Summary

Relief rally unlikely to continue

The bear market rally materialised, but strong US November job market data cooled the markets’ dovish narrative, creating a mixed picture for US inflation, given that the service components remain sticky. The Fed, for its part, slowed the pace of rate hikes, but reiterated that its job is far from over. We believe central banks, including the ECB, will be walking a policy tightrope, as risks of mistakes are high.

On the other hand, we see increasing geopolitical risks in Europe and the US. In EM, the acceleration of reopening in China should result in a rebound sooner than expected, at a time when Europe will still be in recession and the US in a marked slowdown. This highlights a key feature of the 2023 outlook: the strong regional asynchrony in the economic cycles which could result in opportunities for investors.

For markets, this economic backdrop calls for a confirmation of a correction regime at the end of 2022 and in H1 2023, with inflation slowing, but still above normal levels. The correction phase will be driven by the profit recession, which will materialise in particular in H1. Investors should not add risk, but after the recent upside, return to a more cautious stance in equities and be prudent overall.

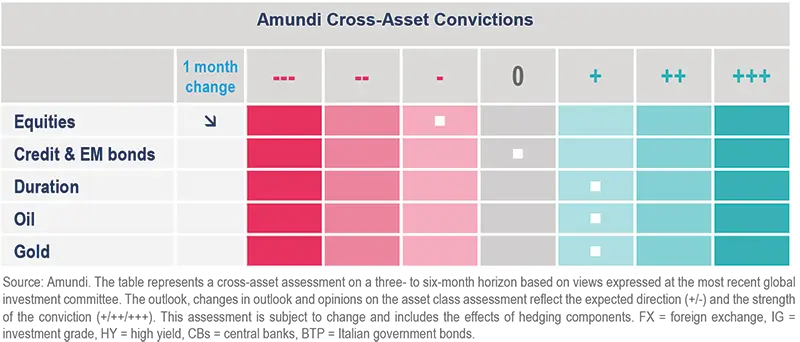

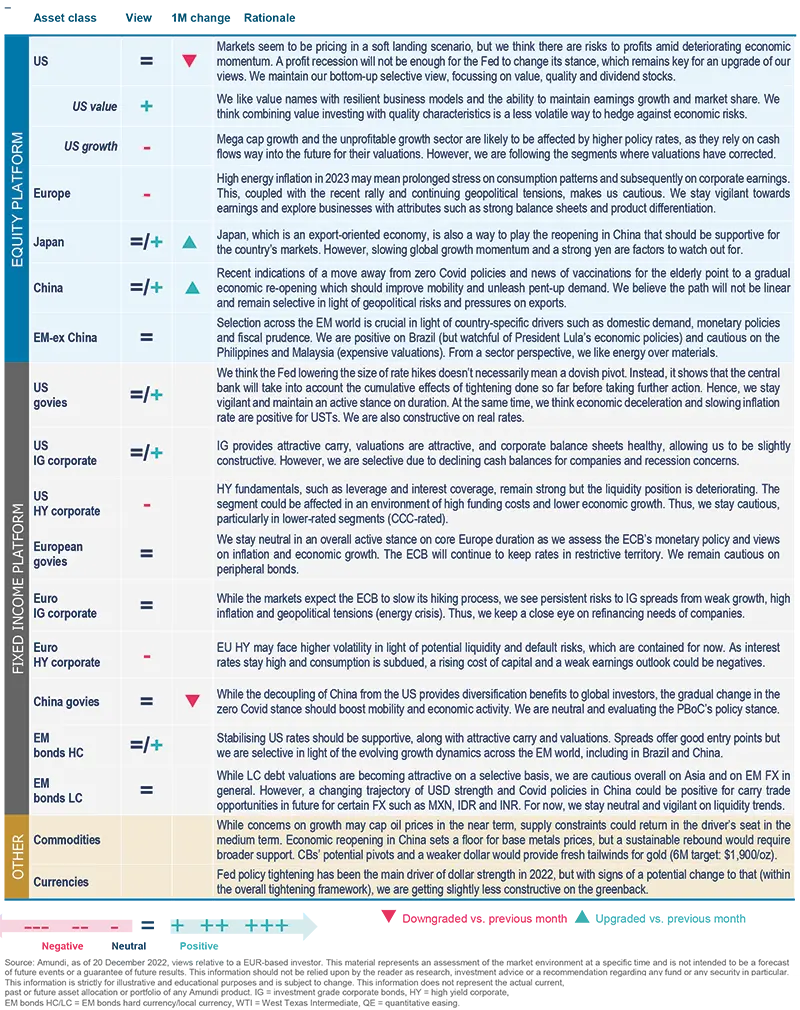

- From a cross-asset perspective, we are very active in identifying opportunities presented by market discrepancies and asynchronies in monetary policies that will soon materialise as a response to slowing growth and weaker inflation. Now, after the rebound played out as expected, we turned cautious on equities, with a neutral stance in the US and still cautious positioning in Europe. We also trimmed our positive view in credit after participating in the rally, though we remain slightly constructive. We also believe investors should seek protection throught hedges, US Treasuries and gold.

- US equities have been driven by downward movements in core yields recently, rather than any significant improvement in corporate fundamentals. We see downside risks, an asymmetric payoff, and are becoming cautious in the near term, given that current valuations do not reflect earnings risks in case of a recession. We are therefore moving neutral in the US market. In Europe, which is more exposed to a stagflationary shock, the uncertainty surrounding the Ukraine war continues. The lack of a common policy response and inflation pressures led us to further increase our defensive view on Europe. In relative terms, we keep our preference for the US over Europe.

