Summary

- Central Bank Digital Currencies are digital forms of a country’s official currency issued by its central bank. Most Central Banks are conducting research and some have initiated projects and pilots, although only a handful of CBDCs have been fully launched. Whereas retail CBDCs are digital equivalents of cash and available to the general public, wholesale CBDCs are more comparable to bank reserves, only accessible by certain financial institutions.

- The Covid crisis, rapid growth in digital money and payment technologies, and geopolitics have accelerated CBDC projects. Proponents of CBDCs, state that they can provide a secure, efficient, and inclusive digital payment instrument and are a tool for sovereignty and financial innovation.

- Detractors, however, have argued that similar user advantages can be brought by other already existing or developing payment technologies. Moreover, they point to various risks carried by CBDCs, from technical and cybersecurity failures to the possibility that CBDCs may infringe on privacy and succumb to abuse by public authorities, or that they may disrupt market funding and threaten financial stability. Most CBDC projects, however, include architectural choices, features and limitations intended to address such risks.

- Even though their advantages in terms of retail user experience are still to be proven, the point that CBDCs can play a role in fostering fintech innovation sounds valid. This includes facilitating the trend towards the tokenization of assets that could, at least in theory, bring disruptions and new possibilities to investment markets.

Retail vs Wholesale CBDC

Since we first wrote about the topic in February 2021, a lot has happened on the Central Bank Digital Currency front. Most Central Banks are now at various stages of CBDC research, with several conducting largescale tests, and a small number even being fully launched. But debates regarding the utility, advantages, and risks of CBDCs have also been growing. Following a brief introduction to the principles of CBDCs, this paper discusses their potential implications and risks, both in general and for financial markets.

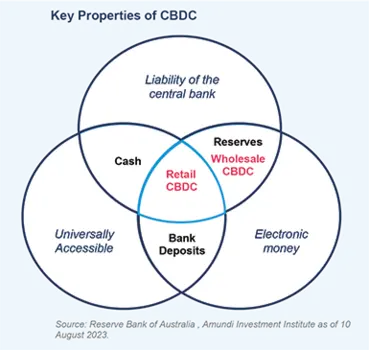

Public debate most often focuses on retail CBDCs, which can be defined as digital equivalents to physical cash. They share similarities with existing forms of money, but also have some differences. Retail CBDCs will be accessible to the public like physical cash and bank deposits, but unlike bank reserves. They will be full liabilities of the central bank, similar to cash and bank reserves, but not deposits. Additionally, they will be digital, like bank reserves and deposits, but not like physical cash.

Wholesale CBDCs, although digital and direct liabilities of the central bank, won’t be accessible to the general public; they function more similarly to bank reserves. However, unlike usual reserves, wholesale CBDCs tend to rely on technologies similar to various recent transferable assets, such as Digital Lender Technologies (DLTs, of which blockchains are a type). Conversely, most large retail CBDC projects, for their part, do not seem to plan to use DLTs at their core, yet some DLT-compatible functions and extensions are being explored.

In the realm of digital assets, CBDCs differ from cryptocurrencies in terms of governance. CBDCs are centralised and originated by the public sector, carrying no credit or liquidity risks as liabilities of the central bank. On the other hand, cryptocurrencies are private and (to varying extents) decentralised, and do carry such risks. While CBDCs could theoretically be made interoperable (through various architectures) with public blockchains, the main motivation for such a deployment would likely be to facilitate transactions between CBDCs and other digital assets, rather than with cryptocurrencies.

