Summary

- Federal Open Market Committee (FOMC) and statement: On 4 May, the Federal Reserve (Fed) hiked the Fed funds rate by 50bp to 0.75-1.00%, the first back-to-back hike since the second quarter of 2006. The FOMC statement signaled the start of a series of rate hikes. The Fed downplayed the negative Q1 GDP data, while upgrading its inflation assessment. The Fed also announced the start of Quantitative Tightening (QT) for 1 June, by shrinking the balance sheet by $30bn per month in US Treasuries and $17.5bn in mortgage-backed securities (MBS) for the next three months, and then ramping up QT to a maximum cap of $60bn per month in US Treasuries and a maximum cap of $35bn per month in MBS.

- Press conference: Chair Jerome Powell stated the need for a 50bp rate hike at the next couple of meetings. There was some speculation that the Fed may retain the option to hike 75bp in the coming meetings, but Powell was emphatic that the committee is not currently considering that policy action. While nuanced, his statement on this point may prove to be a near-term communication challenge. Powell described the the neutral Fed Funds rate as a policy rate that neither stimulates nor slows economic activity and maintains the economy at full employment with a 2% inflation rate. He noted that the Fed believes the neutral rate is between 2-3%. Powell’s comments on rate hikes suggest the Fed will be even more data-dependent going forward.

- Market reaction and investment implications: After the press conference, which was not as hawkish as market expectations, there was a sharp drop in the two-year Treasury yield and a steepening yield curve. Equity markets rallied sharply, helped by Powell’s comment on a soft landing of the economy (i.e., Fed’s ability to fight inflation while not derailing the economy. As the Fed has completed the shift to a more hawkish reaction function, data will drive financial market volatility more than Fed surprises. The market is pricing in an aggressive Fed tightening cycle, expecting the Fed funds rate to peak at approximately 3.5% in 2023. Fixed income markets have factored in a robust tightening cycle, resulting in more attractive US yields, especially in the intermediate part of the yield curve. The outlook for fixed income markets remains somewhat mixed, complicatedbetween attractive yields and uncertainty about how far the Fed will have to raise rates. If the outlook unfolds as envisioned by the Fed, US fixed-income securities should perform well, but could be derailed if inflation becomes entrenched in the economy. The dollar bull market has been driven by both Fed hike expectations and concerns about global growth against the G3. Since the beginning of the year, the euro has depreciated 7.5%, while the Japanese yen has declined 11.6% against the dollar. Going forward, the extent of euro and yen weakness will depend on a combination of Fed rate outlook, Eurozone recession concerns, and BoJ monetary policy. With expectations of further rate hikes by the Fed, interest rate differentials should support the dollar against the G3. However, with markets expecting an aggressive tightening cycle, the dollar may struggle against high yielding EM currencies.

On 4 May, the Fed hiked the Fed Funds rate by 50bp to 0.75-1.00%, the first back-to-back rate hike since the second quarter of 2006. It is also the first 50bp rate hike since 2000. The Fed decision was widely expected.

FOMC statement: a series of rate hikes to come and start of QT

The FOMC statement signaled the start of a series of rate hikes in the coming meetings. Not surprisingly, the Fed downplayed the negative Q1 GDP data by highlighting the strength of household spending and business fixed investment. The Fed upgraded its assessment of inflation, by recognising the upward inflationary impact from the Russia-Ukraine war and adding Covid-19-related lockdowns in China as a factor exacerbating supply-chain disruptions. The Fed also formally announced the start to QT for 1 June by shrinking the balance sheet by $30bn per month in US Treasuries and $17.5bn in MBS for the next three months, then ramping up QT to a maximum cap of $60bn per month in US Treasuries and a maximum cap of $35bn per month in MBS. We believe the Fed is unlikely to hit its maximum cap of $95bn per month, largely due to not enough MBS to sell.

We believe the Fed is unlikely to hit its maximum cap of $95bn per month, largely due to not enough MBS to sell.

Press conference: rates to get to neutral expeditiously

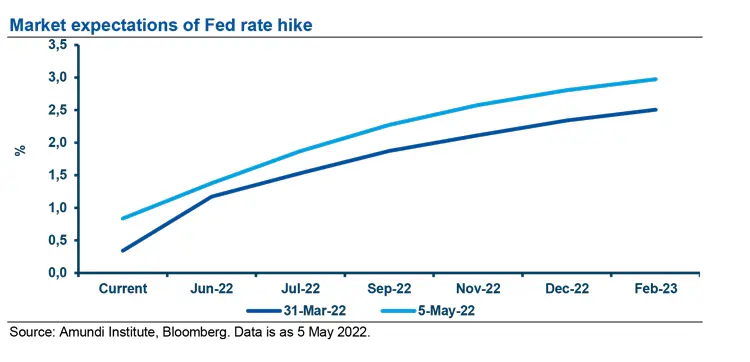

Fed Chair Powell stated the need for a 50bp rate hike at the next couple of meetings. There was some speculation that the Fed may keep the option to hike 75bp in the coming meetings, but Powell was rather emphatic that the committee is not currently considering that policy action. While nuanced, his statement on this point may prove to be a near-term communication challenge. There was a discussion on the neutral Fed Funds rate. Powell described the concept as a policy rate that neither stimulates nor slows economic activity and maintains the economy at full employment with a 2% inflation rate. He noted that the Fed believes the neutral rate is between 2-3%. Powell’s comments on rate hikes suggest the Fed remains comfortable with market pricing at this point, and will be even more data-dependent going forward. With the May FOMC out of the way, market attention will pivot to the June meeting, as the new Summary of Economic Projections will be released. The focus will be on both the new neutral rate forecasts and the dots.