- In government bonds, markets continue to look at inflation and the Fed’s reaction, but we believe that attention will soon turn to growth and recession fears. For the time being, the direction for rates is still up. The Fed has clarified that it now expects the terminal rate to be higher than what was expected in September. How long central bank keeps rates restrictive becomes more important. Slowing economic growth and hints regarding the change in the size of rate hikes call for an active duration stance.

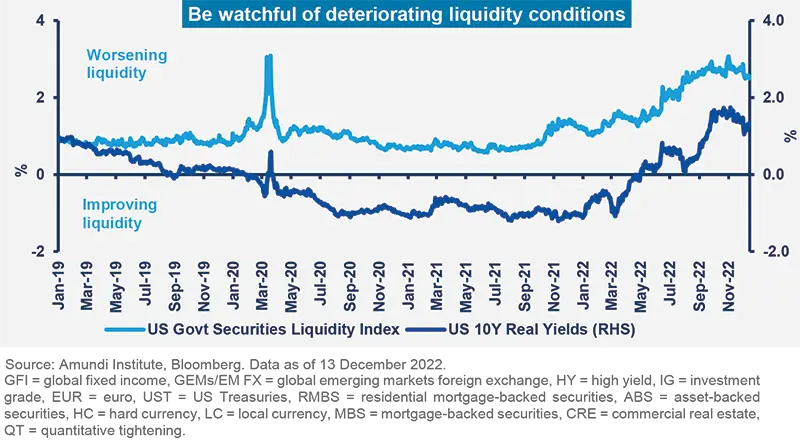

- Credit markets enjoyed the bear market rally, despite the transition towards a higher funding cost environment that could potentially be more painful, particularly for low-rated, excessively leveraged HY issuers. Corporate fundamentals remain strong, but cash holdings have been declining. Companies’ ability to generate cash flows and withstand refinancing pressures could be affected if the economic backdrop deteriorates. This may be aggravated if commercial banks tighten their lending standards, causing liquidity to dry up for corporates when they need to refinance. Overall, in credit, we see relatively better opportunities in US IG over Europe, and we remain cautious in high yield.

- The USD is a key variable to watch in particular to detect opportunities in emerging markets. We believe that the headwinds that have penalised EM bonds in 2022 will gradually fade in 2023, when country-specific drivers will come back into focus. We stay positive on HC debt, and believe that some LC debt is selectively becoming attractive. In general, reopening plans in China will likely be another positive catalyst for EM in 2023. The recent decision by the Chinese government to lift some Covid restrictions supports an earlier rebound for the economy.

Big picture in short

King dollar losing some of its shine

|

Monica DEFEND |

Frederico CESARINI Head of DM FX, Cross Asset Research Strategist |

The USD cycle is being stretched. We expect to see a bumpy road, but position for a stronger depreciation in 2023.

