Summary

Executive summary

While the fallout from the pandemic has accelerated several long-term trends, it has also given rise to some misguided expectations. The crisis has paved the way for a new economic cycle, which could be depicted by a resurgence of inflation. Real assets are emerging as the major beneficiaries of this new environment. They appear to meet the global economic challenges, as well as the expectations of institutional and retail investors with regards to both performance and impact.

After more than a year of the Covid-19 crisis, the health situation seems to be improving overall, despite some worries about the spread of the Delta variant. We can hope that a normalisation will be achieved, allowing us to emerge from the repeated ‘stop-and-go’ episodes experienced by the economic and financial world over the past 18 months. There is also hope for a return to a sustainable economic trajectory.

Inflationary pressures are on the rise, especially in the United States. Supply chain disruptions could fuel this inflationary situation. It is too early to know whether this trend will be temporary or structural, but it is vital to seek protection against a resurgence of inflation as certain safe asset classes could be exposed.

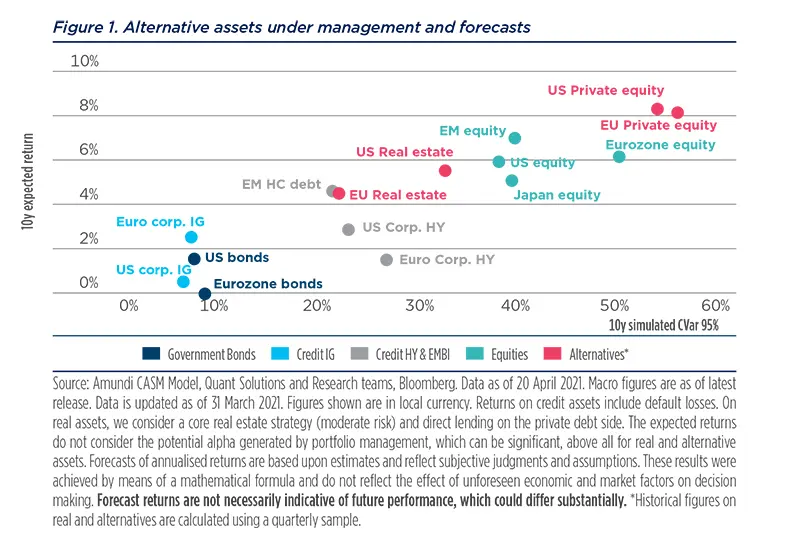

In this context, real assets appear to be the ‘winning bet’ for the post-Covid-19 world, as they have the potential to combine protection against inflation with the prospect of higher returns than traditional liquid assets. According to our analysis, over the next ten years, real and alternative assets could offer an extra return over traditional asset classes worth 200-500 bp, depending on the asset class. This extra income opportunity could approach the higher bound of this range through an active asset picking policy. Such a sizeable spread of anticipated yields should accelerate capital flows into real assets as investors seek to optimise their risk/return trade-off.

