Summary

This paper is co-written with the African Development Bank.

Key takeaways

- Although Africa's historical and current contributions to global carbon emissions are below 3% according to the IEA, it is at the receiving end of devastating climate change impacts. The African continent is indeed the least climate-resilient region in the world, with high vulnerability and low readiness for climate change.

- Nevertheless, almost all African countries have signed the Paris agreement in 2015 and submitted to the UNFCCC a Nationally Determined Contribution (NDC). Many governments have also set Net Zero targets with the aim of decarbonizing their economies. Importantly, the transition to a decarbonized economy needs to include plans to soften the social impacts it triggers, as highlighted in the recent Just Energy Transition Partnership signed between international donors and South Africa.

- The African Development Bank has notably been a key actor to initiate change at scale in Africa, having committed to mainstream climate change through its lending and financing practices.

- While the mobilization of funds from international public sources will be critical, these need to be complemented with private sources of financing to fill the massive climate financing gap. Institutional investors therefore have a crucial role to play in redirecting capital towards projects that are aligned with climate mitigation and adaptation objectives.

- However, to accompany the development of climate finance and attract international investors at scale to the continent, a supportive policy and regulatory environment is crucial.

- There is also a strong potential for blended finance instruments to de-risk investments and catalyze private investors to frontier markets across the African continent.

- A prerequisite of this will be to develop robust local institutional frameworks – under the form of Green National Banks for example – which are needed to mainstream climate change considerations within the African financial sector.

- Finally, supporting the development of efficient carbon markets can lead to the unlocking of the needed capital to finance climate mitigation and adaptation efforts in Africa.

Introduction

The Impact of Climate Change in Africa

Since the beginning of 2020, much of the developing world has been struck with a series of social, economic and geopolitical shocks. These include the Covid-19 pandemic and, recently, food and gas shortages following the Russia-Ukraine war. In addition, increasing threats from climate change exacerbate the socioeconomic impacts of these crises. Africa is one of the world's most affected regions by the global climate crisis, putting a significant strain on its public finances, growth prospects, and employment levels. The pandemic severely impacted the macroeconomic conditions of African countries by worsening debt vulnerability and fiscal distress. It also resulted in a loss of jobs to the tune of 22-30 million people and close to 33.9 million additional people driven into extreme poverty in 2020- 2022 (AfDB, 2022). The low level of Covid-19 vaccine rates are likely to make a faster post-pandemic economic recovery more difficult across the continent1. These impacts were only worsened by the Russia-Ukraine war, which led to food and natural gas price shocks across the world. African households, who already spend over 50% of their overall consumption on food and energy, thus particularly felt the impact of these high global energy prices, as well as indirect effects from high transportation and consumer goods costs2.

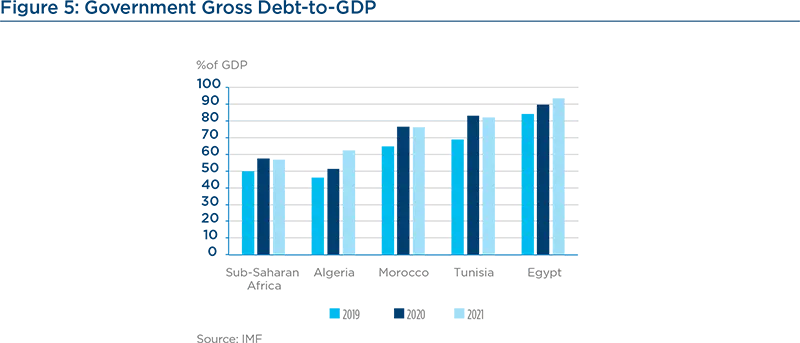

Following the Covid-19 pandemic, GDP contracted by 2.1% in 2020 on average across the continent, a huge decline from 4% annual growth in the pre-Covid-19 period, marking an economic recession for Africa's economies. Although growth rebounded in 2021, it decelerated to 4.1% in 20223. Considerable risks and uncertainty also linger, primarily due to the Russia-Ukraine war and related sanctions on Russia, as well as spillovers of the crisis to global output and trade. Other downside factors include heightened debt vulnerabilities and tight global financial conditions as inflationary pressures rise. Africa's high sovereign debt vulnerability remains a threat to economic recovery despite recent international financial institutions' debt relief initiatives, such as the Debt Service Suspension Initiative (DSSI), the common Framework, and the IMF's Special Drawing Rights (SDRs), which contributed to alleviate the liquidity constraints of many African countries. While these debt relief initiatives helped, the IMF assessment shows that 23 African countries were either in or at risk of debt distress as of February 2022. At the continental level, estimates from the African Economic Outlook (AEO) 2022 show that the debt-to-GDP ratio as at 68% in 2021 and at 65% in 2022, which remains above the pre-pandemic levels. It is estimated to be at 66% in 2023 and to stabilize at around 65% again in 20244.

