Summary

Executive summary

In what turned out to be another volatile year, credit markets remained resilient in 2023, posting both positive excess and total returns. Looking at 2024, there is room for more optimism in the credit space, with expectations for strong total returns and continued demand from investors seeking high-quality duration and longer-maturity investment solutions, supported by anticipated interest rate cuts by major central banks.

Investment grade credit valuations are considered attractive, particularly in the Eurozone. European spreads offset a potentially challenging backdrop and they are relatively cheap compared to history. Financials, especially banks, are favoured over non-financials, and we hold a positive view on euro subordinated debt as well. Technicals paint a supportive picture for the high yield segment, as the asset class’s carry is well above the medium-term level and fundamentals are solid, presenting opportunities for investors.

The Green, Social and Sustainability bond market offers further opportunities. With Europe spearheading the advance, the market has experienced significant growth on a global scale and provides an actionable lever for achieving impact and net zero goals. Green bond investing has become a global asset class, offering diversification opportunities for actively managed portfolios. With changing regulations, central banks’ focusing on greening their balance sheets, increasing investor demand and improving transparency will generate a positive impact on the market.

With strong total returns and continued demand from investors seeking yield and duration, credit markets present an attractive opportunity in an environment of expected central bank rate cuts.

Attractive IG valuations and HY opportunities in 2024

2023 was a volatile year once again for credit markets. Despite this, the market proved to be very resilient, shrugging off fears of a regional banking crisis in the United States (US), the write-down of Credit Suisse Additional Tier 1 (AT1) bonds and the group’s subsequent merger with UBS, and a US sovereign rating downgrade, to post both positive excess and total returns.

In 2024 we remain positive on the credit market, anticipating strong total returns and continued demand from yield and duration buyers. Investors are looking to add high-quality duration and to move away from short-maturity investment solutions, made less attractive by major central banks’ expected interest rate cuts. We continue to search for quality, favouring investment grade (IG) over high yield (HY) names, but we acknowledge that there will be some opportunities to increase exposure to the latter during the year.

Central bank rate cuts present a supportive economic backdrop for credit

The US is expected to face a slowdown in Q2 and Q3, as stringent financial conditions begin to bite, impacting consumers and businesses. Strains on the business sector, particularly small firms, will weigh on capital expenditure intentions and new hiring, eventually translating into the shedding of labour and more progress in labour market rebalancing. A weaker labour market will moderate the strength in consumption to more sustainable spending patterns for households, while government spending should also moderate.

In the Eurozone, growth should remain low with heterogeneous dynamics across countries. The area’s economy contracted slightly in the third quarter of last year, mostly because of declining inventories. Moving forward, tighter financing conditions and subdued foreign demand are likely to continue weighing on economic activity in the near term. Beyond that, the economy is expected to recover thanks to rising real incomes – as people benefit from falling inflation and growing wages – and improving foreign demand, with the labour market continuing to support the economy.

We expect inflation to cool, but central banks need to remain vigilant. We believe US inflation will trend down to 2.6% in 2024 and 2.1% in 2025, and to 2.4% and 2.2% respectively in the Eurozone. Our outlook assumes that the price of energy will remain contained and that central banks will start cutting rates towards the end of H1 2024.

In 2024 we remain positive on the credit market, anticipating strong total returns and continued demand from yield and duration buyers.

Corporate fundamentals are deteriorating, but from healthy levels

In the United States and Europe, companies have not been particularly affected by the recent higher-rate environment. This is explained by a number of reasons:

- Companies have benefitted from a low average cost of debt, thanks to years of historically low interest rates;

- Companies emerged from the Covid crisis with solid fundamentals including high margins, high interest coverage ratios, record levels of cash, etc.;

- Refinancing needs have been limited.

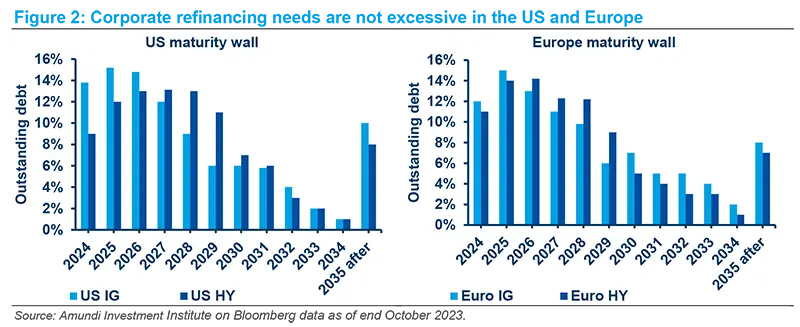

The impact of rate increases on businesses is expected to intensify in 2024 as refinancing needs rise; however, no immediate maturity wall is foreseen in credit markets in 2024, especially in high beta segments such as US and European high yield.