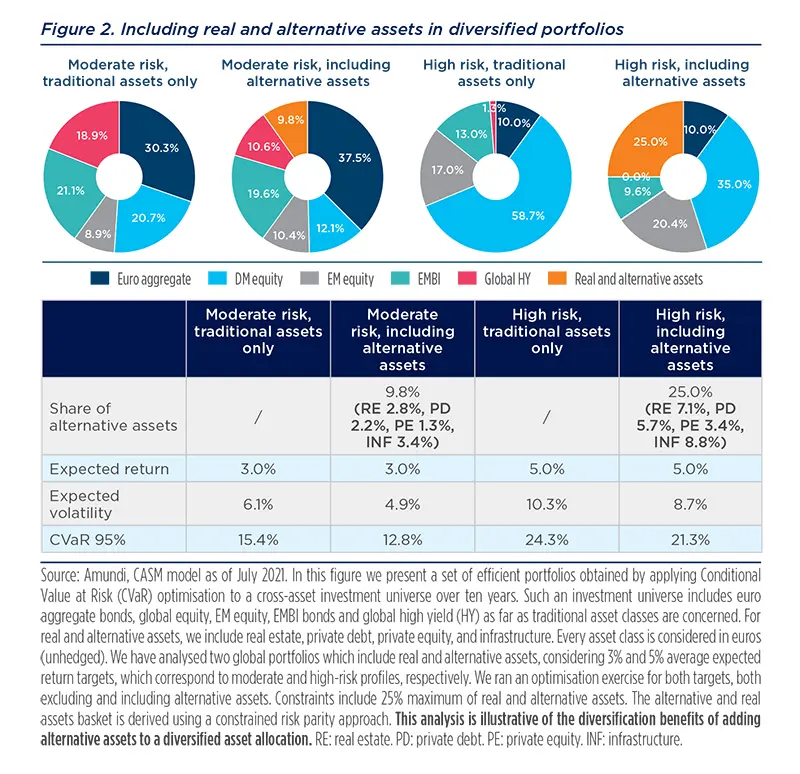

As illustrated in figure 2, the inclusion of real and alternative assets into portfolios might bring significant benefits in terms of diversification for those investors with an adequate long-term investment horizon. For both moderate and high-risk profile investors, the inclusion of alternative assets warrants the achievement of their respective targeted returns of 3% and 5%, with lower volatility and Conditional Value at Risk (CVaR).

For the moderate-risk profile, the allocation to real assets accounts for around 10%, which is achieved through a marked reduction of the exposure to global equity and global HY. For the high-risk profile, the allocation to real assets accounts for the maximum portfolio share allowed (25%) and is financed by a reduction in the exposure to risky assets, particularly DM equities, with the allocation to global HY cut to 0%. This would help rein in portfolio volatility. In both cases, the optimisation confirms a preference for real estate and infrastructure within real and alternative assets.

The above analysis highlights the benefits of investing in alternative assets within a diversified portfolio. However, high scrutiny will be needed when investing in these assets, as the post-Covid-19 world will see high fragmentation and dynamics will vary across different areas and segments.

Prospects for real assets

Structural forces are at play in the post-Covid-19 world and will shape real asset investing. The economy is experiencing a strong economic rebound after the 2020 slump, a sort of V-shaped recovery, which hides divergences and fragmentation at a sector level.

At the same time, after decades of disinflationary forces, we see a resurgence of inflation. While the market debates if this will be temporary or structural in nature – and the jury is still out here – we believe that in the coming years inflation will be stickier and higher than in the previous decade, due to a regime shift, as highlighted in our paper “Don’t give up on fundamental valuations”.

The post-Covid-19 world could not only feature higher inflation, but could also see further long-term trends being reinforced. The digitalisation of economic activity and trade, as well as the strategic importance of supply chains, cannot be denied. The crisis has also rekindled the willingness of governments and central banks to steer economies and financial markets by means of aggressive policies. These efforts are ongoing and could help keep interest rates low. Lastly, the main lesson of this crisis is greater global awareness of the fragility of our environment and way of life, as well as a growing recognition of environmental, social and governance issues.

In this context, real assets appear to be a compelling opportunity for investors with an adequate time horizon, as they could combine protection against inflation with the prospects of higher returns than traditional liquid assets, despite their embedded risk of liquidity and capital loss. The performance of real assets remains equally attractive in the context of contained inflation. In our view, they may offer the best risk-return prospects of all asset classes.

However, investors should keep in mind that the Covid-19 crisis has caused increased fragmentation and divergences both across and within asset classes. This will require high selectivity and research at a single-deal level, as the recovery will be uneven and some re-pricing is still ongoing.

Dominique CARREL-BILLIARD |

Private equity: seize opportunities while market activity is accelerating

Despite the depth and suddenness of the Covid-19 crisis, private equity markets have done very well in 2020, with many funds posting a double-digit performance over the year. Today, transaction valuation multiples are back to their pre-crisis levels on average. This overall trend masks wide divergences.

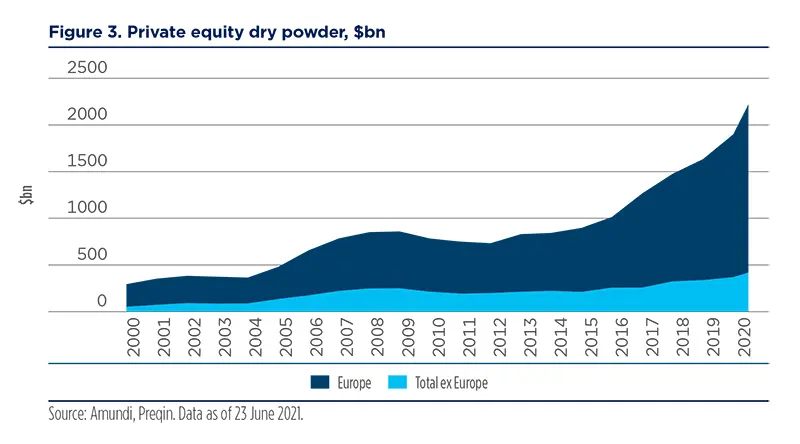

We see no major imbalances in private equity markets and expect the continuation of positive market trends in H2 2021.