As the continent copes with the consequences of global health and conflict crises, climate change continues to be a significant challenge to African countries, threatening the lives and livelihoods of millions of people on the continent. Although Africa's historical and current contributions to global carbon emissions are below 3% according to the International Energy Agency (IEA), it is at the receiving end of devastating climate change induced phenomena. In just two years, about 131 extreme-weather disasters – 99 floods, 16 storms, 14 droughts, and two wildfires – were recorded (WMO, 2020)5. African Development Bank estimates show that African countries lost 5-15% of their GDP per capita growth from 1986 to 2015 due to climate change (AfDB, 2022).

Moreover, climate change is one of the most consequential threats to African economies as its consequences could undo some of the hard-won gains in poverty reduction and economic growth from the past two decades. Indeed, the impacts of climate change on African economies are expected to be manyfold in the coming few decades as global temperatures continue to rise. The projected temperature increase for the next decades in Africa exceeds the global average, according to the Intergovernmental Panel on Climate Change Working Group 1 (IPCC 1)6. Going forward, this is expected to result in increased frequency and intensity of heavy rainfall, flooding, and drought across the continent.

Much of the projected impacts of climate change are in areas where the continent's most vulnerable people live, directly linked to their livelihoods. The estimates show that if the current projections under the high warming scenario through 2050 hold, climate change is expected to reduce the continent's GDP per capita growth by up to 15% by 2050, compared to the baseline GDP per capita scenario.

Beyond macroeconomic consequences, climate change significantly impacts socioeconomic outcomes, including reduced labor productivity and increased morbidity and mortality rates. Studies also show that in addition to direct health impacts, the risks of climate change-related conflicts are rising across many parts of Africa. For instance, in 2020, about 30 million people worldwide became internally displaced because of weather-related disasters, including 4.3 million in Africa – the highest level since 2012. Extreme weather events account for 89% of all disaster displacement (AfDB, 2022).

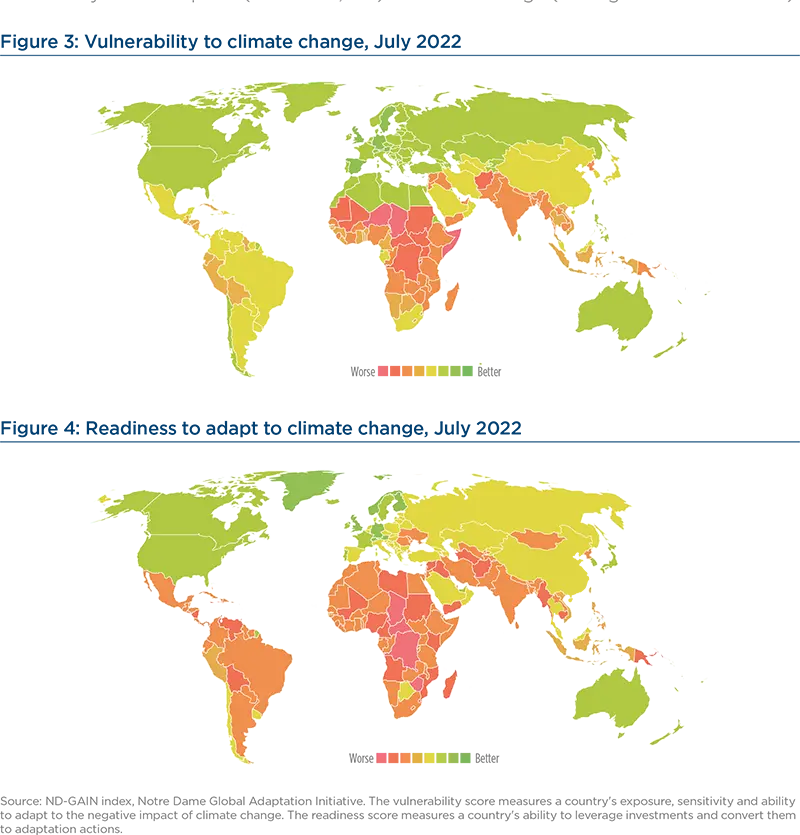

All in all, the continent is the least climate-resilient region in the world, with high vulnerability and low readiness for climate change. According to AEO 2022, its high climate vulnerabilities are attributed mainly to its desert and semi-desert climatic zones, low levels of socioeconomic development, and lack of technological capacity and access to financing for adaptation purposes. As a result, the continent is the lowest ranked in terms of climate readiness and the second-most climate-vulnerable region of the world, only South Asia being more vulnerable.

