Summary

Introduction

The year 2022 proved a challenging one for international capital markets. For only the fifth time in the last 100 years, U.S. Treasuries and the S&P 500 both ended the year lower than where they started.

Much of the turmoil can be attributed to the sharp monetary tightening pursued by the U.S. Federal Reserve and other central banks as they grappled with the inflationary pressures that took hold in the wake of the COVID-19 pandemic. But Russia’s invasion of Ukraine in late February and the resulting geopolitical frictions also dampened the mood, sending bond spreads wider as investors took fright at the heightened sense of risk, making it more costly to borrow in financial markets. As a result, country authorities in emerging markets currently face difficult choices between sustaining financial stability and supporting growth in an environment of tighter global liquidity, increased geopolitical frictions, and slower global growth.

Unsurprisingly, total fixed-income issuance fell by 16 percent from the previous year. The upheavals and primary market shutdowns did not spare the market for green, social, sustainability, and sustainability-linked (GSSS) bonds, as defined in Box 1.1. Bond issuance in this category fell 13 percent from a year earlier, the first ever decline for this still nascent asset class and a sharp reversal from the 68 percent growth recorded in 2021.

This represents an outperformance by GSSS bond issuance versus the broader fixed-income asset class. But it is, nevertheless, an ominous development for sustainable finance, particularly in emerging markets where the capital needed to fund the green transitions is most scarce. Such resources are crucial to put economies on track to meet international climate goals.

Among the challenges faced by GSSS bonds we also acknowledge the ongoing political debate surrounding investment decisions based on environmental, social, and governance (ESG) factors more broadly. Specifically, we highlight legislation passed in Florida (May 2023), along with other U.S. states like Kansas (July 2023) and Indiana (April 2023), which prohibit the consideration of ESG factors in state investments and procurement processes. This reflects the polarized opinions on the topic. In this context, it is worth noting the concerns raised by the Glasgow Financial Alliance for Net Zero (GFANZ), a grouping of insurance companies and pension funds convened by the United Nations. GFANZ warns that political attacks against ESG could have negative impacts on investors, policyholders, and economies.

However, these setbacks mask a series of encouraging developments. We estimate the so-called greenium in emerging markets widened to 6.4 basis points in 2022, from 4.2 basis points in 2021. This suggests a growing imbalance between supply and demand which continues to make the green bond market attractive for investors, relative to the conventional bond market, in emerging markets.

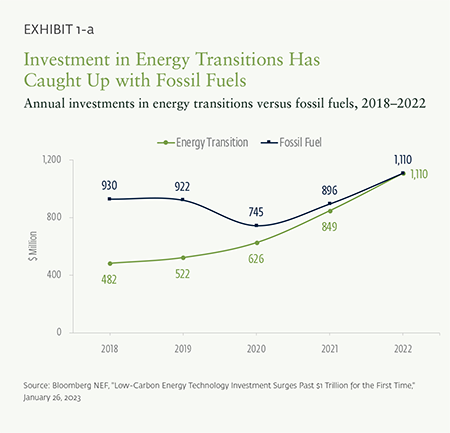

Meanwhile, a significant development was that overall global funding via green bonds and loans to sustainable projects surpassed that of the fossil fuel sector for the first time in2022, a sign that the market for green financing is maturing.

GSSS issuance will continue to grow as energy transitions accelerate, and investor demand rises.

Looking ahead, we expect GSSS issuance will continue to grow over time, driven by an acceleration in the energy transition, a wider greenium in emerging markets relative to advanced economies, and macroeconomic dynamics (high nominal rates in a context of weak economic growth) supportive of the fixed-income asset class in developing economies.

Our central scenario forecasts green bond issuance to grow, cumulatively, by 27 percent in emerging markets excluding China over 2023–2024, on the back of an easing of global inflationary pressures driven by a global slowdown and weaker credit growth. In particular, we see green bond issuance bouncing back in 2023 to grow around 14 percent, slowing to a more normalized increase in 2024 of about percent. However, green bond issuance in China will be slower, due to the combination of a weaker-than-expected post-COVID-19 recovery and lower attractiveness of locally issued bonds (on account of relatively low yields versus the United States and Europe). Given China’s economic weight, this will bring overall growth in green bond issuance for emerging markets down to around 10 percent in 2023–2024, amounting to a 1 percent decline in 2023, followed by a recovery back to about 11 percent growth the following year.1

In the medium term, we expect green bond issuance to be a key beneficiary from an acceleration in the energy transition driven by a greater sense of urgency around tackling climate change. Most recent analyses2 point to an increase in global temperatures of about 2.7 to 2.8 degrees Celsius above pre-industrial levels under current policies, well above the 1.5 degrees Celsius targeted in the Paris Agreement, adding pressure on policy makers to act.

