Summary

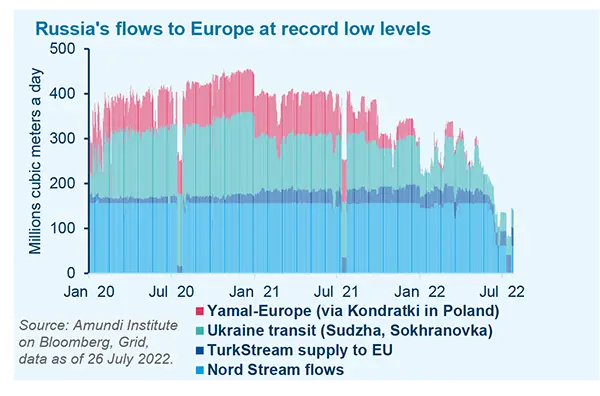

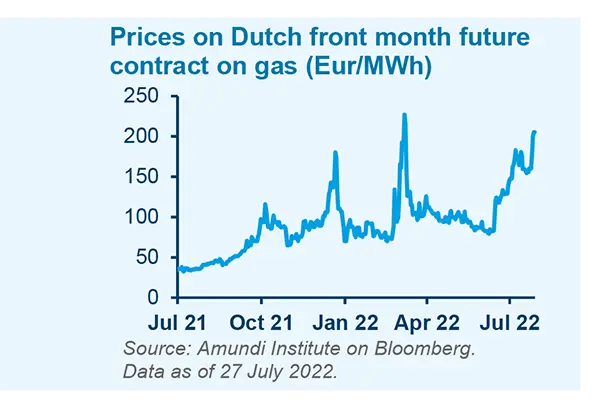

- Russian gas flows to Europe are at a record low level as capacity from Nord Stream 1 has failed to resume fully due to additional maintenance. Gas prices in Europe have jumped again, while EU nations rushed to agree on a coordinated reduction of approximately 15% of gas demand (with country differences) to ensure sufficient gas storage before winter.

- The partial shutoff of gas deliveries is already affecting European growth momentum, adding to the other factors that are increasing uncertainty and darkening the Eurozone outlook, which is already being severely affected by a cost of living crisis.

- A scenario of pre-emptive gas and energy rationing or a scenario of more severe demand containment due to a cut-off of Russian supplies would likely imply that a recession in the Eurozone could start materialising as early as Q3. This could obviously become more intense in the case of a total cutoff, as EU industry would be severely impacted.

- To minimise the damage, EU nations should embrace a coordinated approach by finding alternative sources of energy and encouraging energy savings. This would help reduce the output losses, but would still be painful amid high inflation.

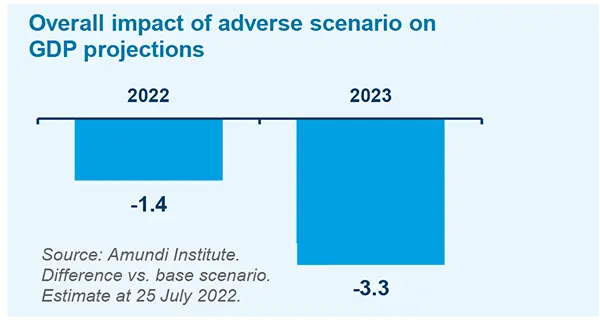

- In our view, a scenario of continuing reduced flows and partial intermittent disruptions is the most likely. The worst-case scenario of a total cutoff of energy deliveries from Russia would lead to a further reduction in Euro area GDP growth of 5% on a 12-month horizon from our baseline scenario.

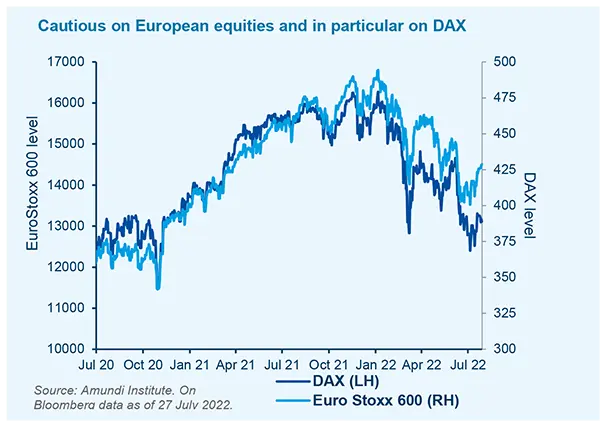

- The worst case scenario is not totally priced into the market. Against this uncertain backdrop, we are increasingly cautious on European equity markets, especially given its cyclical tilt. This is particularly the case for areas that appear more exposed to the adverse scenario, such as the German equity market (DAX).

