Summary

- Significant policy shift: China's Politburo has announced a series of policy easing measures, including rate cuts and relaxed housing restrictions, aimed at stabilising the economy and reviving sentiment. Regarding fiscal policy, there was no explicit mention of a supplementary budget, but markets remain optimistic for potential additional budgets by the end of October.

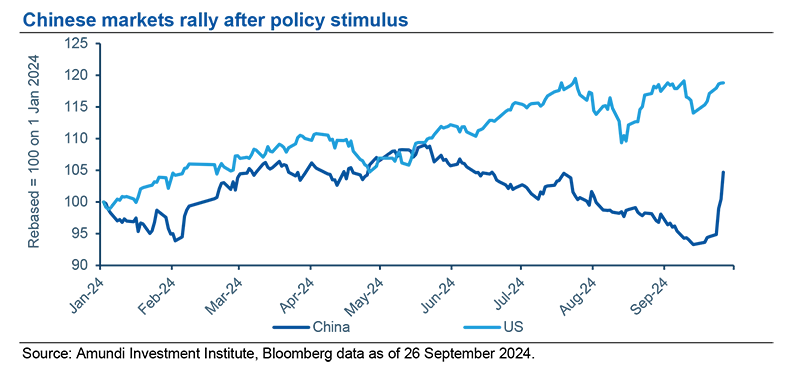

- Chinese stocks rebound: Following monetary stimulus and liquidity measures from the People’s Bank of China, the Shanghai Shenzhen CSI 300 Index saw its highest weekly rally since 2008, erasing year-to-date losses and rising 7.9% for the year, fueled by improving market sentiment.

- More optmistic turn on Chinese assets: recent policy shifts are supportive for Chinese equities, but while monetary easing and housing adjustments may stabilise sentiment in the short term, the effectiveness of these measures in reversing economic challenges will depend on the introduction of robust consumer-oriented fiscal policies.

- Views on Chinese equities: Onshore A-shares and select Hong Kong stocks are poised to benefit from policy shifts, with attractive earning yields compared to bond yields, particularly in consumer staples and financial sectors, while caution is advised regarding potential tariff risks and the need for robust fiscal stimulus.

What are the principal measures that have been announced, and what is yet to come?

The last week of September has seen a change in the direction of China’s policy mix. China’s Politburo held an unscheduled meeting on economic policies, signalling a clear and urgent shift in monetary and housing policy stances. In terms of monetary policy, the Politburo called for ‘impactful’ rate cuts. It revised ambiguous language on housing, urging a stabilisation in the real estate market. On the supply side, it vowed strict controls on new constructions, to increase loans for ‘white list’ projects, and to support the sale of unused land. On the demand side, it asked to further relax housing purchase restrictions and to lower existing mortgage rates - the latter already enacted by the People’s Bank of China (PBoC) earlier in the week.

Regarding fiscal policy, there was no explicit mention of a supplementary budget, but the Politburo reiterated its use of ultra-long government bonds and local special bonds. Markets remain optimistic for potential additional budgets by the end of October.

Main policy measures announced:

- The 7-Day Reverse Repo Rate (the new preferred policy rate) was cut to 1.5% from 1.7%: a bigger cut than we expected and larger than its previous 10 basis point cut in July. This cut will cause the Loan Prime Rate (LPR) to drop 20bp, deposit rates to drop 25bp, and the Medium-term Lending Facility (MLF) rate to drop 30bp;

- The Reserve Requirement Rate (RRR) was cut by 50bp to a weighted average of 6.6% from 7%. Governor Pan gave a clear forward guidance that the PBoC will likely cut the RRR again this year by 25-50bp. The RRR cut will release RMB 1trn of liquidity into the banking system;

- Guide banks to lower existing mortgage rates to match the new mortgage rates. The PBoC estimates this will lower mortgage rates by an average of 50bp, reducing interest payments for households by a total of RMB 150bn. It will take time for Chinese banks to handle technical changes for 50 million households affected by the policies;

- Lower the national minimum down payment ratio for second home buyers from 25% to 15%, the same level as first-time home buyers, marking a symbolic end of policies that strictly restricted speculative investors.

Chinese stocks have rebounded sharply, fuelled by monetary stimulus and the Politburo's commitment to restore confidence

How did the stimulus announcement affect market sentiment?

Chinese stocks staged a sharp rebound following the monetary stimulus and liquidity-boosting measures announced by the PBoC and the Politburo’s commitment to restore confidence. Sentiment was so strong that the CSI 300 Index recorded its highest weekly rally since 2008. With this movement, the Chinese equity market erased year-to-date losses, sending the CSI 300 Index into positive territory at +7.9% since the start of the year.

In our view, three key policies boosted short-term market sentiment:

- The PBoC’s liquidity facilities for Non-Bank Financial Institutions (NBFIs) to buy equities and for listed companies to conduct buybacks, and Governor Pan’s aggressive forward guidance regarding the size of measures;

- The Politburo’s stance on monetary policy, advocating for ‘impactful’ rate cuts over minor adjustments;

- The Politburo’s shifted stance on housing.

A consumeroriented fiscal package could be a true game changer in stimulating household consumption and addressing deflationary pressures.

How did the stimulus package announcement affect your view on Chinese assets?

We have become cautiously optimistic about Chinese assets following the announcements. The monetary easing and housing policy adjustments signal a renewed effort by China’s leadership to support the economy, but they still seem unlikely to single-handedly reverse the structural economic slowdown. While these moves should help stabilise market sentiment in the short term, the real test will come from whether fiscal measures follow. A consumeroriented fiscal package could be a true game changer in stimulating household consumption and addressing deflationary pressures.

What are your investment convictions on Chinese equities?

We believe Chinese equities - specifically onshore A-shares and select Hong Kong stocks - will benefit the most from these policy shifts. The significant gap between earning yields and bond yields presents an attractive opportunity for equity investors. Moreover, a stabilising housing market, combined with improved household expectations, could provide further tailwinds for equities. We are particularly positive on consumer staples and financials, especially brokers and asset managers, which stand to benefit from increased market activity. At the same time, we recommend reducing short positions in RMB to neutral, as speculations are rising on higher growth and inflation following the fiscal measures report, stabilising the currency. However, it is prudent to remain mindful of the risk of a new wave of tariffs, especially in light of the upcoming U.S. elections.

While the market response has been generally positive, much will depend on whether a robust fiscal stimulus package materialises. If consumer-oriented fiscal measures are introduced, we anticipate upward revisions to growth and inflation expectations for 2025. However, without such measures, the initial market rally may be short-lived. In the near term, the combination of monetary easing and targeted housing support should provide a temporary uplift, but a longerlasting recovery will require more decisive fiscal action.

Definition

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

With the contribution of:

Laura FIOROT

Head of Investment Insights and Client Divisions,

Amundi Investment Institute

Giulio LOMBARDO

Publishing Specialist,

Amundi Investment Institute

Nick MCCONWAY

Head of Asia ex-Japan equity