On one hand, there are still few transactions in the sectors that were most affected by the restrictions implemented to fight the pandemic (e.g., catering, travel agencies, event organisations). Nevertheless, market activity is increasing and we expect to see many opportunities build up in these sectors. On the other hand, many sectors are benefiting from the reinforcement of some long-term themes (e.g., technology, healthcare). Today, most transactions are centred on these sectors, as their strong growth prospects attract investors. Furthermore, it is worth mentioning that the amount of dry powder (i.e., cash available for investments into funds) is stable relative to the market size for private equity as well as for private debt, thanks to the parallel slowdown in fund raising and market transactions last year. We see no major imbalances in private equity markets and expect the continuation of positive market trends in H2 2021.

Private debt: investing at the top of the capital structure

The Covid-19 crisis has had a significant impact across private debt markets, with fund raising and deal making having been affected from early 2020. While the onset of this crisis was unexpected, concerns were already being raised about late-cycle conditions in private debt markets relating to underlying economic conditions and to emerging risks associated with demand-supply imbalances, tightening spreads and looser credit standards, which showed up in the prevalence of covenant-lite transactions, increased EBITDA adjustments and rising leverage.

All this led to a challenging year for private debt in 2020. However, prospects point to an improvement. In H2 2021 the focus will be on new opportunities, which should be plentiful, as lower financing from banks will leave the door open for private debt funds to cover issuers’ financing needs. Historically, private debt has delivered diversification, stable income streams and consistent premium returns over liquid and traditional debt, with modest drawdowns over the long term. Additionally, it has been a systemically important contributor to economic growth, thanks to the support it provides to the real economy, counterbalancing the lower contribution from banks after the Great Financial Crisis due to more stringent regulation.

In H2 2021 the focus will be on new opportunities, which should be plentiful as lower financing from banks will leave the door open for private debt funds to cover issuers’ financing needs.

Private debt encompasses a wide investment universe (e.g., senior debt, direct lending, distressed debt, etc) which have different goals, underlying dynamics and risk-return profiles. In H2 2021, investors with a long-term view could focus on safer strategies at the top of the capital structure where risk-adjusted returns are attractive, resulting in a key test arising for general partners (GPs), as some of them might even exit the market.

Real estate: strong investor appetite in H2 2021

Real estate market activity was hit significantly in 2020, although capital values held up relatively well. According to MSCI, capital values in Europe declined by less than 1% YoY in 2020, leading to positive total return performance, with significant discrepancies across asset classes, hotels and retail asset having been hit hard. The expected economic rebound in H2 2021 should favour relative improvements for real estate leasing activity, which should remain constrained by tenants’ wait-and-see attitude, as long as uncertainty remains. Tenant demand – both qualitative and quantitative – will be key in the short run and could make the market rents of prime assets in sought-after locations more resilient. Investors’ appetite for real estate should remain strong in H2 2021, fostered by a wide gap between prime real estate yields and ten-year government bonds.

Investors’ appetite for real estate should remain strong in H2 2021, fostered by a wide gap between prime real estate yields and tenyear government bond yields.

As a growing concern for investors has been the possible acceleration of inflation in the coming years, some long-term institutional investors see real estate as a way to hedge their income return from inflation, as when an asset is leased rents are generally indexed. Market fundamentals and conditions will remain key, as market rent and capital values may vary. Investors’ appetite for assets such as logistics or housing, which have proved resilient during the pandemic, should stay strong, particularly as the Covid-19 crisis could have accelerated structural trends such as e-commerce. The focus of long-term investors on cashflows visibility should favour competition for prime assets – including offices – and ensure that prime yields remain low in our central scenario during H2 2021.

Infrastructure: a key element in many fiscal plans

With the Covid-19 crisis, infrastructure investing has experienced significant differences across sectors in terms of both transaction levels and valuations. In safe-haven sectors – e.g., healthcare, technology and renewable energy – the number of transactions and valuations have remained stable.

The crisis is expected to lead to a favourable political and regulatory environment for infrastructure investing, as the pandemic has not only brought to light the need for health and communication infrastructure, but also stressed the urgency of the energy transition.