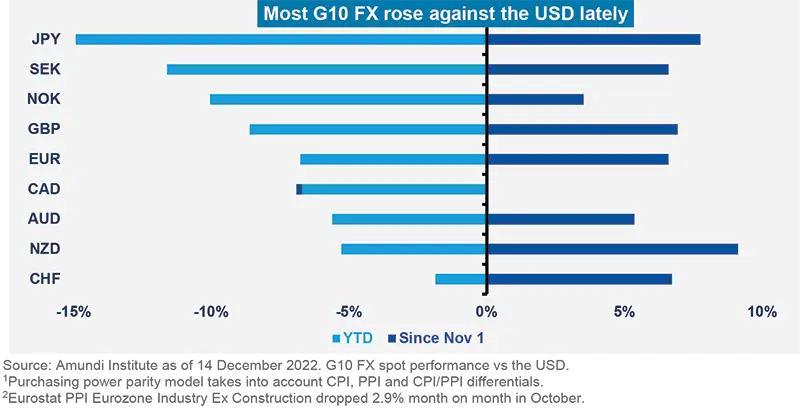

The dollar was on the stage in 2022, registering one of the strongest rallies on record. Risk-free assets fell, uncertainty turned into volatility, and all G10 FX suffered, with no exception. Yet, positive downside surprises on US inflation, with the Fed acknowledging the possibility of lower rate hikes, worked as a cold reality check recently. The USD correction has been huge and the question now is whether the downtrend can be sustained in 2023. To begin with, the USD traded at premium with respect to fundamentals throughout 2022 due to the three main reasons listed below. While none of these conditions has vanished completely, recent developments suggest we may have passed the maximum stress levels, indicating lower tailwinds for the USD in 2023.

- Fed and its monetary policy to tame inflation – The Fed was the key support for the USD in 2022 as the US economy ran with no growth advantage throughout the year. Unlike 2021, when US growth strongly outperformed DM peers, the USD exceptionalism has been a function of two things in 2022:

i) the rising real rates advantage and ii) the rising diversification properties. The Fed remains the key factor to watch regarding both elements at this stage. We think it is too early to believe that the Fed may shift into an easing bias (the clear-cut trigger to short the USD across the board, as it erodes its carry advantage). But any further positive surprise on inflation may rapidly turn the focus towards the Fed’s next steps (potential change in Fed stance), given the current inversion of the US yield curve. A bull-steepening environment usually translates into a weaker USD from a historical perspective. - European energy crisis and the geopolitical risks – The surge in energy prices was the main element causing higher production costs in EZ in 2022. Our Purchasing Power Parity framework has justified, for sometime, a EUR/USD move below parity this year1. Since September, though, gas prices have collapsed and the October PPI dropped significantly in response to that2. We are still not out of the woods (EZ still has a competitive disadvantage at the current price for energy and risks over next winter remain), but the bar for massive USD upside is getting higher from this perspective.

- China reopening, global growth and the USD impact – China’s zero-covid policy has certainly been a drag for global growth in 2022 and it is hard to believe the inertia can change significantly in the short term. The dollar remains a counter-cyclical asset, which usually tends to strengthen when growth slows and central banks do not provide reflationary impulses. Yet, a broader Chinese reopening as a base case for H2 2023 would be positive for the global economy. And when the cycle bottoms, the USD usually pays the toll.

Investment implications: Positive surprises on US inflation triggered a violent reflationary reaction across DM FX. We expect the road ahead to be bumpy as the USD remains a high-yielding, countercyclical asset. However, the poor risk-reward now suggests navigating with limited USD risk in this latest phase. Thus, we maintain our view that the JPY and CHF are the safest currencies to lower the USD stance. Going forward, we expect a more pronounced depreciation moving to H2 2023.

Higher real rates in the US and Fed’s tightening stance have been the mainstays for the dollar in 2022. Any change to that in 2023 may lead the dollar losing its strength.

Take some profit and cautious start to 2023

|

Francesco SANDRINI |

John O'TOOL Head of Multi-Asset Investment Solutions |

Inflation/growth trends, and their effects on monetary tightening, have been the most important market drivers. While domestic demand has been stronger than expected, especially in Europe recently, concerns over economic growth deceleration in the US and Europe persist. This, coupled with risks of profit recession, means investors should turn cautious on equities and credit, and enhance hedges. On the other hand, yield curves in select DM present opportunities amid an evolving monetary policy narrative, which also allowed us to adjust our views on the USD. Overall, investors should consider keeping a diversified stance that seeks to protect them from inflation and a potential economic downturn.