The disproportionate impacts of climate change on Africa require a concerted effort towards climate justice, which calls for a transition from carbon-intensive development to a climate-resilient pathway, as well as accountability and shouldering historical and current costs of emission in a 'just' manner.

Significant amounts of public and private financing will be needed to put African economies on a low-carbon trajectory and to help the continent become more adaptable in the face of climate-related risks.

In this paper, we aim to provide an overview of the African continent’s vulnerability to climate shocks, as well as the policy developments that have taken place to enhance its resilience. In the face of an important financing gap, we highlight the role of asset managers and asset owners in financing climate mitigation and adaptation actions in Africa, as well as the importance of the development of capital market tools aiming to facilitate these financing flows.

Increasing Resilience and Moving towards a Green Economy in Africa

Africa's contribution to global greenhouse gas (GHG) emissions in history is among the least, while the impact of climate change on the continent could be among the worst. With that in mind, adaptation to climate change may appear particularly crucial. Mitigation is nevertheless a key topic in the context of economic development. How to raise the standards of living in the continent without increasing GHG emissions? How to prevent deforestation and protect carbon sinks and biodiversity while developing national economies and supporting local communities?

A. CLIMATE MITIGATION

Pledges to reduce GHG emissions

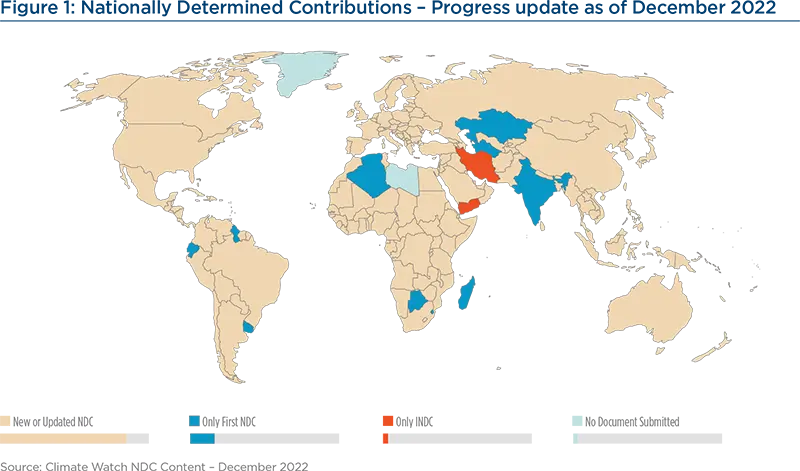

As mentioned in the introduction, Africa accounts for a small share of the world's energy-related CO2 emissions to date and has the lowest emissions per capita of any region. Nevertheless, almost all African countries have signed the Paris agreement in 2015 and submitted to the UNFCCC a Nationally Determined Contribution (NDC). One reason for this is that African countries’ GHG emissions are expected to rise with their development ambitions. Since 2015, only seven African countries have not submitted an updated or a new version of their NDC as required.