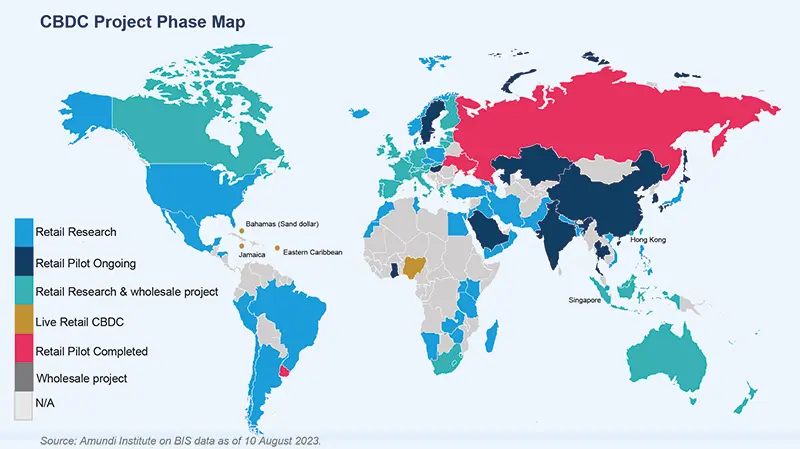

In recent years, the research and development of CBDC projects has begun to surge, yet very few countries have fully launched a CBDC program. Figures from the Bank for International Settlements (BIS) indicate that countries representing more than 95% of world GDP are now at various stages of investigation (from ‘research’ to ‘project’ and even ‘pilot completed’ or ‘launch’). However, full launches have only occurred in Nigeria (October 2021) and the three small Caribbean jurisdictions of the Bahamas (the pioneer, in October 2020), ECCU (East Caribbean Currency Union, in April 2021) and Jamaica (July 2022). In G7 nations, public authorities insist that a final decision has not been made regarding whether to fully launch a CBDC or not.

The many reasons for this acceleration can be grouped into 3 categories:

- The Covid crisis spurred a shift away from cash handling around the world, while also revealing that multiple national authorities (starting with the US Treasury) had difficulties delivering financial aid to certain segments of the population.

- The rise of digital money and new payment technologies has caused concern within state institutions regarding the potential threat to monetary sovereignty. The potential for domestic or foreign digital payment providers to excessively dominate the market, the (now aborted) Meta Platforms universal private currency project, and the rapid rise of cryptocurrencies (particularly stablecoins, which for some countries may carry de facto dollarization risk) have each acted as a wake-up call for public authorities.

- Geopolitics has also played a role considering that the relatively advanced Chinese e-yuan CBDC project is seen as having the potential to accelerate the internationalisation of the renminbi. More generally, the possible cross-border use of future CBDCs has been perceived as a potential ‘soft power’ tool, thereby incentivising countries to join the race.

Direct vs Intermediated Framework

In terms of architecture, large countries are orienting their retail CBDC projects towards ‘intermediated’ frameworks. Under a ‘direct’ architecture, the Central Bank would distribute the new currency directly to retail holders and keep records of their holdings. However, the majority of Central Bank Digital Currencies will use an intermediated architecture, in which the Central Bank issues, and then commercial banks subsequently distribute the digital currency to clients (through an adaptation of their usual client tools, or through a specific ‘electronic wallet’ application).

Commercial banks will thus be in charge of retail book-keeping and client onboarding including Know Your Customer (KYC) and Anti Money Laundering (AML). Most Central Banks are also investigating peer-to-peer transfer functions among retail holders, and technologies to enable offline payments (including payment cards, although it is to be confirmed if they would be issued directly by the Central Bank).

CBDC potential is dependant by country

There are several advantages advocated by central banks for developing CBDCs, but their relative importance varies depending on the country. CBDCs have been presented as:

- A tool for the financial inclusion of unbanked people;

- A way to improve the speed, cost, and reliability of payments (domestic and cross-border);

- An ‘anchor’ to support fintech innovation (a safe monetary infrastructure brick, with no liquidity and credit risk, to build digital assets and application superstructures on);

- A tool to maintain monetary sovereignty (vis-à-vis domestic or foreign competing money).

Depending on each country’s structural economic features, different weight is placed on each factor. Typically, the topic of financial inclusion is very different in rich vs. poor countries, while that of sovereignty varies with the size of the country and its current position against the dominant US dollar. Nevertheless, many critics argue that an increase in financial inclusion and more efficient payments are irrelevant advantages of CBDCs, as both can be pursued through pre-existing or currently developing technologies, such as mobile money and instant payment systems. Additionally, detractors of CBDCs note that a reason people are unbanked (in emerging economies, but also to a significant extent in the United States) may be their distrust for public authorities, which a new form of public money would not address.

Three risks of central bank digital currencies

1. CBDCs carry technical and cybersecurity risk, like all digital network technologies.

If CBDCs become a key piece to a country’s financial architecture, these risks could potentially lead to a catastrophic failure. Additionally, adopting DLT nascent technologies such as DLTs could exposes a country to security, scalability, rapid obsolescence, and reputation risks, depending on setup choices.