High conviction ideas

After the recent rally, we are downgrading our US and European equity stances. Europe is a more cyclical region and hence will be more affected (than the US) by a global growth slowdown and the energy crisis, leading us to continue to favour the US over Europe. Furthermore, we maintain our preference for small over large caps, given the extreme discount of the former over the latter. In EM, we keep our neutral stance on China for now as we assess the new reopening policies and their impact on economic activity.

On duration, we stay constructive on USTs amid decelerating inflation and continued risks to economic growth. At the same time, we see opportunities at yield curve levels – for example, in Canada. The slowing rise path in inflation data and the easing of global supply chain bottlenecks could potentially affect monetary policies.

In Europe, we keep our slightly positive view on 10Y BTP-Bund spreads. This view is supported by Italian yields’ positive correlation with core European yields (moving downwards), attractive valuations and positioning, and negative net issuance of Italian debt.

In credit, after the spread tightening, we downgraded our view on US IG and are no longer positive. While inflation is slowing, it remains above the Fed target, implying that the CB may maintain a longer tightening cycle, affecting financial conditions. In Europe, we maintain a preference for IG vs HY as the latter is more vulnerable to a potential deterioration of the economic environment and default outlook.

In FX, we adjusted our views and are no longer positive on the USD/EUR owing to signs of a less aggressive monetary tightening (although not dovish) approach from the Fed. We maintain the constructive stance on USD/GBP. The cyclicality of the pound, weaker UK growth and low real rates in the UK (vs the US) are headwinds. The CAD, another cyclical FX, could be under pressure owing to a decelerating growth environment, leading us to keep our positive view on the NOK/CAD. We also maintain our positive view on safe-haven currencies – in particular, the CHF/GBP and the JPY/EUR. Changing USD dynamics are also affecting our views on EM FX. On the BRL/ZAR, we are no longer negative on the ZAR but believe investors should consider maintaining exposure to the Brazilian currency as Brazil remains a positive long-term story.

Risks and hedging

Slowing growth and high inflation require efficient diversification and hedging, leading us to keep our positive view on gold and marginally constructive stance on oil. Investors should also maintain safeguards on equities and strengthen their hedges in US HY.

Based on a dynamic investing approach, we downgraded risk assets owing to concerns that the current rally may not be sustained.

Active in duration and watchful on liquidity risk

| Amaury D'ORSAY Head of Fixed Income |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

While inflation remains elevated, we are seeing signs of it peaking in the US and somewhat in Europe. This, coupled with the Fed and ECB’s comments on interest rates, is driving core yields and risk assets. However, the risks of losing credibility and of loosening financial conditions, when central banks are trying to tame inflation, are high. Hence, they are likely to maintain a tightening trajectory, even if they slow rate hikes in the face of a weaker economic outlook. On the other hand, declining cash balances on corporate balance sheets, banks tightening their lending standards, and risks of defaults for highly leveraged businesses mean refinancing could be a problem. As a result, in an overall cautious stance, we remain selective, and see bottom-up opportunities in US IG and HC bonds in EM.

Global and European fixed income

As central banks’ policy narratives continue to evolve, we stay active on duration and remain slightly cautious mainly through the US, Europe, the UK and Japan. We are also exploring opportunities across different yield curves and are slightly reducing our curve flattening views in Europe. On peripheral debt, our close-to-neutral stance remains in place. Although we acknowledge the positive sentiment as CBs show their willingness to reduce the magnitude of future rate hikes, we remain skeptical about rising risk in credit. We maintain our slightly positive stance, with a preference for IG and Euro subordinated financial debt. But we avoid highly leveraged names because corporate cash balances are deteriorating and earnings concerns persist. In particular, we remain cautious in HY.

US fixed income

We are witnessing mixed signals, with resilient employment and consumer balance sheets but weak money supply and inverted yield curves. Core services inflation remains sticky, which is likely to keep the Fed on the tightening path. In this environment, we remain active on duration, with a bias towards neutrality. We have a similar active approach on TIPS, which look to be reasonably valued. In credit, we remain highly selective, with a preference for financials over industrials and with a strong focus on liquidity. We also generally favour higher-quality segments. In securitised markets, given the interest rate volatility, investors should be flexible, particularly in agency MBS. While consumer fundamentals currently remain strong, they may feel the pressure as excess savings erode.