Market reaction and investment implications

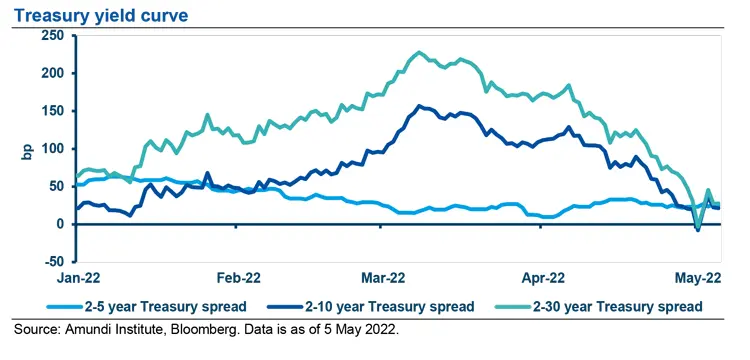

There was little reaction in the financial markets following the release of the FOMC statement. However, after the press conference, which was not as hawkish as market expectations, there was a strong rally in risk assets, with a sharp drop in the two-year Treasury yield and a steepening yield curve. The dollar index fell nearly 0.8%, with the euro strengthening 0.7% and the Japanese yen gaining 0.9%. In other risky currencies, the Australian dollar appreciated 1.4%, while the Mexican peso rose 1.0%. The two-year US Treasury yield fell 11bp and the ten-year yield dropped 4 bp, while the 30-year yield was largely unchanged. This led to a steepening of the yield curve, with the slope of the Treasury curve from two to ten years increasing to 29bp.

While the measured tone of the Fed in its tightening cycle and the push back to a 75bp rate hike has led to a rally in the markets, the basic message from the Fed has not changed: highly attentive to inflation risks.

Equity markets rallied sharply, rising about 2.5% in the Dow Jones, S&P 500, and the Nasdaq indices, helped by Powell’s comment on a soft landing of the economy (i.e., Fed’s ability to fight inflation while not derailing the economy). The S&P 500 delivered its strongest daily performance since May 2020. While the measured tone of the Fed in its tightening cycle and the push back to a 75bp rate hike has led to a rally in markets, the basic message from the Fed has not changed: highly attentive to inflation risks. The Fed will calibrate its message and policy based on the upcoming data. As the Fed appears to have completed the shift to a more hawkish reaction function, data will drive financial market volatility more than Fed surprises. The Fed delivered a 50bp hike that a few months ago would have been unimaginable. The market is pricing in an aggressive Fed-tightening cycle, expecting the Fed funds rate to peak at approximately 3.5% in 2023.

If the outlook unfolds as envisioned by the Fed, US fixedincome securities should perform well, but could be derailed if inflation becomes entrenched in the economy and persistently elevated.

Fixed income markets have factored in a robust tightening cycle, resulting in more attractive US yields especially in the intermediate part of the yield curve. The outlook for fixed income markets remains somewhat mixed, complicated between attractive yields and uncertainty about how far the Fed will have to raise rates to slow the economy. If the outlook unfolds as envisioned by the Fed, US fixed-income securities should perform well, but could be derailed if inflation becomes entrenched in the economy and persistently elevated. The outlook for the dollar has become more nuanced. The dollar bull market has been driven by both Fed rate-hike expectations and concerns about global growth against the G3. Since the beginning of the year, the euro has depreciated 7.5%, while the Japanese yen has declined 11.6% against the dollar. Going forward, the extent of euro and yen weakness will depend on a combination of the Fed rate outlook, Eurozone recession concerns, and BoJ monetary policy. With expectations of further rate hikes by the Fed, interest rate differentials are likely to remain the bedrock of support for the dollar against the G3. However, with markets expecting a fairly aggressive tightening cycle, the dollar may struggle against high-yielding EM currencies, such as the Brazilian real, Chilean peso, South Africa rand, Czech Koruna, Indian rupee, and Indonesian rupee.

Definitons

- Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association (known as GNMA or Ginnie Mae), Federal National Mortgage (FNMA or Fannie Mae), and Federal Home Loan Mortgage Corp. (Freddie Mac). Securities issued by any of these three agencies are referred to as agency MBS.

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or shortterm rates dropping more than long-term rates.

- FX: FX markets refer to the foreign exchange markets where participants are able to buy and sell currencies.

- Monetary policy reaction function: A function that gives the value of a monetary policy tool that a CB chooses, or is recommended to choose, in response to some indicator of economic conditions.

- Quantitative tightening (QT): The opposite of QE, QT is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.