Summary

We are witnessing a global realignment towards a multi-polar world, and geopolitics will be a crucial factor to watch for investors in 2024.

- A large section of the world (around 42% of global GDP) will elect its political leaders this year, with the US in focus.

- Increasingly, internal politics in emerging powers such as China, India, and Latin America will shape global geopolitics.

- This realignment presents opportunities arising out domestic consumption, supply chain reallocation, near shoring etc.

2024 will see 40 countries going into national elections, representing over 40% of the global population (around half of the world if we also consider European parliament elections). People in the Americas (US, Mexico), Russia, and in Asia (India, Indonesia) will choose their leaders, and, as Donald Trump’s recent victory in the Iowa caucuses has shown, this will definitely not be a quiet year.

While the victory of China-hawkish DPP party in Taiwanese elections did not come as a surprise, this cannot be said with certainty about polls in other countries. The outcomes of these elections would affect the future economic path, and international relations, of established leaders such as US/Europe and of emerging powers for instance in Asia and Latin America. Hence, investors looking for higher returns in EM should assess country-specific factors such as political stability, public finances and economic growth.

Actionable ideas

- US bonds

Government bonds offer safety in times of slowing economic growth and high geopolitical risks in the form of tensions in the Middle East/Red Sea, Russia/Ukraine war. But the need to be active is high.

- Emerging Market bonds

EM bonds for example in Asia and Latin America provide high yields to investors looking to boost their income. Importantly, EM show divergences in their growth path and hence selection is important.

This week at a glance

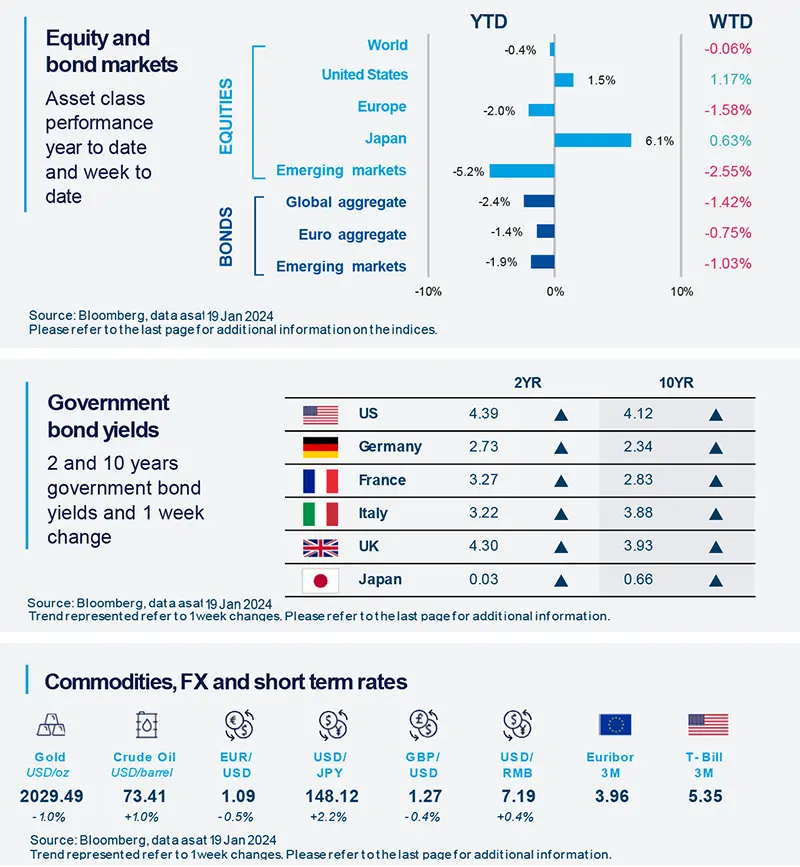

Equities were mixed and bond yields rose, as central bank comments led the markets to assess the timing and extent of policy rate cuts. Japanese stocks were up on interest from foreign investors and improving corporate governance. In commodities, oil prices rose on geopolitical risks in the Red Sea and Middle East.

Amundi Investment Institute Macro Focus

Americas

US retail sales outpaced expectations, for now

Headline retail sales number in December came in above consensus expectations at 0.6% (MoM) due to end-of-year discounts offered by companies. In particular, sales excluding cars and gasoline were up 0.6% and control-group sales (that exclude vehicles, gas, food and building materials) rose 0.8%. While this past data indicates that consumption is strong, we are not very confident of how well this strength can be sustained in the future.

Europe

Euro Area headline and core inflation diverged slightly in December

Headline inflation ticked up to 2.9% (vs. 2.4% YoY in November) but this was mainly because of fading energy base effects. Core inflation, however, decelerated to 3.4% (down from 3.6% in November), which is in line with our disinflationary views. This is also positive for the ECB which remains focused on bringing price increases back to its target.

Asia

China growth moderation to continue

China’s GDP grew 5.2% in 2023, in line with our expectations. We stand by our view of a growth moderation in 2024 to 3.9%, diverging from the more optimistic views of the markets. A shift to a 3% growth rate over the next three years appears imminent. This deceleration is not merely a statistical inevitability; it is China’s strategic recalibration towards a more sustainable growth model in the long term.

Key Dates

|

23 Jan BoJ Monetary Policy, EZ |

25 Jan |

26 Jan US PCE, Mexico Trade |