Summary

Key Takeaways

- Biodiversity is a standalone risk and opportunity for the insurance sector

- High degree of variability in the sector around awareness of biodiversity with only a handful of companies identifying it as a distinct topic requiring strategic attention

- Apart from a few players, the sector demonstrates a lack of top down oversight over biodiversity within its operations, investments and underwriting

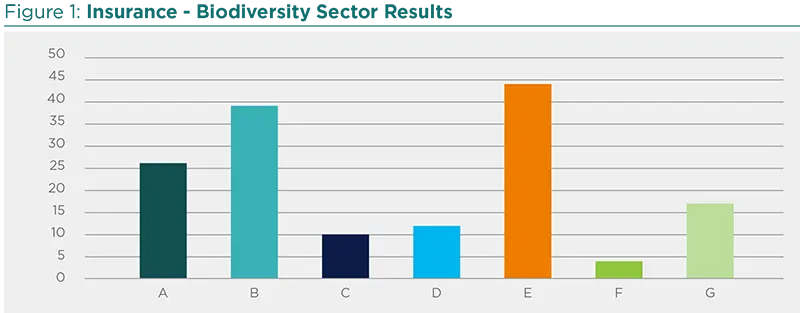

Based on our engagement sample, the insurance sector demonstrates a mixed bag of awareness on the topic of biodiversity1. Some of the insurers are taking the subject of biodiversity very seriously, and have announced a specific biodiversity strategy and/or devoted significant resources to initiatives and research on the topic. On the other hand, some of the companies were surprised and uncomfortable by our enquiry as biodiversity is not yet on their radar screen. These insurers appeared unfamiliar with the subject and how it pertains to the sector specifically.