EM bonds

We see opportunities in 2023, thanks to some stability in core US rates. Spreads currently offer a compelling entry point for HC, and in LC, valuations are attractive. We are evaluating how a potential USD weakening and China reopening could affect Chinese bonds. In LatAm, while we like Brazil, we are monitoring policy evolution.

FX

We are positive on the USD but the peaking inflation narrative leads us to marginally lower our conviction. In EM, we raised our conviction on the BRL/USD. LatAm FX offers attractive carry and should benefit from any changes in the USD trend. We are positive on the MXN but defensive on the TWD and HUF.

The job for the Fed is not done yet as core services inflation is still sticky, keeping us vigilant on the impact of higher rates on market liquidity and credit spreads.

Don’t chase the rally, stay balanced

| Kasper ELMGREEN Head of Equities |

Yerlan SYZDYKOV Global Head of Emerging Markets |

Kenneth J. TAUBES CIO of US Investment Management |

Overall assessment

The rebound in equities appears to be a relief rally, led by indications on Fed policy and optimism around China reopening. But we may see this resilience breached due to headwinds on margins and a slowdown in demand (affecting revenues). On the former, we believe costs will rise from structural and cyclical perspectives, and at the same time margins should fall as consumers trade down to withstand the effects of still-high inflation. Thus, we see significant divergences in valuations and earnings prospects that calls for a selective approach. In addition, we like value, quality and dividends stocks which should be complemented by strong bottom-up analysis.

European equities

In a barbell style approach, we are more balanced, with positive views on quality cyclical sectors such as industrials and financials (more constructive). However, we are active in adjusting our views amid market movements. For instance, we are taking profit in some industrial names, given their strong performances. On the other hand, we also explore idiosyncratic names that have been penalised excessively by the markets. At the other end of the spectrum, we are constructive on attractively valued defensive names in consumer staples, but we increased our cautious stance on discretionary. Importantly, as Europe grapples with an energy crisis, we think progress on ESG investing should continue. In fact, this is the time to identify names that display potentially improving ESG standards and in the process could reward investors. Overall, we continue to prioritise balance sheet strength.

US equities

Companies may face a margins squeeze as employment remains robust, wages are rising, and dollar headwinds persist. If disinflation on goods continues, this could aggravate those pressures. Thus, markets’ aggregate earnings expectations for 2023 are not bearish enough. It is a time for stock-pickers who can sift through expensive names by going down the market cap spectrum, carefully assessing earnings potential and evaluating the resilience of business models. This valuation dispersion should also support the continuation of outperformance of value over growth. At a sector level, we are becoming more balanced when it comes to consumer discretionary, particularly on services and retail businesses. This is because although select consumer surveys are still coming in strong, we are seeing consumers trading down to cheaper goods to withstand pressure on incomes. In contrast, we like banks with stable returns on equity and select names in health care.

EM equities

A faster-than-expected retreat of China from its zero Covid policies could be a turning point for EM equities. This is supported by attractive valuations and limited drag from the dollar. Having said that, we are very selective and maintain a flexible stance, which allowed us to upgrade our stance in China equity, while we are monitoring political developments in Brazil.

At a sector level, we prefer energy over materials, and favour real estate and consumer discretionary, especially in China amid the Covid policy-induced rebound.

Markets’ earnings expectations appear too optimistic and will have to come down, indicating adjustments from current levels.

Amundi asset class views

Definitions & Abbreviations

-

ADR: A security that represents shares of non-US companies that are held by a US depositary bank outside the US. They allow US investors to invest in non-US companies and give non-US companies access to US financial markets.

-

Agency mortgage-backed security: Agency MBS are created by one of three agencies: Government National Mortgage Association, Federal National Mortgage and Federal Home Loan Mortgage Corp. Securities issued by any of these three agencies are referred to as agency MBS.

-

Curve flattening: A flattening yield curve may be a result of long-term interest rates falling more than short-term interest rates or short-term rates increasing more than long-term rates.

-

Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates.

-

Beta: Beta is a risk measure related to market volatility, with 1 being equal to market volatility and less than 1 being less volatile than the market.

