Summary

Multi-asset investing may help access attractive bond yields while also exploring opportunities from a resilient economic outlook, in particular in European equities.

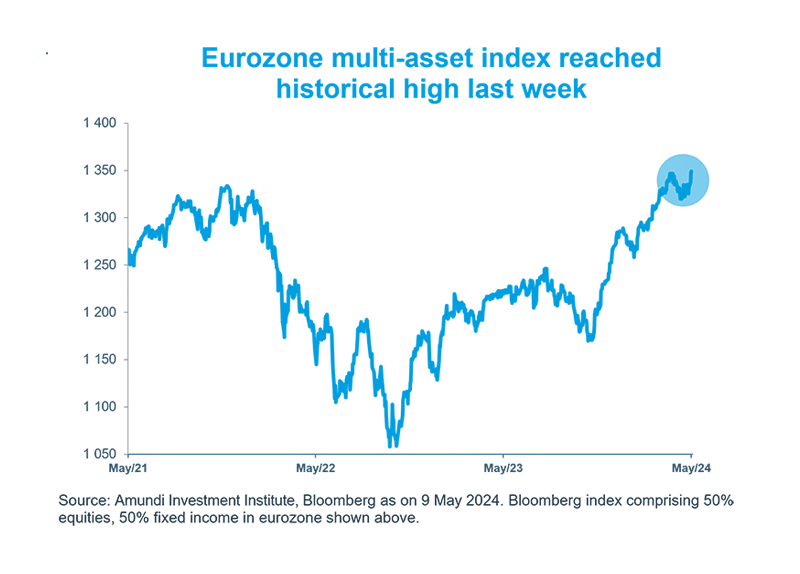

- Slowing inflation, expectations of interest rate cuts and tech exuberance led the index to touch all time highs.

- In Europe, recent data points to better-than-expected growth, but uncertainty remains high.

- Hence, a multi-asset approach could help investors benefit from the positive economic backdrop and stay balanced.

The Bloomberg Eurozone index of equal allocation to fixed income and equities reached its all-time high last week. It also recovered previous losses experienced in the challenging period of high inflation and economic difficulties in 2022. With YTD returns of above 5%, this index outperformed a similar US strategy.

Going forward Europe may benefit from improving growth prospects and slowing inflation, which could allow the ECB to cut rates. But uncertainty around monetary policy mistakes and economic growth remain. In addition, escalating tensions in the Middle East, resulting in higher oil prices (not our base case), may hamper ECB efforts. Thus, a balanced approach may help identify attractive opportunities across asset classes.

Actionable ideas

- Multi-Asset

Investors could explore flexible investing strategies that may help garner attractive yields and also capture the potential upside in quality risk assets.

- Pan European equities

Improving outlook on growth and falling inflation are likely to be positive for European and UK equities that display traits such as strong earnings prospects, high margins, differentiated products.

*Diversification does not guarantee a profit or protect against a loss.

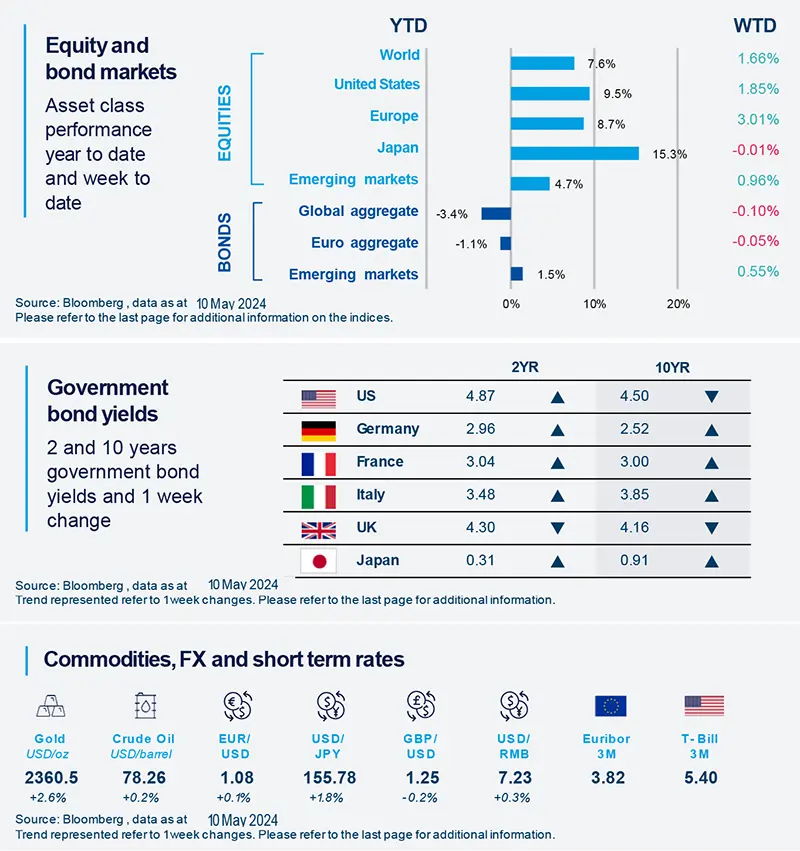

This week at a glance

US and European equities rose on optimism around earnings, and on increasing confidence that Fed and ECB would cut rates this year. But US yields were mixed amid not so positive economic data. In commodities, gold prices were up, and oil was boosted by persisting geopolitical risks.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD) All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 10 May 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Institute Macro Focus

Americas

US consumer credit grows less-than-expected in March.

After rising modestly in February, consumer credit growth slowed in March. This slowdown may reflect the lagged impact of higher interest rates and tighter lending standards by banks. Considering this lag, it is likely that credit growth may continue to slow throughout 2024. However, this is being partially offset by an increase in loans from alternative finance companies, and this trend could also continue.

Europe

Investor confidence improving in Europe.

In May, the Sentix Investor Confidence indicator posted its seventh consecutive increase, indicating that a moderate recovery is underway in Europe. The index rose to -3.6 (up from -5.9 in April) owing to better current and future expectations on economic activity. However, the index shows a moderate momentum, and is still below its long-term average.

Asia

Exports of select Asian countries rebounded in April.

The bellwether of global trade – exports of China, Taiwan, Korea and Vietnam recovered in annual terms, rebounding 2% in April vs -5.5% in March. That said, the sequential momentum has plateaued, showing that the strong artificial intelligence-led chip shipments haven’t broadened out to other sectors yet.

Key Dates

|

14 May Japan PPI, |

15 May US CPI, EZ GDP |

17 May EZ CPI, China retail sales |