BASE SCENARIO: STAGNATING GROWTH WITH HIGH INFLATION

The partial shutoff of gas deliveries is already affecting European growth momentum via heightened uncertainty, which is adding to the other factors that are darkening the Eurozone outlook. In response to worsening European sentiment data, signs of decelerating activity and weak prospects for domestic demand, we progressively revise down our forecast for the Eurozone economy, expecting EA GDP to grow by 2.4% in 2022 and 1.3% in 2023, though we are still waiting for the Q2 GDP release.

Under our base-case scenario, energy prices, in particular oil, will remain elevated but slowly moderate in H2 2022 and 2023 as global growth weakens. Importantly, in this scenario a total cutoff of Russian gas deliveries will not occur. Monetary policy will progressively become tighter.

The ECB has already started to hike rates, delivering a hawkish surprise in July, and it will likely increase the depo rate to 1.25% in the next 12 months. Some fiscal support will come to the rescue of economic agents, at national level mainly, but this will only partially reduce the impact of persistently high inflation, which weighs on consumption as the cost of living crisis bites disposable incomes; higher input costs, tighter financial conditions and weaker global demand cap investment projects and weigh on corporate activity. With very weak quarterly growth and a non-negligible risk of contraction, especially in H2 2022, Eurozone GDP will broadly stagnate in 2022, with much of the growth being influenced by important carryover effects.

RECENT GEOPOLITICAL DEVELOPMENTS INCREASE THE LIKELIHOOD OF MORE DOWNSIDE RISKS MATERIALISING

Recent reductions in Russian energy deliveries have heightened the risk of gas and energy rationing by putting at risk Europe's ability to fill up its gas storage facilities to a minimum of 80% by November as planned. Moscow has restricted gas deliveries to 12 EU countries since the war in Ukraine began, cutting some off completely over the ruble payment dispute and reducing flows to others. Over the last few weeks, Austrian oil and gas company OMV, as well as Italy’s Eni, said that Gazprom had been significantly reducing the supply of gas to their countries. In addition, a further reduction of flows via Nord Stream 1 (NS1) to Germany has just been announced.

Concerns among European authorities, markets and businesses have been progressively mounting about flows from NS1, which is the largest single pipeline carrying natural gas from Russia to Germany, particularly as alternative pipelines are not rerouting gas. The NS1 pipeline’s annual maintenance started on 11 July 2022, with flows dropping to zero and expected to be stopped for 10 days. NS1 was already operating at 40% capacity, reportedly due to a missing turbine that was under maintenance in Canada, as well as sanctions. That turbine has now finally been delivered to Germany. At the end of the maintenance period on July 21, gas flows resumed via NS1, but Gazprom said that another turbine is due for maintenance, leading to an additional drop in capacity to about 20% from 27 July.

Therefore, gas prices in Europe jumped again after seeing some temporary relief in mid-July due to the reopening of the NS1. EU nations have rushed to agree on a coordinated reduction of approximately 15% in gas demand (varying from country to country) before the winter in order to counteract the reduced flows from Russia. EU energy ministers gathered in Brussels and reached the new compromise on July 26.

Currently, Europe’s priority is to proceed with gas storage, with the goal of 80% by November (in line with the new REPowerEU gas storage rules of 27 June) to build up a supply buffer for winter, when heating demand peaks. EU gas storage is currently estimated to be about 62% full .

Plans for gas and energy savings at the European level, to protect key industries and allow storage to increase, have already been defined, for now on a national voluntary basis. Germany has already moved in this direction by triggering a phase two emergency plan. And should gas flows decline further, Germany may trigger phase three of its gas emergency plan, encompassing the rationing of gas supplies. This would have severe implications on the industrial sector, and other European countries could possibly be forced to take similar steps, in line with the European Commission’s proposed contingency plans.