2. CBDCs could disrupt market funding and pose financial stability risks.

If savers overwhelmingly prefer CBDCs due to their lack of credit risk, it could impact commercial bank’s funding sources and lending capabilities. Moreover, during times of financial stress, there could be a rush to CBCDs, leading to domestic or cross-border bank runs. CBDCs may also pose risks to the financial sector by potentially cannibalising some payment-related activities currently performed by banks or specialist providers, although these risks may be less systemic.

3. CBDCs may infringe on privacy and succumb to potential abuse by public authorities.

This is because CBDCs provide central banks with extensive information about private transactions, and may include programmability features that restrict certain types of transactions or transacting with certain counterparties. Detractors of CBDCs often highlight this ‘dystopian Big Brother’ risk, which has been voiced in particular during the upcoming US Presidential campaign1.

CBDC’s implications for monetary policy, and the safeguards

CBDC projects are typically not presented by central banks as a route to open new possibilities for monetary policy. However, studies have highlighted potential implications:

- CBDCs could ease monetary policy’s Zero Lower Bound (ZLB) constraint, if they carry negative interest and if options for investors to turn to physical cash are limited.

- On the contrary, CBDCs could strengthen the ZLB constraint, if they carry no interest rate and are more convenient to safely accumulate than physical cash.

- CBDCs could open the way to easier monetary/fiscal interaction, for instance, by allowing fiscal stimulus subsidies to be directly delivered to users’ electronic wallets.

- CBDCs could help the central bank assess the state of the economy in a more timely way (through instant monitoring of transactions), and thus better calibrate monetary policy.

- CBDC’s that include programmability features (for instance, limited life or various other restrictions) could also offer new monetary possibilities.

However, most current CBDC projects (at least in large countries) aim to mitigate the aforementioned risks and incorporate measures to limit their impact on monetary policy. These typically include imposing caps on the amount held by each participant and not offering interest rates, thereby minimising competition with bank deposits. Indeed, CBDCs are primarily presented as a payment method, not an investment asset, designed to coexist with cash rather than replace it. Certain major central banks have also indicated that their CBDCs will not be programmable (although the term may retain some ambiguity). Additionally, most central banks have acknowledged the necessity to preserve privacy (facilitated by their intermediated architecture), although AML/KYC procedures will likely be necessary for larger amounts. However, these reassurances have not placated critics who assert that if a crisis emerges, the established safeguards will be bypassed for emergency reasons, leading to ‘temporary’ new features or central bank powers that will subsequently become permanent.

On the other hand, current experience with CBDCs that have already been launched or are undergoing widespread testing, have not, so far, demonstrated significant user advantages in terms of payment. Other systems already offer, or should soon offer, features like instant 24/7 payment, peer-to-peer transactions and offline payments. Therefore, without any new developments in CBDCs, there is a high risk of public skepticism when they are eventually launched in large advanced economies.

The role of CBDCS in support of innovation, and how they can help improve financial markets

This is not at all to say that CBDCs will prove useless. Their role as an ‘anchor’ for fintech applications seems to be a valid proposition, as it can foster innovation and bring geopolitical advantages. New financial ecosystems and services could well benefit from a form of digital currency that carries no credit or liquidity risks, is compatible with their technologies, and remains under the control of domestic public authorities, for use as a settlement tool or as a building block with versatile roles. The sovereignty implications are also significant, as innovative financial services are a major area of competition between global hubs, each aiming to be a standard-setter. An efficient CBDC infrastructure, if it aids the development of new services, particularly those with cross-border features, could even become a valuable tool for exerting soft power influence or even enhancing global intelligence capabilities.

Financial markets and, therefore, asset management, are areas where CBDCs can facilitate transformation, especially in the context of asset tokenization. While cryptocurrency reports have dominated digital asset-related headlines, the real story for finance may lie in the development of DLT-based tokenized versions of traditional assets2. This has the potential to disrupt and bring new possibilities (such as faster and more cost-effective trading, fractionalization and increased liquidity) to investment markets. True, so far, the adoption of tokenization has been slower than initially anticipated, mainly due to the fragmented nature of projects and lack of network effects.

Nonetheless the probability that tokenization will become more mainstream and deliver its potential in the coming remains significant. Progress on this front should be closely monitored.