According to Bloomberg NEF, global investment in the energy transition reached $1.1 trillion in 2022, an all-time high and a 31 percent increase from 2021 (See Exhibit 1-a).3 While this is encouraging—as it matches global fossil fuel investments for the first time—it also falls short of the $4.55 trillion that needs to be invested annually for the remainder of this decade to get on track under BNEF’s Net Zero Scenario.

Three drivers are contributing to most of this acceleration. First, the energy transition is likely to be supported by ongoing global progress at the policy level. During the last COP27 international climate summit, held in Egypt in November 2022, governments agreed to establish a fund to compensate developing countries for the loss and damage that climate change has wrought. Key details on how this will be funded or how to deploy the financial assistance are yet to be agreed and will be up for discussion at COP28 in Dubai, which starts in November 2023. Furthermore, the UN Secretary General has also called for a “Climate Ambition Summit” in September 2023 for governments to seek agreement on new country pledges or nationally determined contributions (NDCs).4 The Inflation Reduction Act in the United States and the REPowerEU package in the EU should also be viewed as two crucial steps in this direction.

Second, a wider greenium will continue to make green bonds more attractive to issuers than conventional bonds. This is particularly the case in emerging markets where the greenium is widening, as we show in Section 2 of the report, relative to developed economies where the spread advantage appears to be shrinking.5

Third, high nominal rates in a context of easing inflationary pressures and weaker growth (on a combination of a weaker-than-expected recovery in China and slacker credit growth in developed markets reflecting events in the U.S. and European banking sectors since mid-March 2023) are likely to be supportive of emerging market fixed income in 2023–2024 in absolute terms. Moreover, emerging market bonds could also outperform local equities as the cumulative rate hikes implemented so far by emerging market central banks feed through to the real economy, translating into weaker growth and downward earnings-per-share revisions.

This is, as discussed earlier, our central scenario. However, as in previous editions of the report, we also run two alternative scenarios for emerging markets. The first of these is the more optimistic (“catch-up”) scenario, defined by a faster normalization of inflation rates alongside higher inflows of funds into emerging market debt. Under these conditions, we would expect green bond issuance to grow by close to 20 percent cumulatively in 2023–2024, with 8–10 percent growth in both years.

Our more pessimistic (“slowdown”) scenario is defined by a global economic slump driven by much tighter financial conditions than in our central scenario. In this case, we would expect green bond issuance to remain broadly flat, cumulatively, over the next two years, with an 11 percent year-on-year decline in 2023, offset by a 12 percent rebound in 2024.

Policy action, new technology, and better-aligned guidelines can help deepen GSSS markets.

In 2022, GSSS bond issuance was around 0.4 percent of China’s gross domestic product (GDP), compared with 0.3 percent a year earlier. For the rest of the emerging market category, the proportion was equivalent to 0.2 percent of GDP, falling from 0.4 percent in 2021. In light of these numbers, bond penetration as a proportion of GDP seems broadly similar in China compared to the rest of the emerging market space. This class of bonds remains more established in developed markets, with issuance in 2022 equivalent to around 1.2 percent of GDP in 2022, down from 1.4 percent in 2021.

Interestingly, bond penetration as a proportion of total debt issuance seems much lower in China than in other emerging markets. China stood at 6 percent in 2022, rising from 3 percent in 2021. In other developing economies, the rate was 16 percent in 2022 and 15 percent in 2021. This puts these emerging markets excluding China ahead of developed country levels of penetration, which were around 13 percent in 2022 and 11 percent in 2021. This also highlights the importance of further developing local fixed-income markets across emerging markets as a pre-condition for sustained growth of the GSSS segment going forward.

Importantly, the low proportion of green bonds carrying internationally recognized credit ratings remained a key barrier for investing in the asset class in 2022. Only 14 percent of green bonds issued in China carried investment-grade ratings (by internationally recognized rating agencies) in 2022, down from 16 percent in 2021. In other emerging markets, the proportion was up to 33 percent, from 30 percent the previous year.

Against this backdrop, the report reviews potential actions to increase GSSS bond penetration across emerging markets.

First, the potential for reputational damage associated with so-called greenwashing, whereby an issuer misstates the extent to which an activity meets sustainability criteria, is also a significant concern for investors. To counter this risk, the report discusses the benefit of tighter data disclosure requirements related to sustainability and a potential shift from voluntary to more formal guidelines on green definitions.

Second, another problem investors face is the potential fragmentation of the asset class via a lack of comparability between different countries or regions, each with their own regulations and market conditions. Fragmentation carries higher screening costs and reduces overall investment as a result. In this context, the report argues for further standardization of taxonomies globally. Furthermore, we also discuss the Assessing Sovereign Climate-related Opportunities and Risks (ASCOR) Project, the first coordinated investor framework to assess sovereign bond issuers on climate change.

