Summary

Political uncertainty can amplify short term market movements.

However, markets tend to recover once the political situation clarifies and the focus comes back to corporate earnings.

- French markets mildly suffered after the announcement of elections amid high political uncertainty.

- Uncertainty will fade once the political situation clarifies, just as it has in similar election phases.

- After the recent movement, sound global French companies could offer opportunities for long term investors.

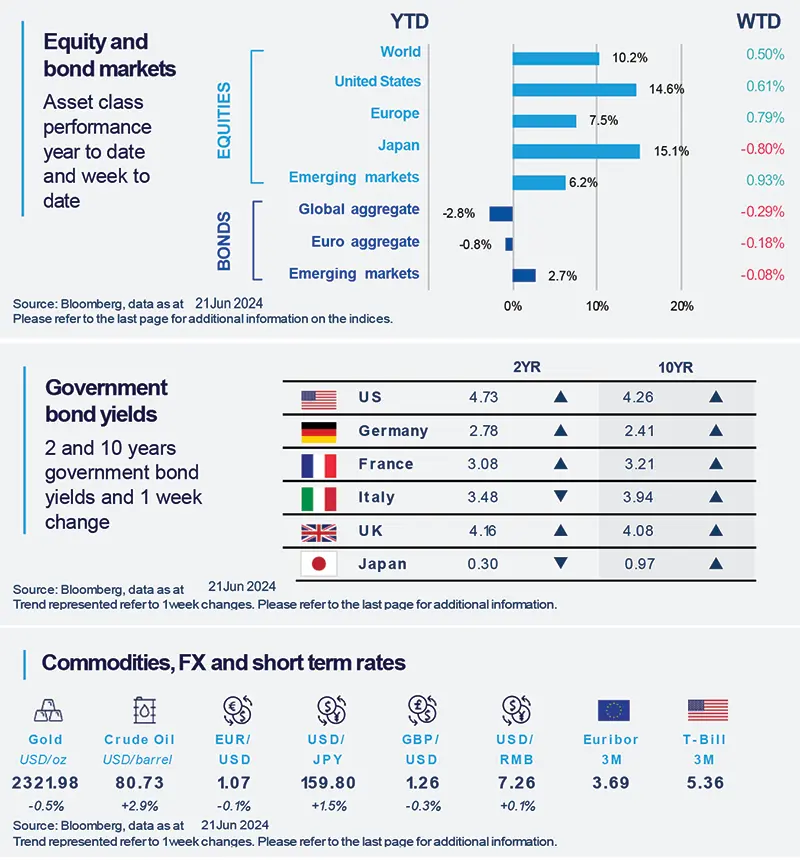

After the snap election call, the French equity market has underperformed the European one, but it has shown recent stabilisation and remains positive year to date. The spread between French government bond yields and the German Bund has widened, but it is also stabilising in recent days.

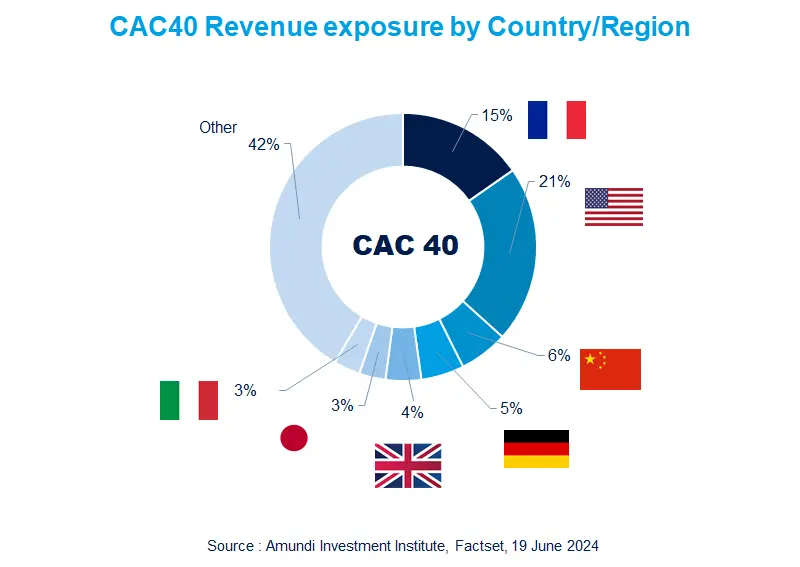

Markets dislike political uncertainty and closely monitor public finance developments. Sectors more sensitive to political risk, such as Financials and Utilities, are most affected, while Consumer Staples and Healthcare have remained resilient. As the French market consists mainly of international companies, with over 80% of sales coming from outside France, its behaviour should align with international equities once political uncertainty diminishes.

Actionable ideas

- Global equities

A mildly constructive global outlook with regional differences, coupled with the Central Bank’s plan to cut rates, should be positive for global equities.

- Multi asset investing

In phases of high uncertainty multi asset investing may benefit from the safe haven appeal of government bonds and from the exposure to a broad range of asset classes and sectors.

This week at a glance

During the week, US markets touched new highs on the back of artificial intelligence-induced enthusiasm. European equities partially recovered from previous declines amid a stabilisation of the political newsflow. Oil prices were driven up by signs of robust US demand ahead.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 21 June 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US retail sales for May point to subdued consumption.

Retail sales growth in May came in below expectations at 0.1%, month-on-month. The number affirms our views that consumption in the US is likely to moderate in the second quarter. Looking ahead, given that consumption constitutes a large part of the US economic growth, any moderation in consumption will likely affect economic activity in the second half of the year.

Europe

Eurozone survey points to moderate expansion.

A preliminary survey of business activity in the Eurozone (PMI) showed a decline in June compared to May, but it remained above the threshold indicating economic expansion. The survey indicated softer but still expanding services activity, while weakness in manufacturing persisted. These readings are in line with our view of a mild and gradual expansion for the Eurozone this year.

Asia

Inflation data for Japan was lower-than-expected.

May inflation data came in below consensus expectations. Inflation (excluding energy and fresh-food prices) was 2.1%, year-on-year, compared with expectations of 2.2%. The return of inflation towards the Bank of Japan’s target is progressing marginally faster than expected. This supports the view that the bank is likely to keep interest rates unchanged in the near term.

Key Dates

|

25 June Canada CPI, Japan |

27 June Bank of Mexico policy, |

28 June US PCE, ECB CPI |