-

Breakeven inflation: The difference between the nominal yield on a fixed-rate investment and the real yield on an inflation-linked investment of similar maturity and credit quality.

-

Carry: Carry is the return of holding a bond to maturity by earning yield versus holding cash.

-

Core + is synonymous with ‘growth and income’ in the stock market and is associated with a low-to-moderate risk profile. Core + property owners typically have the ability to increase cash flows through light property improvements, management efficiencies or by increasing the quality of the tenants. Similar to core properties, these properties tend to be of high quality and well occupied.

-

Core strategy is synonymous with ‘income’ in the stock market. Core property investors are conservative investors looking to generate stable income with very low risk. Core properties require very little hand-holding by their owners and are typically acquired and held as an alternative to bonds.

-

Correlation: The degree of association between two or more variables; in finance, it is the degree to which assets or asset class prices have moved in relation to each other. Correlation is expressed by a correlation coefficient that ranges from -1 (always move in opposite direction) through 0 (absolutely independent) to 1 (always move in the same direction).

-

Credit spread: The differential between the yield on a credit bond and the Treasury yield. The option-adjusted spread is a measure of the spread adjusted to take into consideration the possible embedded options.

-

Currency abbreviations: USD – US dollar, BRL – Brazilian real, JPY – Japanese yen, GBP – British pound sterling, EUR – Euro, CAD – Canadian dollar, SEK – Swedish krona, NOK – Norwegian krone, CHF – Swiss Franc, NZD – New Zealand dollar, AUD – Australian dollar, CNY – Chinese Renminbi, CLP – Chilean Peso, MXN – Mexican Peso, IDR – Indonesian Rupiah, RUB – Russian Ruble, ZAR – South African Rand, TRY – Turkish lira, KRW – South Korean Won, THB – Thai Baht, HUF – Hungarian Forint.

-

Curve inversion: When long-term interest rates drop below short-term rates, indicating that investors are moving money away from short-term bonds.

-

Curve steepening: A steepening yield curve may be a result of long-term interest rates rising more than short-term interest rates or short-term rates dropping more than long-term rates (bull steepening).

-

Cyclical vs. defensive sectors: Cyclical companies are companies whose profit and stock prices are highly correlated with economic fluctuations. Defensive stocks, on the contrary, are less correlated to economic cycles. MSCI GICS cyclical sectors are: consumer discretionary, financial, real estate, industrials, information technology and materials. Defensive sectors are: consumer staples, energy, healthcare, telecommunications services and utilities.

-

Duration: A measure of the sensitivity of the price (the value of principal) of a fixed income investment to a change in interest rates, expressed as a number of years.

-

High growth stocks: A high growth stock is anticipated to grow at a rate significantly above the average growth for the market.

-

Liquidity: The capacity to buy or sell assets quickly enough to prevent or minimise a loss.

-

P/E ratio: The price-to-earnings ratio (P/E ratio) is the ratio for valuing a company that measures its current share price relative to its per-share earnings (EPS).

-

Quantitative easing (QE): is a type of monetary policy used by central banks to stimulate the economy by buying financial assets from commercial banks and other financial institutions.

-

Quantitative tightening (QT): The opposite of QE, quantitative tightening (QT) is a contractionary monetary policy aimed to decrease the liquidity in the economy. It simply means that a CB reduces the pace of reinvestment of proceeds from maturing government bonds. It also means that the CB may increase interest rates as a tool to curb money supply.

-

Quality investing: This means to capture the performance of quality growth stocks by identifying stocks with: 1) A high return on equity (ROE); 2) Stable year-over-year earnings growth; and 3) Low financial leverage.

-

Rising star: A company that has a low credit rating, but only because it is new to the bond market and is therefore still establishing a track record. It does not yet have the track record and/or the size to earn an investment grade rating from a credit rating agency.

-

TIPS: A Treasury Inflation-Protected Security is a Treasury bond that is indexed to an inflationary gauge to protect investors from a decline in the purchasing power of their money.

-

Value style: This refers to purchasing stocks at relatively low prices, as indicated by low price-to-earnings, price-to-book and price-to-sales ratios, and high dividend yields. Sectors with a dominance of value style: energy, financials, telecom, utilities, real estate.

-

Volatility: A statistical measure of the dispersion of returns for a given security or market index. Usually, the higher the volatility, the riskier the security/market.