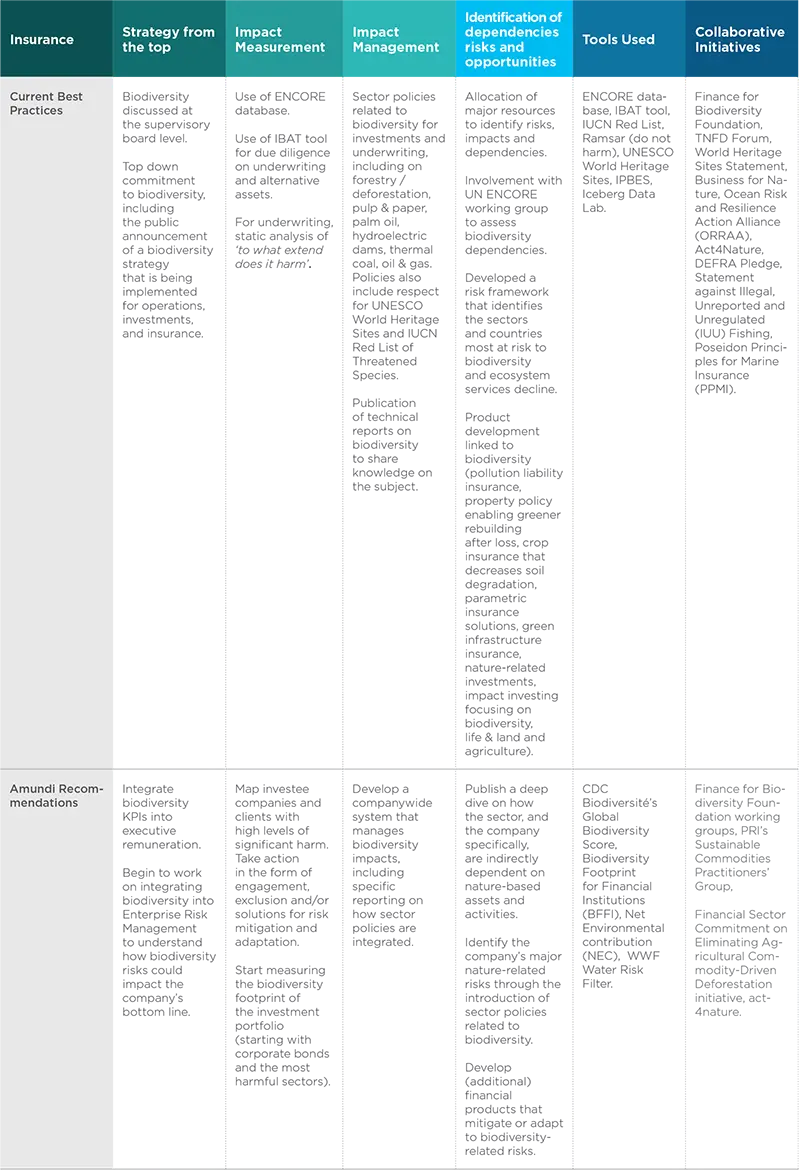

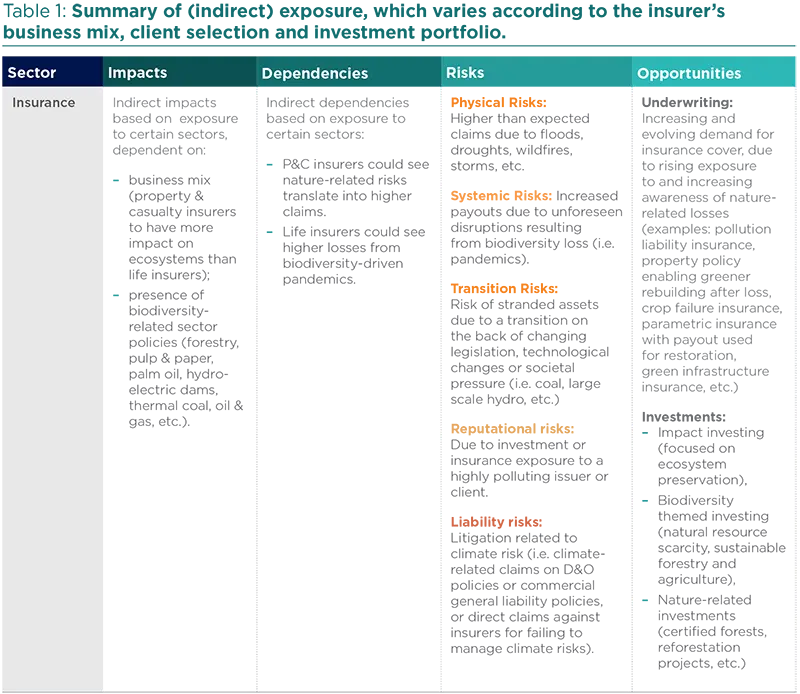

We noted that most of the insurers have started to indirectly take biodiversity risks and impacts into account through its strong links with climate change, but not through a direct assessment of the risk and impact. In the case that insurers do directly asses the topic, they first start to approach biodiversity for their investment portfolio (assets), before considering it for the underwriting activities (liabilities) – as they do for climate. We also note that the industry‘s primary focus on biodiversity is a risk approach, more than an approach of impact, dependencies or opportunities. The nature of the industry as a risk manager and risk carrier explains this tendency.

Top Down Strategy on Biodiversity

Just like the understanding of the topic, individual insurance companies look to have a heterogenic approach to biodiversity strategy from the top. Biodiversity is an important point of strategic attention for the few companies that demonstrated best practices. One of these companies publicly committed to embark on a biodiversity strategy, subsequently announcing a specific plan 3 years later to fight deforestation and preserve biodiversity. However, for most companies within the study, biodiversity was not a major topic of discussion at board level. These insurers that lack significant top down oversight over biodiversity also demonstrated weaker practices on managing biodiversity-related impacts within their operations, investments and underwriting. Biodiversity-related policies, such as on deforestation, palm oil and hydroelectric dams, were often non-existing. For these lagging companies, efforts were also more philanthropic in nature (i.e. planting trees, donations to nature charities) rather than actually addressing the impact from their own processes on biodiversity. Such an approach goes indeed against the wise statement from one of the leading insurers, which said that instead of planting trees, it is more beneficial to avoid deforestation. We would conclude that a top down strategic prioritization and oversight is essential for insurance companies to successfully develop policies and processes, addressing biodiversity loss.