While substitution with other sources is an option, substitution of Russian gas with LNG is currently estimated to have reached its limit, meaning lower imports from Russia may now be met only by reducing EU gas demand, as recently agreed by EU nations. This conclusion is supported by a recent analysis published on Bruegel, which suggested that, “for the EU as a whole, a total demand reduction over the next 10 months of about 15% compared to average demand in 2019-2021 would be required to compensate for a complete stopping of Russian pipeline imports”. The required reduction would differ largely across Eurozone countries, as certain country groups would require much steeper demand cuts and therefore suffer proportionally larger economic losses.

Both the scenario of pre-emptive gas and energy rationing, assuming continuing reduced flows, and the scenario of more severe demand containment and rationing following a cutoff of Russian supplies, would imply a recession in the Eurozone, and this could start to materialise as early as Q3. Its intensity and duration would clearly depend on the severity of the required rationing, with it being more intense in the case of a total cutoff.

ASSESSING THE WORST-CASE SCENARIO

Downside risks that we had envisaged may now be more likely to materialise. The downside scenario we already had in mind ranged from self-imposed pre-emptive rationing to gas supply cutoff-induced rationing. Both would make a recession likely, with one potentially starting as early as in Q3 2022 in the most severe outcome.

We believe that a scenario of continuing reduced flows and partial, intermittent disruptions (with protracted uncertainty on gas supplies and higher, albeit not further skyrocketing, gas prices) would be the most favourable for Russia’s bargaining power and that it is therefore the most likely downside scenario to develop from here in the current context. Yet, in order to analyse the most severe downside scenario, we explore the economic consequences of a total cutoff of energy deliveries from Russia.

Estimates of the worst outcome result from compounding effects and macroeconomic amplification.

1. Direct impact of gas rationing on gross value added.

Based on ECB estimates of sensitivities to gas rationing, back in April, when we put into our radar this risk scenario, we assessed the impact of a complete halt in gas supplies from Russia (with no substitution) on gross value added. Over a 12-month horizon, under this adverse scenario we estimated that the Eurozone might experience a loss of approximately 3% of GVA over 12 months compared with our baseline scenario. That could push Eurozone GDP growth down to 1.9% in 2022, partially eroding the carryover effect, and to -0.8% in 2023, assuming the impact of gas rationing starts in Q4 2022.

2. Additional impact considering compounding effects and macroeconomic amplifications.

These could operate through multiple channels: heightened uncertainty, terms of trade shock, increased inflation drag on consumption, tighter financial conditions and a worsening unemployment outlook. All of these factors are likely to materialise in case of a sudden stop to gas flows, leading to a much worse outcome that subtracts up to an additional 1.5pp-2pp from baseline GDP growth in 2023. This would lead to an overall drag closer to 5% vs. the baseline over 12 months. In this case, growth may go much lower, slightly above 1% in 2022 and about -2% in 2023, which would be our reference downside scenario for severe rationing.

