Summary

Key points

Insurance companies are generally able to invest cash at long tenors and face the challenge of investing it in a way that maximizes their return in a capital constrained framework such as the one defined by the Solvency II directive in Europe while maintaining profitability in a volatile financial market.

Banks are subject to both long and short-term liquidity requirements to ensure their financial stability.

Insurers can leverage aligned interests with banks to unlock a premium by providing them stable financing.

This case study looks at a European insurance company that implemented an innovative solution, leveraging on the long-term nature of its investments and smart financing strategies through “fund” structure to maximize returns while complying with evolving regulatory and ESG guidelines.

Key considerations when implementing this type of innovative solution:

- Expertise in financing operations

- Access to top tier counterparties

- Being supported by an independent fiduciary manager

- Favor the “fund” structure, which allows to access additional premium and enhanced security

The business model and the regulatory framework of insurance companies compel them to adopt long-term investment strategies and to maintain profitability amidst a volatile environment. Simultaneously, regulatory authorities impose long and short-term liquidity requirements on banks to ensure their stability and their ability to withstand financial stress.

In this article, we explore through a case study how the implementation of an innovative solution via a fund structure could enable insurers to unlock the premium stemming from the aligned interests between insurers and banks.

1. A premium can emerge from the complementary interests between insurers and banks

Insurers need to diversify their investment portfolio and are willing to explore new investment opportunities to meet their objectives.

Insurers have typically long-term investment capacity and a need for revenue diversification

Insurance companies often hold strategic cash as part of their global asset allocation strategy for their general assets1 or in their own accounts.

They also often seek to optimize the return on their security portfolios and, to this end, engage in market operations such as repurchase agreements2 (repos) to access liquidity that can be used to invest in higher yielding opportunities.

In both cases, to achieve their long-term obligations and ensure profitability, the cash is invested in a way that maximizes return relative to the level of risk involved, while also considering the capital requirements associated with the proposed investment. For European insurers, such capital requirements are defined by the Solvency II Directive with the SCR ratio level being one of the highly monitored indicators.

Traditional investments such as short-term bonds and money market funds, which insurers often prefer for their stability, can be affected by factors such as changes in interest rate, credit risk (idiosyncratic risk) and liquidity risk, particularly during periods of stress or economic downturns. Therefore, they need to diversify their investment portfolio and are willing to explore new investment opportunities to meet their objectives.

Banks have typically short- and long-term liquidity needs

Concurrently, banks are subject to regulatory liquidity requirements aiming to ensure their stability and ability to withstand financial stress. For example, regulatory ratios such as the Liquidity Coverage Ratio (LCR) and the Net Stable Funding Ratio (NSFR) are designed to ensure that banks maintain stable funding sources to support their assets and activities, respectively over the short and long term.

Under such conditions, insurers can seize a premium by leveraging their ability to provide long-term stable funding to banks. This premium reflects insurers’ participation to banks’ liquidity needs and stable financing, creating a win-win situation for both parties.

Benefits deriving from the adoption of a fund structure

The fund structure can serve as a good intermediary to meet these complementary interests for several reasons.

- Firstly, the fund structure provides access to independent professional fund managers who have expertise in navigating financial markets and making informed investment decisions, thereby aiming to actively optimize returns while effectively managing risks.

- Secondly, it facilitates transparency and accountability through regular reporting and disclosure requirements ensuring stakeholders are well-informed about the transactions.

- Finally, it generally enhances the premium the bank offers. Indeed, the fund can enable banks to transfer assets off their balance sheets, thus optimizing regulatory ratios other than liquidity ones, such as the leverage ratio.

2. An innovative investment solution to seize the premium opportunity under Solvency Capital Requirement (SCR) constraints

The fund structure can serve as a good intermediary to meet these complementary interests for several reasons.

Case Study

Background & Challenge

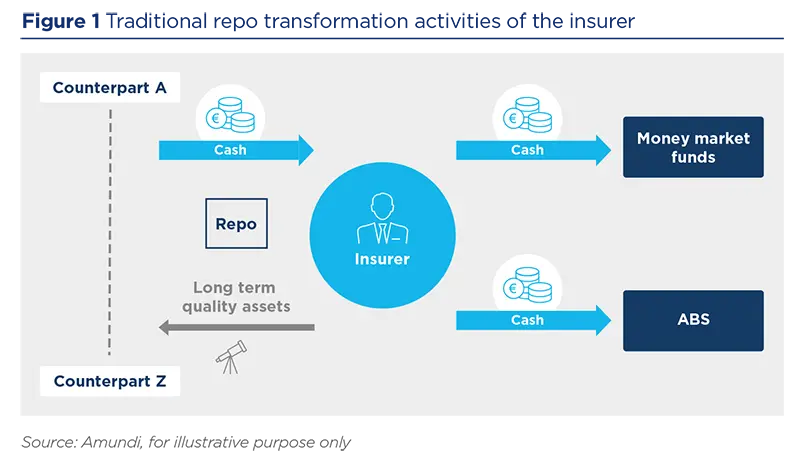

We look at the case of a European insurance company that implemented a traditional repurchase agreement transformation strategy (as illustrated in figure 1 below), involving a temporary exchange of high-quality assets for cash.

The cash is subsequently invested with a short-term investment horizon in low-risk solutions (such as money market funds or financing operations) considering their return on SCR level. In some cases, investment can also be made in higher-yielding short-term fixed income products such as asset-backed securities (ABS).