Impact measurement & management

Biodiversity as a stand-alone risk and opportunity, instead of linked to climate

Several insurers mentioned indirectly taking biodiversity risks into account through its strong links with climate change instead of through a direct assessment of the risk. By contrast, we would recommend companies to start identifying more directly, and acting on the risks and impacts of biodiversity.

At the same time, the industry can rely on the progress that has been made on climate. Several insurers mentioned that the climate agenda has brought them valuable lessons, which they are now able to leverage upon for the topic of biodiversity, including the TCFD disclosure framework.

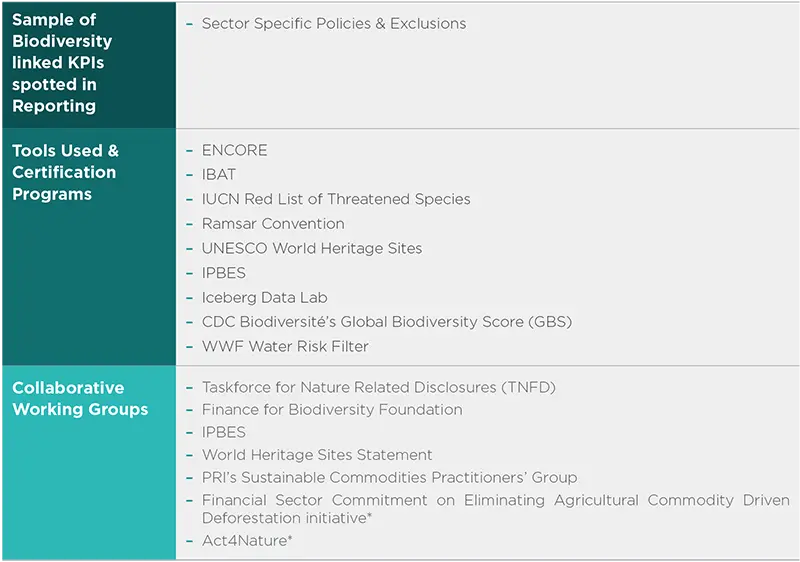

More and more tools are becoming available for the industry to start measuring nature-related risks. The ENCORE tool, for example, broadly maps impacts at a sector and sub-sector level. The quality of data and its application still leaves room for improvement. One insurer mentioned to us that it currently uses ENCORE to serve only two primary objectives: to comply with regulation and to invigorate awareness.

Many companies in a variety of sectors are also using the IBAT (Integrated Biodiversity Assessment Tool) to get a sense of where they operate and if they are near protected or high risk areas. The insurance industry uses it for due diligence of underwriting and of alternative asset investments, but there could be opportunities later on, to integrate the data into a wider range of investment strategies.

Additionally, several insurers mentioned the application of exclusions or due diligence on the basis of data from the IUCN Red List of Threatened Species, the Ramsar Convention, UNESCO World Heritage Sites, IPBES and Iceberg Data Lab.

What is still missing, is the quantitative measurement of financial companies’ impacts. This is arguably a difficult feat, considering that there is no ‘simple’ KPI like CO2. Some insurance companies are actively involved in major working groups such as the TNFD and the Finance for Biodiversity Pledge to collectively determine how to address this issue.

We support these initiatives but also encourage companies to personally trial certain KPIs and tactics to measure nature-related impacts across portfolios. New tools are emerging for the financial sphere including Iceberg Data Lab and the Global Biodiversity Score. As awareness of the issue improves, data availability is likely to follow.

Still, it remains difficult for a financial company to measure its impact on specific species. On the other hand, it is easier to identify the drivers that negatively impact biodiversity and to look at what the company does in that respect. As is the case for other sectors, there are KPIs available that have links to the drivers of biodiversity loss such as CO2 emissions, toxic waste and pollution intensity. Related to that point, one insurer rightly stated to us that biodiversity can take care of itself! In the first place, it is more about reducing the negative impact instead of creating a positive impact. It is therefore essential to first start reducing the negative footprint of a company (whether through CO2 emissions, toxic waste and/or pollution intensity).