2023 saw euro (EUR) HY default rates remain low and below the long-term median, closing the year at 3.5% on an issuer basis and only 1.3% on a par-weighted basis according to Moody’s data. In the US, the upward trend pushed default rates to 5.5%, but these defaults were almost entirely represented by the lowest-rated CCC names, which reached 9%, while both B and BB-rated names remained flat. There are many reasons to explain this benign cycle, especially for higher-quality issuers.

Moreover, from a bottom-up point of view, a common denominator of historical default cycles is the existence of a 'problem' sector or sectors: for example, retail/consumer services/hotels during the pandemic crisis, energy in 2016, or telecom/technology in 2001. Current distress ratios show no specific sectoral story, potentially further driving the cycle.

We expect slightly higher defaults through 2024, albeit to levels close to long-term averages and mainly affecting low-rated names and SMEs.

Our baseline scenario, assuming no recession in Europe but very low levels of growth, is for default rates of 3.5-4.0% for EUR HY, with risks tilted to the upside in the case of worsening macro conditions. Even if the Eurozone avoids a recession, higher funding costs will be the most significant driver of defaults, therefore potential maturity walls clearly matter. In this respect, 2024 seems manageable: in the last 12 months, companies have started addressing 2025 maturities, reducing their stock predominantly in the loan market and to a lower extent in the bond market. According to our projections of scheduled maturities, 2025 and 2026 should be more challenging, as the transmission mechanism of higher rates into coupons requires time. The average coupon has only just ticked over 4.1% now versus 3.6% in 2022 and is likely to continue to rise, but the aggregate impact on corporate fundamentals will take several years to play out, probably mostly in this biennium.

In the US, we expect HY default rates to reach slightly higher levels than in Europe at 5.5-6%, mostly driven by the lowest-rated names. Contrary to some rating agencies’ baseline scenarios of a Q1/Q2 peak in defaults, followed by a downtrend in H2, we see more of a plateau around these levels. In our view, low-quality issuers will keep driving the trend, while high-quality names (representing the dominant share of EUR speculative grade markets) will remain resilient. While distress ratios remain quite low by historical standards, bank lending standards are still restrictive: this combination, together with the faster impact of higher rates through loans, is likely to affect small and medium companies more than the mid-high-rated names of the HY market.

Technicals: the demand side remains strong for IG

Following two years of quite low supply, the gross issuance of non-financial corporate bonds is likely to finally increase in 2024. However, this will mostly be driven by refunding needs rather than by capital expenditures, dividends or mergers and acquisitions (M&A), so net issuance should not record any meaningful growth. This is likely to be the case for both IG and HY, but especially for the latter.

While net issuance of non-financial IG in Europe is likely to remain modest, as we have seen over the last few years, financials will probably confirm their leading role in 2024 as well. However, as most of the Targeted Long Term Refinancing Operations (TLTRO) have already been repaid and the weaker growth outlook means less lending activity needing to be refinanced, the extent to which financials’ net supply is likely to surprise to the upside appears lower than in 2022 and 2023.

The demand side so far has shown persistent flows back into IG more than HY, both in the US and Europe. This is due to the attractiveness of absolute yields on a historical basis. Should short-term rates decrease following central banks’ expected interest rate cuts in 2024, the demand for high-quality corporate bonds should remain relatively strong, as the competitive returns offered from short-term/cash investments will diminish.

Investment Grade market convictions

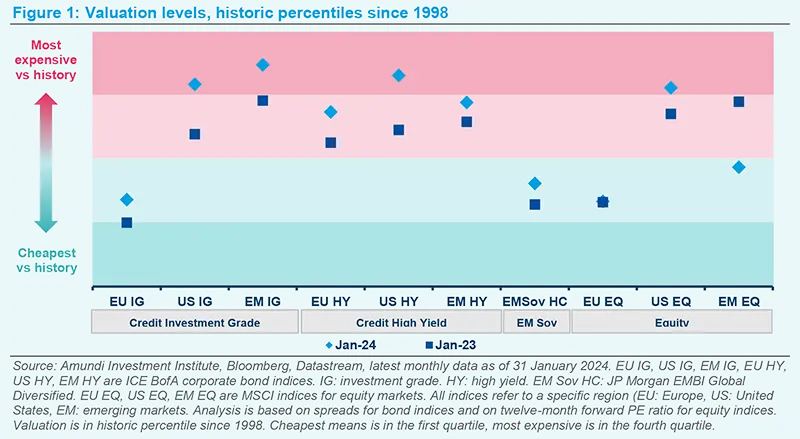

The valuation of euro Investment Grade remains attractive:

- We favour Eurozone names over the United States and United Kingdom: The level of European spreads offsets a bleaker backdrop than we expect and spreads are still relatively cheap by historical standards. We are more neutral on US and UK credit given current levels compared to history. Following the recent outperformance of the US versus other regions, we believe that at current levels, spreads do not offer a sufficient buffer in relation to our US growth outlook. Despite the winding down of Bank of England corporate bond holdings in 2023, the UK credit market was the best performing region. Given the UK’s economic situation is still complicated, with persistently high inflation, we maintain a neutral view at this time;

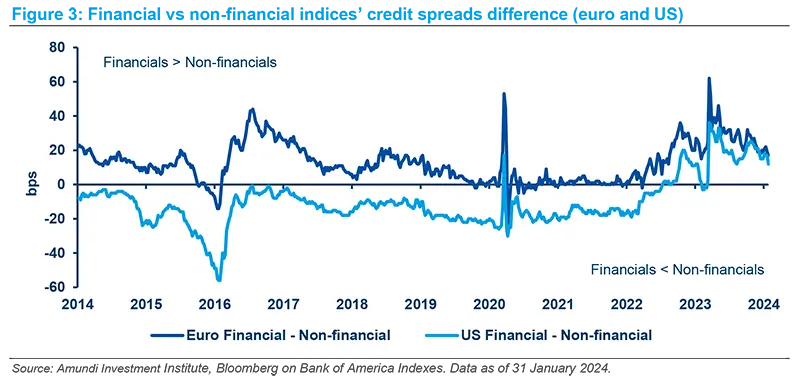

- Financials over non-financials: We remain constructive on financials, especially banks. We do not expect bank credit quality to come under material pressure and they still offer additional returns versus non-financials. Capital levels are quite strong and, although the cost of risk will end up deteriorating in the future, it will be absorbed by better profitability. In Industrials, we favour the autos, media and telecom sectors. On the other hand, we are cautious on cyclical sectors such as consumer goods, capital goods and transportation;

- Positive view on euro subordinated debt: The AT1 market was rocked by the Credit Suisse writedown in Q1 last year, but subsequently bounced back with investors becoming more confident following a series of bondholder-friendly calls. The ECB and BoE also helped boost confidence, assuring investors they would take an alternative route than the Swiss Financial Market Supervisory Authority (Finma) in the occurrence of any ‘event’. Extension risk has been a theme in some parts of the subordinated debt market in 2023, notably in the real estate sector. However, we believe that this remains contained to a few names, creating interesting opportunities in names which we believe have the capacity and willingness to refinance;

- In EUR IG we continue to favour the five-to-seven-year segment of the euro IG curve, with spreads screening attractively, as curves remain steep relative to the very front end;

- We see the poorest value in the long end of the US IG curve. The +15-year area of the US credit market has seen very limited supply as corporates do not want to lock in high coupons for an extended period. This subdued supply, coupled with strong demand from pension funds due to the attractive yields on offer, means credit curves are now trading around their all-time tight levels. This has led to break-evens looking increasingly unattractive, particularly for the higher-rated segments of the market. We therefore prefer the front end/belly of the US curve.

High Yield market convictions

After a painful 2022, the European High Yield market recovered strongly in 2023, posting a Total Return of more than 12% year to date (YTD) 1 . We think that exposure to the asset class will continue to offer value in 2024, with performance mainly being driven by carry:

- HY companies’ fundamentals have been solid so far, with contained leverage and a limited decline in interest coverage ratios despite higher interest rates, except for the weakest CCC-rated companies. The HY market has already taken this into account, with a high level of distressed issuers within the HY indices (around 11%). Default rates should be around 4%, not far from the historical long-term average. It is worth noting that BBs should be a good place to be in 2024, thanks to sound fundamentals, multiple sources of financing and a yield of 5.5%.