The insurer seeks innovative ways to efficiently reinvest part of the cash generated from this repo transformation activities. This entails looking for investment opportunities that offer attractive yield while complying with regulatory and ESG guidelines and at the same time ensuring prudent risk management and portfolio diversification.

Proposed solution

The type of assets that the bank can provide is determined at the launch of the fund and takes into account the evolving selection criteria of the insurance company in terms of ESG, risk and diversification.

We identified that the cash generated from the repo transformation activities provided the insurer with the capacity to engage in transactions exceeding a one-year tenor3. Such capacity enabled the insurer to be aligned with the liquidity needs of banks subject to the Net Stable Funding Ratio (NSFR)4.

Leveraging our strong expertise in financing solutions, we proposed a solution involving a vehicle replicating the structure and outcomes of a reverse repo (provision of liquidity against securities as collateral) through the use of derivatives instruments which can be assimilated to a “synthetic reverse repo transaction”.

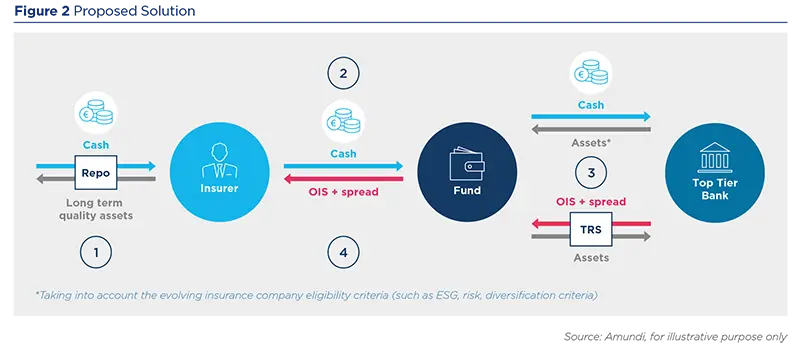

Indeed, as illustrated in the figure 2 below, the solution consists in investing portion of the cash generated from the repo transactions (step 1) into a dedicated vehicle (step 2). This vehicle then exchanges the cash for assets provided by a top tierbank looking for stable funding sources to improve its Net Stable Funding Ratio (NSFR) (step 3).

The type of assets that the bank can provide is determined at the launch of the fund and takes into account the evolving selection criteria of the insurance company in terms of ESG, risk and diversification.

The vehicle simultaneously trades a total return swap which allows to send back the performance of the assets to the counterparty in exchange for a linear Overnight Indexed Swap5 (OIS) rate plus a spread (step 4).

Outcome

This innovative solution results in several favorable outcomes:

- Enhanced returns to SCR: the solution offered returns significantly above the ESTR index6 with a low SCR ratio (below 5%).

- Predictability of performance: unlike traditional fixed income instruments, which are sensitive to market fluctuations, this solution provides a linear return equal to a money market index (the ESTR) plus a fixed spread.

- Diversification: the premium of this transaction contributes to diversification by providing income from a strategy that is not sensitive to market risks. Indeed, the premium is not subject to interest rate, credit or liquidity risks like traditional cash investment products. In contrast, the premium is paid by a bank which is able to pay such premium as it adds a new stable funding source.

- Creditworthiness:

- Partnering with a top tier bank (in terms of size, credit quality and liquidity) as a counterparty provides additional security and reliability to the transaction. Top tier banks typically have strong credit ratings and solid financial stability, reducing the risk of default or counterparty failure.

- All operations are fully secured, meaning they are always backed by assets.

- To enhance risk mitigation, the value of the assets involved is adjusted through applying haircuts7 to all the assets provided by the bank (i.e not only those linked to the market value of the derivatives but also their full notional value). - Tailor-made:

The solution was built in full cooperation with the insurer to ensure a perfect fit with its investment needs and full compliance with all its internal guidelines including ESG, while optimizing operational efficiency and risk control.

3. Conclusion

Through the presented case study, we have showcased how a European insurance company embraced an innovative approach to unlock additional yield opportunities while mitigating risks and capital requirements. By leveraging long-term transactions and smart financing strategies, the insurer capitalized on aligned interests with banks to generate a diversifying premium.

Amidst these opportunities, we believe the following factors stand out as critical for success when exploring this type of solutions:

- Expertise in financing operations: ability to structure and execute complex transactions is crucial for optimizing returns and mitigating related risks efficiently.

- Access to top-tier counterparties: having established relationships with reputable institutions is preferable to ensure transactional security, reliability and minimize counterparty risk.

- Support of an independent fiduciary manager: having an independent fiduciary manager allows to benefit from impartial advice, to avoid conflict of interests, and to access a wider range of investment options for better portfolio diversification and potential higher returns.

Sources and References

1. General assets refer to the assets of an insurance company that are not specifically segregated or allocated to cover particular liabilities or obligations.

2. Repos involve the temporary transfer of financial securities, mostly bonds, in exchange for cash.

3. “tenor” refers to the duration or maturity period of a financial instrument.

4. The NSFR is a regulatory requirement that mandates banks to maintain stable funding over a longer time horizon to withstand potential funding stress. Source: Basel Committee on Banking Supervision “Basel III: the net stable funding ratio”, October 2014

5. The OIS is the overnight interbank interest rate at which banks lend to each other in the interbank market

6. The ESTR (Euro Short-Term Rate) index is a benchmark interest rate representing the overnight borrowing costs within the eurozone.

7. Haircuts represent a percentage reduction applied to the value of the assets provided by the bank, which serves as a buffer against potential losses in the event of a counterparty default.