Looking more closely at an insurer’s investments, we get the same picture. Only a small part of the portfolio concerns biodiversity-positive activities and services, such as green infrastructure. The vast majority of the portfolio refers to ways how issuers can decrease their negative impact.

We are aware of a best-in-class insurer (which was not part of our sample for this engagement) that has started to calculate its biodiversity footprint on a small part of its investment portfolio (corporate bonds and concerning the most harmful sectors only for the time being). The insurer is expanding the scope over time. This player mentioned still staying far away from being able to pilot the investment portfolio according to biodiversity risks and impacts. However, the information gathered allows it to target its engagement activities.

Identification of dependencies, risks and opportunities

Compared to other sectors we examined, insurance is making the most strides, through the efforts of a few players, on measuring risk exposure linked to biodiversity. This is of course inherent to the nature of their business as risk managers and risk carriers. One insurance company even has developed a commercial tool to assess sector reliance on nature, and geographic exposure to ecosystem decline.

This work will not only help the industry and individual insurers to better address nature- related loss but could also provide guidance to corporates within their portfolio to better take into account biodiversity. We see the work of the leading companies as particularly innovative.

Companies with the strongest practices have identified biodiversity as a(n emerging) risk. One company in particular has specifically identified biodiversity within its risk framework, which is translated, among others, into nature-related sector policies.

The presence of sector policies ‘automatically’ addresses biodiversity from a risk as well as an impact perspective. We believe this to be the first major step to be taken for an insurer when adopting a meaningful biodiversity strategy. The implementation of biodiversity- related sector policies (for example on forestry, pulp & paper, palm oil, hydroelectric dams, thermal coal, oil & gas) should be applied to the investment and underwriting portfolios as well as the sourcing activities.

There is a long way to go to precisely price biodiversity into risk management processes. Still, a specific nature-related risk, the risk of a pandemic, has now been integrated into risk management by the industry. Insurers have either excluded this risk from their policies (travel, business interruption, workers compensation insurance), or the inclusion of pandemic risk has led to higher premium rates.

A systematic risk deserves collective action

One insurer rightly stated that nature-related risks need collective action, as we are talking here about systemic risks. Insurers, part of the broader financial sector, play a key role in helping industries like agriculture, infrastructure and energy to transition. But insurers also cited the help that is needed from the public sector.

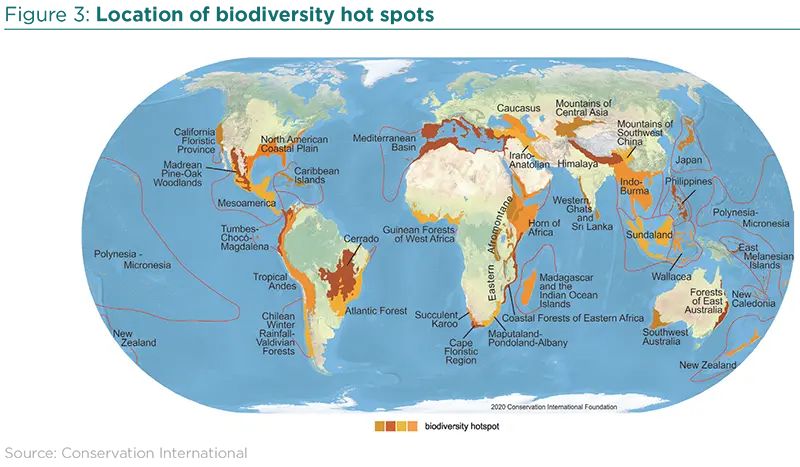

For example in the form of blended finance instruments to attract capital to emerging markets, where many of the biodiversity hot spots reside. Additionally, there is an increasing call for governments to remove subsidies on polluting activities.

Tools & Collaboration

There is quite an offering of tools available for the sector to start identifying its exposure to nature-related risks. As cited higher up, these tools concern for the time being primarily the investment portfolio of insurers, and to a lesser extent the liability exposure. New tools have emerged for the financial sphere such as CDC Biodiversité’s Global Biodiversity Score (GBS), which also has potential applications in other sectors3. Still, some insurers rightly cited the shortage of quality nature-related data and the need for further disclosure by data providers.