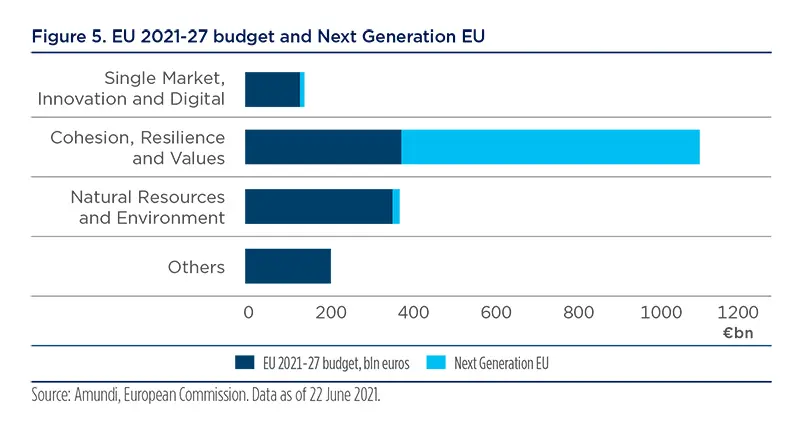

We believe that diversification will be key in order to generate attractive returns, while buy-and-hold strategies are gaining traction. Assets relating to the energy transition will remain resilient after Covid-19, disseminating waves of economic shock given their critical nature for business continuity. Infrastructure projects are expected to be a key element of many stimulus plans. A significant share of the EU 2021-27 multi-year budget and of the Next Generation EU plan has been committed to the green transition and to digital infrastructure.

The crisis is expected to lead to a favourable political and regulatory environment for infrastructure investing.

Definitions

- Basis points: One basis point is a unit of measure equal to one one-hundredth of one percentage point (0.01%).

- Closed-ended fund: In these funds, there is no internal mechanism for investors to redeem their subscriptions. Investors’ subscriptions are tied-up for the lifetime of the fund unless investors can find a buyer for their shares on the secondary market.

- Core real estate investment strategy: ‘Core’ is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

- Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

- Covenant: It is a promise in an indenture, or any other formal debt agreement, that certain activities will or will not be carried out or that certain thresholds will be met. Often they relate to terms in a financial contract – such as a loan document or bond issue – stating the limits at which the borrower can lend further.

- Covenant-lite: A covenant-lite loan is a type of financing that is issued with fewer restrictions on the borrower and fewer protections for the lender. By contrast, traditional loans generally have protective covenants built into the contract for the safety of the lender. On the other hand, covenant-lite loans are more flexible with regard to the borrower’s collateral, level of income, and the loan’s payment terms.

- CVaR: Conditional Value at Risk. Also known as the expected shortfall, it is a risk-assessment measure that quantifies the amount of tail risk an investment portfolio has. CVaR is derived by taking a weighted average of the extreme losses in the tail of the distribution of possible returns, beyond the VaR cut-off point. Conditional value at risk is used in portfolio optimisation for effective risk management.

- Drawdown: The peak-to-trough decline during a specific record period of an investment, fund or commodity, usually quoted as the percentage between the peak and the trough.

- Dry powder: It refers to cash reserves kept on hand by a company, venture capital firm or individual to cover future obligations, purchase assets or make acquisitions. Securities considered dry powder could be Treasuries or other short-term fixed income investment that can be liquidated on short notice in order to provide emergency funding or allow an investor to purchase assets.

- EBITDA: Earnings before interest, taxes, depreciation, and amortisation.

- GP: General partner, a fund manager that raises capital from institutional investors through open-ended or closed-ended fund structures or non-fund vehicles with fund-like economics.

- IRR: Internal rate of return. This is a method of calculating an investment’s rate of return. The term internal refers to the fact that the calculation excludes external factors, such as the riskfree rate, inflation, the cost of capital, or financial risk.

- LP: Limited partner, an institutional investor that commits capital to private funds through limited partnerships.

- Office vacancy rate: Share of unoccupied office space immediately available relative to all existing office space.

- Open-ended funds: In these funds, investors have the choice of whether to partially or completely redeem their subscription on each redemption day, subject to the redemption terms specified in the fund’s offering document.

- Prime rent: Rent of the most sought-after assets relative to available supply. This is the highest rent for a given asset class and geographical area.

- Prime yield: Yield provided by leasing under the market conditions of the assets - sometimes few in number – most sought-after by investors relative to available supply. This was the lowest yield for a given asset class and geographic area.

- Take-up: Spaces leased or acquired for own use. It does not include lease renewals.