CBDCs may play a critical role, as the speed and cost advantages of tokenization may be maximised if tokenized assets are traded against tokenized money (specifically tokenized deposits) integrated on the same platform. Wholesale CBDCs can facilitate settlements of tokenized deposits among banks, with different setups depending on whether the CBDC itself is tokenized and on the same platform3. Although retail CBDCs have a less clear-cut transformative potential for financial markets for the moment, there could be in the future setups enabling the general public to directly purchase digital assets using retail CBDCs, that would facilitate new forms of investor experience. More generally, retail CBDCs could help familiarise the general public further with digital transactions and assets.

In summary, even though CBDCs may not radically improve consumers’ experience for day-to-day payments (relative to other technologies) and while the risks they carry deserve attention, they may nonetheless provide a useful infrastructure to accelerate financial innovation. Regarding the asset management business, the main implication of CBDCs is likely that they can facilitate the trend towards the tokenization of assets, a potentially valuable source of efficiency gains and new possibilities.

Spotlight on CBDC projects

In 2021 and 2022, CBDCs were launched in The Bahamas, Nigeria, the Eastern Caribbean Currency Union (ECCU) and Jamaica. These launches were driven by a variety of motivations, such as financial inclusion, resilience against natural disasters (in the Caribbean cases) and central bank concerns over the growing use of Bitcoin (in Nigeria). It is important to note that the economic characteristics of these countries may limit the applicability of their experience to large advanced economies. However, in the cases of The Bahamas and Nigeria, the projects have been technical successes (the CBDC system worked), but interest and usage have been slow to pick up. Additional features may be added to enhance their appeal.

Among large nations, China has made the most significant advancements in CBDC projects with its e-yuan, which has been in development since 2014. The Peoples Bank of China (PBoC) has conducted widespread testing and adoption with over 260 million retail wallets and 10 million corporate wallets since 2020. However, there is no confirmed full launch date yet. While the official reason for development is to support the digitization of the economy, many believe that the Chinese authorities were motivated by concerns over the dominance of private digital payment providers like Alipay and WeChat. Additionally, the e-yuan could play a role in boosting the international status of the renminbi, and China has already participated in cross-border CBDC platform projects with other countries’ central banks.

True, it appears that the e-yuan, operating through an intermediated architecture and distributed by commercial banks, has seen limited retail interests. Many wallets remain inactive and transaction amounts are small, as consumers seem to remain unconvinced of its benefits compared to familiar payment methods. Nonetheless, the project is still progressing and new features are being introduced that may make the e-yuan more attractive.

While the Federal Reserve has been actively investigating CBDCs, it has consistently stated that it does not aspire to be first in the CBDC race. This stance is primarily due to the existing global status of the USD, which already grants it a first mover advantage. Nevertheless, regional Federal Reserves have engaged in domestic and crossborder experiments in collaboration with various institutions. In the case of the United States, the presence of massive research capabilities within the private sector, coupled with the prevalence of dollar-based products in certain categories of digital assets, such as stablecoins, may suggest that the Federal Reserve has greater flexibility to delegate research to the private sector, whether formally or informally. Subsequently, if deemed necessary, the public authorities can internalise these technologies for wider implementation.

The European Central Bank (ECB) initiated an investigation phase for a digital euro in October 2021, that included technical research and engaging in discussions with various stakeholders. In the first half of 2023, proposed characteristics for a digital euro were revealed, including an intermediated architecture through commercial banks, support for peer-to-peer and offline transactions, an individual holdings cap, no interest bearing capabilities, and not being ‘programmable’ money. In June 2023, a legal proposal was submitted to the European Parliament. The reasons stated by the ECB for launching a CBDC included financial inclusion, the notion of being a monetary “anchor”, innovation, and resilience. A preparation phase is commencing in the second half of 2023, with a potential deployment, if finally decided, in 2027-28.

Sources:

1 For instance, in May 2023, Florida Governor and candidate for the Republican primary election Ron DeSantis mentioned that he would ban CBDCs in his State over risks of abusive power by public authorities.

2 Please see, ‘Crypto-currencies: a bubble or the emergence of a new paradigm in decentralised finance?’, Amundi, Investment Insights Blue Paper, February 2022.

3 For a detailed discussion of the role of CBDCs in tokenized assets architecture, refer to the June 2023 BIS Annual Economic Report, Chapter 3. Blueprint for the future monetary system: Improving the old, enabling the new.