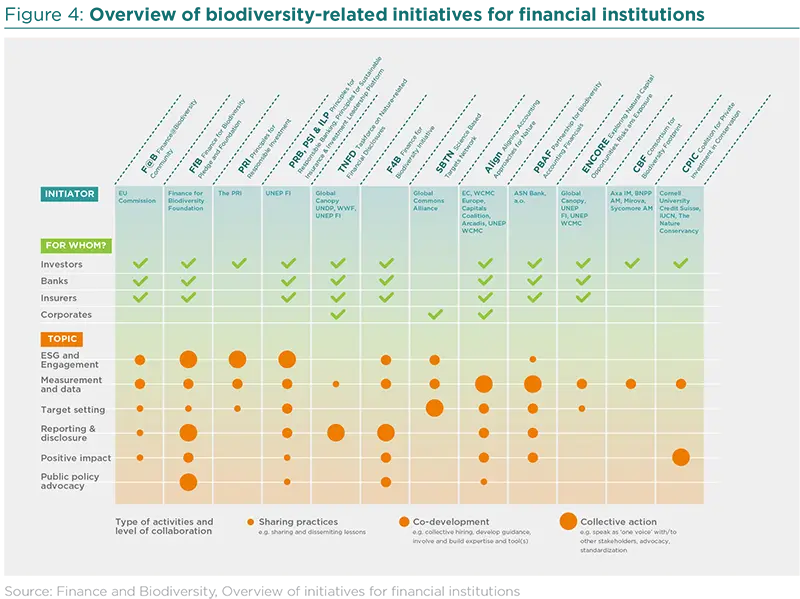

In terms of collaborative initiatives, there is equally a choice available as seen in the table above. Some were cited by companies within the engagement pool but additional initiatives also exist in the market, but were not mentioned during our meetings (*table above). Several players however signaled their hesitance to allocate precious resources to an initiative that might not turn out to become market-leading over time. Once the sector becomes more conscious of the risks it runs, the willingness to invest in these initiatives might increase – if we can wait that long!

Overall, as is the case for climate, insurers first start to approach the topic of biodiversity for their investment portfolio (assets), before considering it for the underwriting activities (liabilities). There are several reasons for this order of implementation. Firstly, regulation is more coercive for the investment side, for example in France through Article 29 of the law on Energy and Climate, which requires financial institutions to disclose biodiversity-related risks. Secondly, a large part of assets (public equity and bonds) are easily identifiable (through ISINs for example), which is not the case for activities or risks under insurance coverage. Thirdly, while it is relatively straightforward to get the data for the investment portfolio (through external providers), it is considerably more difficult to get information on exposure (to biodiversity, climate or other) through insurance contracts. Finally, it is easier to coerce pressure on investee companies on the topic of biodiversity, using the stick of divestment than it is to influence insurance clients, as these are often longer term and tighter relationships.

Case Study: Interview with Esther Dijkman Dulkes, ESG analyst Insurance

Q: What was one company in your engagement study that you want to highlight? What are they doing on biodiversity currently?

A: I would like to highlight AXA, as the example demonstrates that biodiversity cannot be addressed from one day to the other, but that it is instead a path that one embarks on, in collaboration with other stakeholders.

Q: What was particularly interesting about AXA?4

A: AXA has approached the subject of biodiversity from several different angles. It launched in 2008 the scientific philanthropy initiative the AXA Research Fund, which has supported over 60 projects addressing the environmental, social and economic impact of biodiversity loss. In 2018, AXA publicly committed to embark on a biodiversity strategy, to be implemented for operations, investments and insurance. The company moved a bit further in 2021 when it announced a plan to tackle deforestation. This plan includes a committed €1.5bn investment to support sustainable forest management, of which €500m in emerging markets’ reforestation projects. The plan also includes a tightening of its investment and insurance requirements in activities that actively contribute to deforestation, such as certain soy, palm oil, timber, and cattle productions. In parallel, AXA selected Iceberg Data Lab, together with three other investors, to develop a biodiversity impact measurement tool for investors. The asset management subsidiary, AXA IM, subsequently took a stake in Iceberg Data Lab in September 2021.

