, which suffered from sharp volatility earlier, is a long-term play that offers diversification.

Declining inflation should encourage the Fed and ECB to cut rates and that allowed us to maintain our positive views on US and core Europe duration. We stay vigilant after the recent yield movements and wary of any potential fiscal risks. We are also positive on Italian BTPs as they should benefit from a move lower in core European yields. In Asia, our cautious stance on Japanese bonds is retained because we expect yields to go up after the BoJ turned less dovish.

Fundamentals in EU IG corporate credit are robust, demand is strong and yields are attractive. This keeps us constructive on the segment. We like the carry offered by EM bonds, but we turned cautious on the FX component of local bonds. Geopolitical risks and higher for longer Fed rates could negatively affect select currencies. However, we continue to see value in BRL/EUR for the positive macro backdrop in Brazil and in INR/CNH for its carry and stability. The USD should do well vs the SEK and CHF in the near term as these central banks have already begun a monetary easing cycle.

Finally, gold’s appeal to protect from geopolitical stress, amid its strong demand, is maintained. Investors may also consider raising hedges on US duration and maintaining safegaurds on equities, to protect from higher yields.

FIXED INCOME

Flexibility in duration is crucial at this stage

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

Reaffirmations of the Fed put by Chair Jerome Powell primarily due to continued progress on inflation have shifted the market’s focus towards labour markets and economic growth. While we are seeing signs of slowing labour markets that would encourage the Fed to cut rates, a lot of that monetary easing is already priced into the markets. In Europe, the story is similar with respect to inflation falling, but some components such as services are sticky. As a result, the extent of central bank easing would actually depend on the macro data. Hence, we think it is important for investors to be agile on duration in order to take into account market moves and they should maintain their long-term convictions. In credit, quality in DM and EM may be explored to benefit from a high carry.

- Before summer we moved constructive on duration. Although yields have declined, we believe duration is still attractive and there are regional divergences.

- We are positive on core Europe but have tactically turned neutral on the UK and are vigilant on any surprises on growth. We maintain our curve steepening views in US.

- Carry is attractive in credit, but we favour Euro financials, and IG over HY.

- We stay active and slightly positive on USTs but have tactically reduced our stance as we think some parts of the curve have become expensive. In particular, the intermediate part of the curve offers reasonable risk/reward.

- In credit, we maintain our quality bias and also see selective opportunities in new issues whose risks are mispriced.

- In securitised markets, some agency MBS and auto ABS look attractive.

- Fed policy, USD and US elections are the main global factors affecting EM debt that we are monitoring closely. While we see Fed easing as favourable for the asset class, there are country-specific risks that allow us to be selective.

- In LatAm, we like Brazil and Peru and in South Africa, slowing inflation is positive.

- Elsewhere, we slightly trimmed our constructive view on Turkey (inflation) but await attractive levels to raise our stance later.

EQUITIES

Play market anomalies led by fundamentals

| Barry GLAVIN Head of Equity Platform |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Marco PIRONDINI CIO of US Investment Management |

The August turmoil that began after negative surprises on earnings of some US tech companies was later exacerbated by weak macro data. We have been saying for quite some time that there is ambiguity about whether companies can quickly translate their AI-related investments into a sustainable growth in earnings. Now, the markets seem to be questioning that as well, as valuations in select corners are still a concern, along with weak macro dynamics. Even in the EZ, where the economic recovery is moving up towards its potential, the path is vulnerable and dependent on exports. In this environment, fundamentals like earnings and balance sheet strength become even more important. We believe investors should play market dislocations, favouring segments such as US equal weighted, value and emerging markets.

- While we took advantage of the market moves, our barbell view is maintained. This is mainly through cheap defensives and quality cyclicals.

- We are positive on staples and health care but cautious on tech. The recent pullback could open up opportunities in the tech consulting space.

- Recent earnings have been strong, but for export oriented sectors such as luxury, weakness in China is becoming apparent.

- The valuation gap between market-cap weighted indices and the broader markets is huge. We think in case of a liquidity scare, the top-of-the-market stocks would suffer more.

- EPS growth in the broader markets is likely to improve and could support a rally-broadening outside of large caps/AI-driven segments.

- We stay balanced, positive on financials (large banks) and materials, and also on defensives through specific investment cases.

- Economic growth remains strong and earnings recovery is on track. But we could see some volatility on US elections (Harris vs Trump presidency) and discussions on trade barriers, etc.

- In LatAm, we raised our stance on Brazil given its attractive valuations and are also positive on Mexico.

- India and Indonesia offer strong long-term potential. We are also positive on South Korea but reduced our views on some banks.

VIEWS

Amundi asset class views

Definitions & Abbreviations

- Currency abbreviations:

USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.