- Technicals could continue to be supportive: Gross supply is likely to be higher than in 2023, as issuers anticipate their 2025/2026 refinancing needs. However, net supply is likely to be limited due to the lack of leveraged buy-out (LBO) and M&A activity;

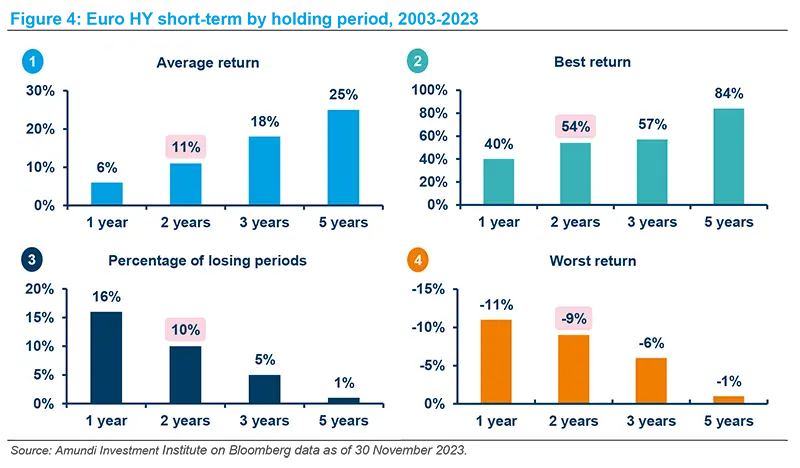

- The asset class’s carry (6.7%, almost equivalent to the 6.8% long-term median level between 1999 and 2023) is well above the medium-term median level (4.2% between 2012 and 2023). Yield is therefore back in HY, especially in the short-term part of the curve (6.1%). Potential curve normalisation over the coming months makes euro HY short-term particularly attractive;

- As highlighted below, over the last 20 years, investing in euro HY short-term for 2 years brought an average return of 11% (1), and the best run was +54% (2). About 10% of the time those 2 years resulted in a loss (3) with the worst run at -9% (4). Returns were positive 90% of the time. Due to the asset class’s carry, being invested over a reasonable investment horizon is more important than timing the market.

Credit opportunities in responsible investing

Background

Despite annual clean energy investments having increased significantly in recent years, they are still far from the level deemed sufficient for achieving net zero by 2050. According to the International Energy Agency, annual global clean energy spending has to rise from USD 1.8tn in 2023 to USD 4.5tn by 2030. Private capital needs to be leveraged and crowded in.

At the same time, for the transition to be successful, investors must remain mindful of the adverse social impacts the transition can have on workers and society at large, and make sure it is socially acceptable.

How to invest with this in mind?

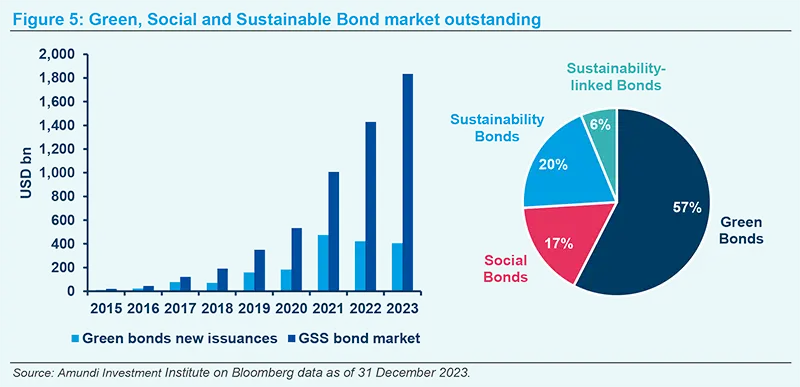

The Green, Social and Sustainability Bond (GSS) market has grown exponentially since the first green bond issuance in 2007. The green bond market alone has crossed the key milestone of USD 2tn of cumulative issuance and the total GSS bond market has recorded a total cumulative issuance of USD 3.7tn, becoming a mainstream tool to tap capital markets to support the financing of green and sustainable projects.

Green bond investing has become an increasingly global asset class, moving away from euro-dominated issuances, with increased diversification in terms of issuer industry sectors and geographies, supported by renewed momentum from new entrants in tapping the GSS bond market, but also project and instrument diversification. This trend presents increasing opportunities in actively managed global portfolios, and we feel that this trend will accelerate further within the wider Green, Social and Suitability universe going forward.

For fixed income investors with sustainable investment objectives (including impact and net zero contribution goals), it provides an actionable lever that has become an essential impact-building block, supported by enhanced market standards and impact reporting practices.

Selection is of primary importance in the GSS universe

One important consideration in GSS investing is that issues are self-labelled by their issuers, which makes it crucial for investors to perform their own analysis to assess the actual quality and transparency of the underlying projects that they intend to finance. Thanks to several technical factors including: changes in ESG regulation, Central Banks moving towards greening their balance sheets, growing investor demand and improving transparency, we believe now is the optimal time to invest; taking advantage of the attractive yields while also having a positive impact (see also 2024 Amundi Responsible Investment Views).