After our engagement meeting with AXA in September 2021, the company has now published an exploration of the potential biodiversity-related impacts on its operations and its investment portfolio. In this respect, the insurer can be considered a precursor because the quantification of business impacts on biodiversity is still a relatively new field, as discussed earlier. Additionally, the company launched most recently the AXA Forests for Good project together with a consortium of actors, to help restore damaged forest ecosystems and make them more resilient to climate change.

To drive the insurer’s engagement agenda, AXA engages with a selection of companies on biodiversity-related topics on behalf of the Group and its third-party clients. Furthermore, AXA IM actively participates in initiatives of the Finance for Biodiversity Foundation, chairing the working group on biodiversity impact metrics and contributing to other working groups.

Q: Any recommendations for improved practices?

A: To put further weight behind AXA’s drive to protect the ecosystem, we would recommend the company to include a nature-related KPI into executive remuneration. Such a demand would of course first require the definition and measurement of KPIs. We would recommend AXA to start measuring the biodiversity footprint of its investment portfolio, initially for corporate bonds and the most harmful sectors and then expanding the scope over time. The information gathered would also allow the company to help target its engagement activities. Another recommendation, for the underwriting activities, would be to develop additional financial products that mitigate or adapt to biodiversity-related risks. The development and sale of these products should then ideally be included into performance targets for concerned employees.

Conclusion

Generally speaking, awareness on the role of biodiversity for the insurance sector is still low. Most insurers are not focused on this topic yet, as they are rather in the process of grappling the full impact from climate change. We note that the insurance sector’s CRO Forum only relatively recently added biodiversity to its Emerging Risk Radar.

Having said that, several insurers are taking the lead through the application of biodiversity- related sector exclusion policies, the active participation or leadership in collaborative initiatives (TNFD, the Finance for Biodiversity Pledge, the World Heritage Sites initiative), the spending of major resources to identify biodiversity risks, impacts and dependencies or through the development of financial products that mitigate or adapt to biodiversity-related risks.

When taking into account biodiversity into its operations, the industry in general starts with the investment portfolio, before moving on to the underwriting activities. In most cases, we have seen the same order of integration for climate-related risks and opportunities. This order of implementation can be explained by regulation as well as the relative facility to identify, assemble data and engage with investee companies in the investment portfolio.

We also note that the industry’s primary focus on biodiversity is a risk approach, more than an approach of impact, dependencies or opportunities. The nature of the industry as a risk manager and risk carrier explains this tendency.

In terms of recommendations for the sector, we would like to put forward the following:

- A commitment from the board and top management to pursue a biodiversity strategy.

- Integration of biodiversity-related KPIs into executive remuneration.

- The introduction of sector policies related to biodiversity for investments and underwriting (forestry/deforestation, pulp & paper, palm oil, hydroelectric dams, thermal coal, oil & gas).

- Start measuring the biodiversity footprint of the investment portfolio with the help of tools such as Iceberg Data Lab’s Corporate Biodiversity Footprint, CDC Biodiversité’s Global Biodiversity Score.

- After identification of investee companies and clients with high levels of nature-related harm, take action in the form of engagement, exclusion and/or solutions for risk mitigation and adaptation.

- Develop (additional) financial products for clients, which mitigate or adapt to biodiversity- related risks.

- Support the development of increased disclosure (through TNFD, SBT for Nature, etc.)

- Also join other collective initiatives, such as the Finance for Biodiversity Pledge.

For more insights

This article is part of the series “Biodiversity: it’s time to Protect our Only Home”. To learn more about this theme, please click below on the following article.

Biodiversity : It’s Time to Protect Our...

Sources

1 This report was written in 2022, based on engagements that took place in 2021.

2 Observation is based off of sources including ENCORE, BCG, engagement calls, and analyst assessments.

https://encore.naturalcapital.finance/en

https://www.bcg.com/fr-fr/publications/2021/biodiversity-loss-business-implications-responses

3 The GBS is used by Solvay and Schneider Electric for instance.

4 Comments as of October 2022.