Summary

- Fed action: On 1 February, the Federal Reserve (Fed) hiked the fed funds rate by 25bp, to 4.50-4.75%, continuing to slow its pace of rate hikes after four consecutive 75bp rises and a 50bp increase in December of last year. While the Fed indicated that inflation has slowed, it remains high. Chair Powell also mentioned that the Federal Open Market Committee (FOMC) will consider cumulative tightening and economic data on growth and inflation when making future decisions.

- FOMC statement: The FOMC made some changes to the statement, with the overall tone indicating that the Fed is not yet done tightening. However, there was a slight change in the assessment of inflation and no reference was made to the Russia-Ukraine war, implying that the Fed is not worried about the war’s effect on inflation. Importantly, while Chair Powell’s opening remarks appeared hawkish, his responses to questions from the media were relatively less hawkish. He also did not show any concern with regard to easing of financial conditions.

- Market reaction and investment implications: Equities initially fell after the release of the statement as markets interpreted it as hawkish. However, during the Q&A, when the Fed chair sounded dovish, stocks rose and bond yields declined. We believe volatility will remain high as markets assess labour markets and inflation and their effects on the Fed’s future rate hiking path. As a result, we stay active and tactical on duration management to benefit from yield movements.

- January labour data: The latest employment data were much stronger than expected by the markets, indicating that the US is not close to a recession. We think the tight labour report and signs of sticky wages will mean the Fed continues its tightening cycle beyond the March meeting.

Fed action: rates raised 25bp

The Federal Reserve hiked the fed funds rate by 25bp, to 4.50-4.75%, a step down after the Fed hiked by 50bp in December. The slowing in the pace of rate hikes was widely expected. Some modest changes to the FOMC statement were initially perceived as hawkish. However, Chair Powell’s comments at the press conference were not as hawkish as the FOMC statement and prepared remarks. Post the meeting, risk assets rallied strongly, as Chair Powell did not show concern about the recent easing in financial conditions (yields falling and stocks rising). Market reaction was strong: with US Treasury yields down, equity markets rallied and the USD sold off.

Key takeaways

- The Fed slowed the pace of rate hikes for the second consecutive meeting from 50bp to 25bp, moving the Fed funds target rate to 4.50-4.75%.

- The FOMC statement: Some modest changes were made to the text, but the tone remained hawkish.

- Press conference: Chair Powell’s tone during the press conference was not as hawkish as in the FOMC statement and the prepared opening comments.

FOMC statement: Some modest changes to the statement.

The Fed acknowledged that inflation eased a bit, but warned that it remains elevated.

There were some changes to the statement. The February statement maintains the previous guidance, with only a vague hint of a pause coming soon. This is reflected in the replacing of “pace” with “extent” of future rate hikes. However, by keeping the text “ongoing increases” the Fed makes it quite clear it is not yet done tightening. The extent of future increases signals the 25bp rate hike is a “return to normal” in the pace of hikes going forward.

In the economic section of the statement, the current assessment of the US economy remained unchanged. However, there were small changes on inflation. The Fed acknowledged that inflation has eased somewhat, but warned it remains elevated. The reference to factors behind inflation being elevated – like supply and demand, etc – was deleted.

Another notable part of the statement that changed is the deletion of the reference to the Russia-Ukraine war contributing to upward pressure on inflation and weighing on global activity. This seems to suggest less concern about either its effects on inflation or weak global economic activity. This may be a nod to the improving growth outlooks for Europe and China.

Finally, they removed the “readings on public health” as a factor in the Committee’s assessment, an indication the Fed is no longer worried about the pandemic and its impact on growth and inflation.

Press conference: Powell less hawkish than expected

Chair Powell’s initial remarks were hawkish, but during the Q&A, he sounded less hawkish.

Chair Powell’s opening remarks remained rather hawkish and he reiterated that it will take substantially more evidence to give confidence that inflation is on a sustained downward path, a similar tone to that taken in the December press conference. However, during the Q&A, Chair Powell sounded less hawkish and may have inadvertently sounded dovish. In particular:

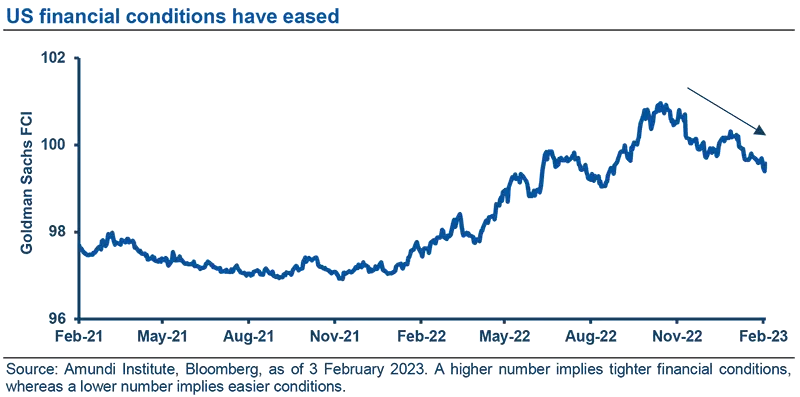

- Despite having a few opportunities, Chair Powell did not show concern about the recent easing in financial conditions. He said the Fed’s focus is not on short-term moves, but on sustained changes to broader financial conditions.

- Chair Powell’s response to a question on whether a pause was discussed during the meeting implied that some members of the FOMC were in favour of a pause. He talked about the path to a soft landing with lower inflation without significant economic decline. He mentioned disinflation several times during the press conference. While he was clearly referring to goods inflation, this raised the risk of slightly diminishing his concerns about core services inflation.

- On the other hand, in a slight hawkish push-back to market expectations of a rate cut in Q4 2023, he stated the Fed does not expect to cut rates in 2023 if the economy performs as expected.

January labour market data

The latest labour market data demonstrate that while leading indicators of recession are flashing red, the US economy is clearly not close to a recession. In January, the US generated 517,000 new jobs, a much higher number than the market expected (at 189,000). This pushed the unemployment rate to 3.4%, the lowest level since 1969. Wage growth is slowing, shifting from an upwardly revised 4.8% in December to 4.4% in January, slightly higher than market expectations of 4.3%.

We believe there are a few factors contributing to the surprisingly resilient US labour market. First, corporations remain flush with revenues that are approximately 11% ahead of prepandemic levels. So, firms are still hiring. Second, COVID-depressed sectors, such as leisure & hospitality and education, continue to rebound, as these are the last remaining sectors where total employment remains below pre-pandemic levels. Finally, there may be seasonality issues in the retail and warehousing sector, where we would normally see layoffs following hiring for the holiday season. We did not see this in the January report.

Investment Implications

We anticipate an uptick in market volatility as investors discount readings on the labour, growth and inflation fronts, and on the Fed’s reaction function to the economic data. The overall outcome of the FOMC meeting was in line with our expectations and so does not change our investment outlook. With Fed policy increasingly data-dependent, the focus will be on upcoming labour, growth and inflation reports. The tight labour report and signs of sticky wages will keep the Fed on its tightening cycle beyond the March meeting. It should also lead to reduced market expectations for rate cuts in the fourth quarter of 2023.