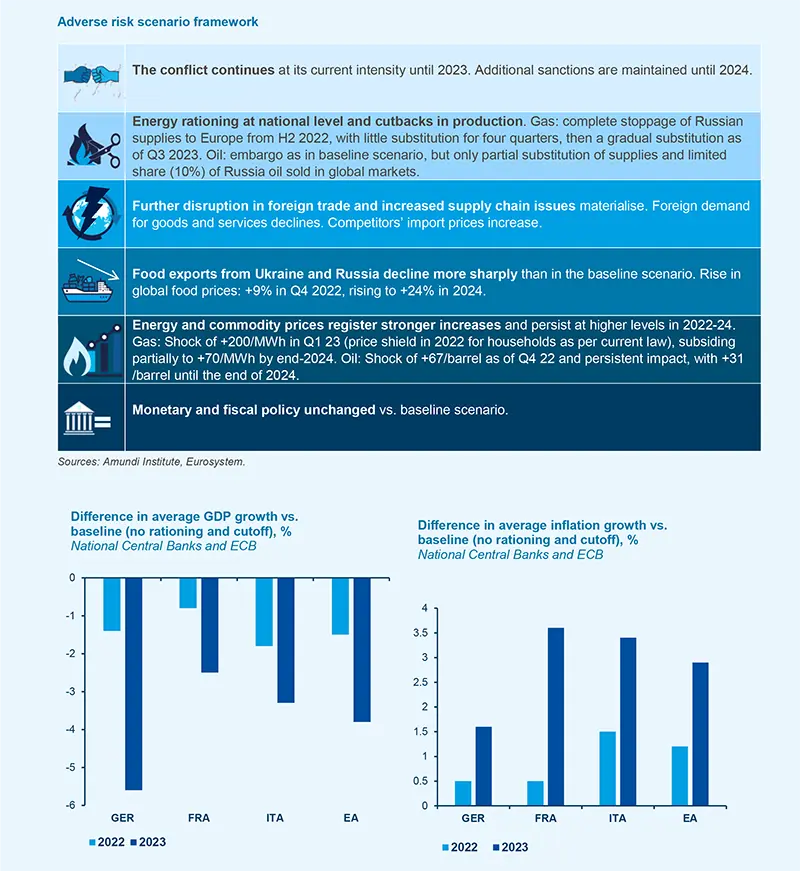

Based on a common exercise for the Eurosystem, using their economic models national central banks have recently estimated the impact of a full gas rationing scenario, where the economy is affected by energy rationing and production cutbacks, increases in inflation and increased uncertainty, which all translate into higher financing costs and tighter financial conditions. A summary of the most relevant assumptions and conclusions are contained in the infographic on the following page. Eurozone GDP would grow by only 1.3% in 2022, significantly eroding the carryover so far accumulated, and would contract by 1.7% in 2023, broadly in line with our own estimates. Inflation would also be much higher, on average, reaching 8% (vs. the 6.8% baseline) in 2022 and 6.4% (vs. 3.5%) in 2023.

In a similar analysis, a very timely piece by the IMF on the risks associated with flows ceasing highlights the potential damage under a more coordinated or fragmented approach. The output loss could be very damaging to the most exposed countries if flows cease and fragmentation sets in – the IMF estimated a loss of about 5-6% of GDP for Hungary, Slovakia, Croatia and Italy. Germany would see damage of about 2-3% (similar to that of EU as a whole), and France about 1% (over the next 12 months vs. baseline scenario of no interruptions).

To minimise the damage a coordinated approach must be taken. The key is to stay integrated internally (sharing intra-bloc by rerouting where possible) and externally by finding alternative sources of energy and encouraging energy savings via higher prices (offset by transfer payments to the vulnerable). The integrated market approach would reduce output losses by about two-thirds. The block as a whole and Germany would see an output loss of about 0.5-1.5pp, the Italian range stretches from 0.5-2% and France’s loss would be up to 0.6%. This would still be painful, especially considering the inflation cost associated, but would possibly avoid the worst outcome.

INVESTMENT IMPLICATIONS-

The adverse scenario of a total gas cutoff is only partially priced in by equity and credit markets, both marginally improving recently because of rates normalization. What is clear is that countries and European institutions are actively working on contingency plans to face a more severe reduction of Russian supply, including the tactical use of alternative energy sources to mitigate the economic damage.

Moreover, the economic impact at country and sector level will be uneven and this appears in the current political actions. We have seen the German government stepping up contingency planning in case of further supply disruptions, while the European Commission proposal to enforce 15% mandatory gas cuts (versus the 5-year average) faced strong resistance (particularly from Spain and Portugal) and has been watered down as expected.

Despite few energy and utilities companies’ CEOs pointing to a possibly less negative storage scenario approaching winter, we think that the extreme scenario of a 0% supply from Nord Stream will have a remarkable impact on companies’ earnings (only partially discounted in ongoing reporting and guidance). Clean energy producers have been rallying for a few quarters in anticipation of rising demand for renewable energy and fiscal stimulus to accelerate energy transitions.

Against this uncertain backdrop, we remains cautious on European Equity markets, especially given also its cyclical tilt. This is particularly the case for those areas that appear more exposed to the adverse scenario, such as the German equity market (DAX).

INFOGRAPHIC: Amundi Institute adverse scenario analysis based on Eurosystem coordinated exercise

|

______________

Sources :

-

https://www.bruegel.org/2022/07/european-union-demand-reduction-needs-to-cope-with-russian-gas-cuts

-

https://blogs.imf.org/2022/07/19/how-a-russian-natural-gas-cutoff-could-weigh-on-europes-economies/#

-

ttps://www.bancaditalia.it/pubblicazioni/bollettino-economico/2022-3/en-boleco-3-2022.pdf?language_id=1

-

REPowerEU: affordable, secure and sustainable energy for Europe | European Commission (europa.eu)