Third, we discuss how central banks in developing countries can support energy transitions, referencing the European Central Bank’s proposal for greening its bond portfolios.6

Clearly, any move by a central bank to sell conventional debt to buy green bonds would increase demand for the latter, driving down yields and eventually prompting issuers to sell more into a receptive market. This would ultimately lead to greater penetration of green bonds into local capital markets. We note, however, that we are agnostic about whether central banks should indeed follow this path and acknowledge that there is no consensus on the question.

Fourth, we look at how new technologies could help mobilize savings in emerging markets. Both fintech and blockchain-based technologies could help develop local capital markets while tilting incremental investments toward sustainable assets, including GSSS bonds. In particular, we review some of the leading initiatives in the field.

Fifth, a traditional challenge facing foreign investors with some exposure to emerging markets is the relatively high cost of capital associated with investing in projects in the region.7 The report looks at synthetic securitizations with some government or supranational participation as a potential way to reduce the cost of capital for projects in emerging markets and increase their appeal to developed market investors.

Finally, the report reviews initiatives to deepen sustainable capital markets in three developing countries. This segment examines Brazil’s GSSS bond ambitions under the new government that assumed office at the start of 2023. It also outlines key features of Uruguay’s sustainability-linked bond, which includes an innovative step-up-down coupon structure, before assessing Colombia’s new green bondframework and Indonesia’s climate budget tagging strategy.

Donwload the full report

Labeled Bonds: Definitions and Guidelines

Green bonds: Fixed-income instruments with proceeds earmarked exclusively for projects with a positive environmental impact. The Green Bond Principles, guidelines developed by the International Capital Market Association (ICMA), have four components: use of proceeds, process for project evaluation and selection, management of proceeds, and reporting. These principles were last updated in June 2022. Several countries and jurisdictions have developed guidelines for green bond

issuance, many of which align with the Green Bond Principles. A related category, blue bonds, focuses on financing water-related sustainable projects.

Social bonds: Proceeds from social bonds are directed toward projects that aim to achieve positive social outcomes, especially, but not exclusively, for a target population. ICMA's Social Bond Principles have four components analogous to the Green Bond Principles: use of proceeds, the process for project evaluation and selection, management of proceeds, and reporting. The 2017 Social Bond Principles were updated in June 2020 to reflect changes in the market in light of COVID-19, notably by expanding social project categories and target populations.

Sustainability bonds: Sustainability bonds are debt instruments that raise money to finance or refinance a combination of green and social projects. The Sustainability Bond Guidelines established by ICMA are aligned with the core components of both Green and Social Bond Principles.

Sustainability-linked bonds: These instruments are performance-based bonds whereby their financial or structural characteristics, such as the coupon rate, are adjusted depending on whether the issuer achieves predefined sustainability objectives. The objectives are measured through key performance indicators and assessed against sustainability performance targets. Failure by the issuer to meet those goals may result in a higher coupon. These bonds can also be structured to reward better-than-expected performance with a lower coupon. Unlike social or green bonds, proceeds are not earmarked for specific projects. In June 2020, ICMA published the Sustainability-Linked Bond Principles, providing guidelines on structuring features, disclosure, and reporting.

Climate transition bonds: This category of debt aims to finance the transition to a low-carbon economy. The "Climate Transition Finance Handbook" published by ICMA in December 2020 recommends disclosures for issuers marking either use-of-proceeds or sustainability-linked instruments with a climate transition label. There are four key elements to the recommended disclosures: the issuer's climate transition strategy and governance, the environmental materiality of its business model, the climate transition strategy that must be science-based and include targets, and the transparency of

implementation.

Other labels: Some issuers have used other marketing labels for sustainable debt funding, such as adaptation, or SDG (Sustainable Development Goals) bonds. Most of these are use-of-proceeds bonds aligned with ICMA principles, but their branding has been adapted to single out a specific feature. Some bonds labeled "sustainable development bonds" depart from ICMA principles, as they are not "use-of-proceeds" bonds but are general purpose securities from issuers who wish to flag that their mission is inherently sustainable. The proliferation of labels requires vigilance from investors around project eligibility, allocation, and impact reporting commitments.

1. Green bond issuance forecasts have been run by Amundi.

2. See for example, Climate Action Tracker, November 2022 or CDP and OliverWyman, 2022, “Missing the Mark Report,”

3. If we add investments in the power grid, overall energy transition investments would reach $1.4 trillion. See Bloomberg NEF, 2023, “Global Low-Carbon Energy Technology Investment Surges Past $1 Trillion for the First Time,” January 26, 2023

4. UN News, December 19, 2022, “Guterres announces ‘no nonsense’ climate action summit; calls for practical solutions,”

5. Financial Times, 2023, “Green Bonds: the Disappearing Greenium is a Welcome Development,” January 2, 2023.

6. Schnabel, I. 2023, “Monetary Policy Tightening and the Green Transition,” Speech to the international Symposium on Central Bank Independence,” Sveriges Riksbank, Stockholm, January 10, 2023

7. See data from International Energy Agency, 2023, “Cost of Capital Observatory Report,”January 2023