Summary

A favourable macro backdrop and a Fed close to cutting its policy rates are positive factors for emerging market assets.

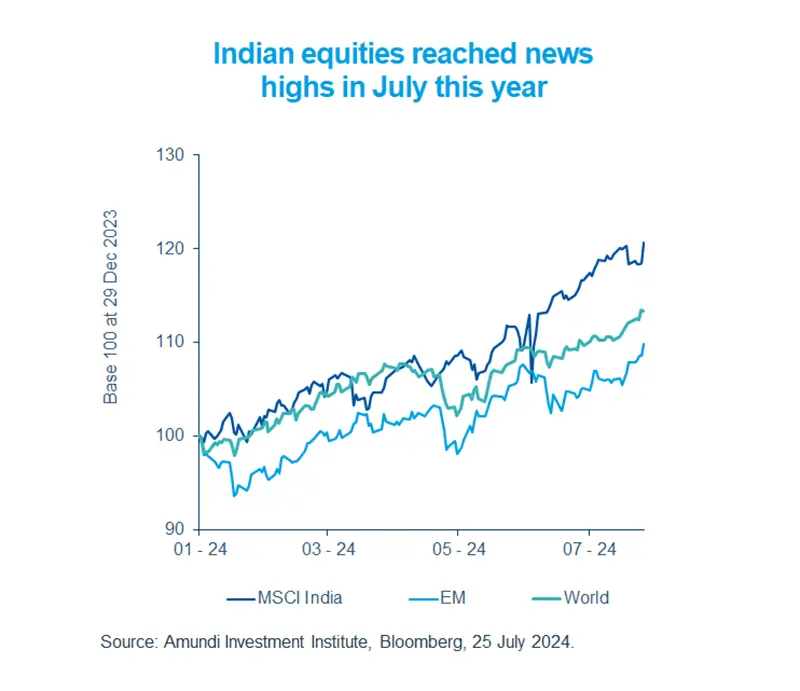

- Indian markets have delivered strong gains this year on expectations of strong economic growth and demand.

- We think the country should continue to benefit from prudent fiscal and monetary policies, and stable inflation.

- In general, the global backdrop remains constructive for attractively-priced emerging market assets.

Since the start of the year, Indian stocks have outperformed the overall emerging markets and global indexes due to optimism around strong economic growth and robust domestic demand. While in the short term, equity markets may take a pause, India continues to be a long-term story of structural growth led by favourable demographics, a growing middle class, and stable policy making. The recent annual budget confirms this direction with a prudent allocation of resources towards inclusive growth. The government is likely to focus on boosting infrastructure, employment generation, upskilling of the population, and social security. Additionally, India stands to benefit from the global reallocation of supply chains. Indian bonds also offer potential opportunities, given the contained inflation and their recent inclusion in global benchmarks.

Actionable ideas

- Explore long-term opportunities in Indian bonds and equities

Indian assets offer an attractive backdrop to support global investors’ search for yield and diversification*.

- Emerging market bonds

Policy easing in the developed world such as US and Europe and robust economic growth in EM paint an attractive picture for EM bonds.

This week at a glance

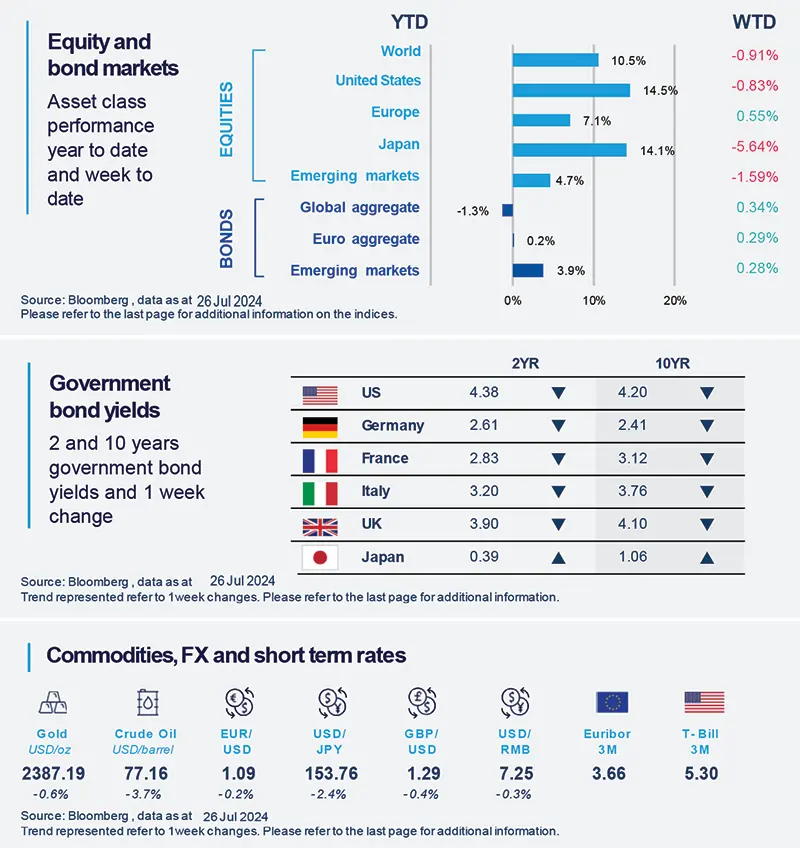

US and Japanese stocks fell due to concerns over the sustainability of the artificial intelligence-driven rally in the tech sector. A strengthening yen, which makes Japanese exports expensive, also affected sentiment. Bond yields declined, and oil prices also fell on worries about demand from China.

Equity and bond markets (chart)

Source: Bloomberg. Markets are represented by the following indices: World Equities = MSCI AC World Index (USD) United States = S&P 500 (USD), Europe = Europe Stoxx 600 (EUR), Japan = TOPIX (YEN), Emerging Markets = MSCI Emerging (USD), Global Aggregate = Bloomberg Global Aggregate USD Euro Aggregate = Bloomberg Euro Aggregate (EUR), Emerging = JPM EMBI Global Diversified (USD)

All indices are calculated on spot prices and are gross of fees and taxation.

Government bond yields (table), Commodities, FX and short term rates.

Source: Bloomberg, data as 26 July 2024. The chart shows Global Bonds= Bloomberg Global Aggregate Bond Index, Global Equity = MSCI World. Both indexes are in local currency.

*Diversification does not guarantee a profit or protect against a loss.

Amundi Investment Institute Macro Focus

Americas

US economic growth above expectations

Second quarter GDP growth came in better than expected, supported by robust domestic demand as consumption, investments and government spending expanded at a sustained pace. While domestic demand remained resilient in the first half of the year, we may see signs of weakness in the second half as labour markets cool.

Europe

Preliminary July survey data was weak

The euro zone composite purchasing managers’ index (PMI) came in at 50.1, falling for the second consecutive month and barely reaching the expansionary territory of 50. Activity in the manufacturing sector contracted but it was partially offset by expansion in services. At a country level, the picture was mixed. Looking ahead, the number is in line with our view of a modest growth in the region.

Asia

India’s budget shows fiscal prudence

The Indian government released its annual budget which confirmed its commitment to capital spending. We also noticed allocation of resources to enhance employment, support small and medium enterprises and improve public infrastructure. We think, in its third consecutive term, the Bhartiya Janta Party-led government is working on the lessons learnt in the recently concluded national elections by providing support to the neglected parts of the economy.

Key Dates

|

30 Jul Euro area GDP, |

31 Jul Fed policy, Bank of |

1 Aug Bank of England policy, |