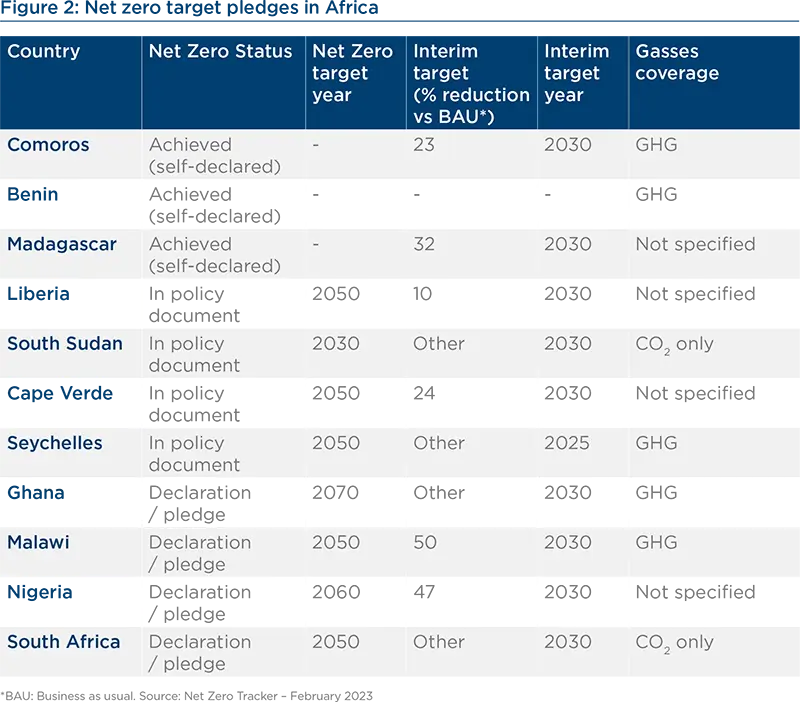

Several African countries have also set a Net Zero emissions target, three of them declaring the target reached already (Benin, Madagascar and the Comoros).

Phasing out coal

Regarding coal, the "dirtiest" fossil fuel, it represents 28% of Africa’s electricity mix (vs. 52% in Asia). Only three African countries have a share of coal above 30% in their power generation. In the southern part of the continent, where the coal mining industry is a major employer and the electricity demand is rising, efforts focus on the development of renewable energies and on initiatives to prevent the potential negative social impacts of phasing down or phasing out thermal coal.

Just transition

The transition to a low-carbon economy is challenging not only from the technical, economic and financial standpoints but also from the social standpoint. It will trigger significant transformation that will notably affect the labour force and communities. It is thus key to assess the exact impact and prepare plans to offset or smoothen the social impact of such changes. The International Labour Organization (ILO) describes just transition as “greening the economy in a way that is as fair and inclusive as possible to everyone concerned, creating decent work opportunities and leaving no one behind. One good example is the phasing out of coal in countries which still rely significantly on this energy for power generation. It will necessitate training programmes and support schemes for workers to find jobs in other sectors and potentially other geographical areas.

B. CLIMATE ADAPTATION

Although a minor contributor to global emissions, Africa needs to do far more to adapt to climate risks than the rest of the world. A global average temperature rise to 2°C around 2050 would reduce African GDP by around 8% in 2050 relative to a baseline without any climate impacts (AEO 2022, IEA). Urgent action to adapt to climate change would reduce the severity of these economic effects. However, works from the University of Notre Dame – which publishes the ND-GAIN index on adaptation – shows that Africa is the most vulnerable and the least prepared to climate change (see Figures 3 and 4 below).

The IPCC's Sixth Assessment Report highlighted different ways to support climate adaptation in Africa7:

- Ecosystem-based adaptation or "naturebased solutions to climate change": actions that involve the protection, restoration or management of natural and semi-natural ecosystems; the sustainable management of aquatic systems and working lands; or the creation of novel ecosystems in and around cities, with the full engagement and consent of local communities and Indigenous Peoples (as defined by the Nature-based Solutions Initiative8).

- Gender-sensitive and equity-based adaptation approaches would reduce vulnerability for marginalized groups across multiple sectors in Africa.

- In agriculture, the introduction of drought-and pest-tolerant crop and livestock varieties would help farmers, who often cannot afford these without assistance.

- Management of the competition between the different water users: household, farmers, energy producers.

- Make use of local and indigenous knowledge to cope with climate variability.

- Integration of climate adaptation into social protection programmes, such as cash and in-kind transfers, public works programmes, micro-insurance and healthcare access.

- Development of early warning systems, targeting weather and climate information to specific users and sectors.

National Adaptation Plans

The goal of National Adaptation Plans is to enable countries to identify and address their medium- and long-term priorities for adapting to climate change.

As defined by the United Nations, the objectives of the National Adapatation Plans (NAP) are “a) to reduce vulnerability to the impacts of climate change by building adaptive capacity and resilience; b) to facilitate the integration of climate change adaptation, in a coherent manner, into relevant new and existing policies, programmes and activities, in particular development planning processes and strategies, within all relevant sectors and at different levels, as appropriate.

There are 17 African countries that submitted a NAP to the UNFCCC as of April 20239. Among them, least developed countries (LDC) can benefit from the support process – both technical and financial – established by the Conference of the Parties.

C. THE AFRICAN DEVELOPMENT BANK’S CLIMATE ROADMAP

The African Development Bank’s Climate Change and Green Growth Strategic Framework

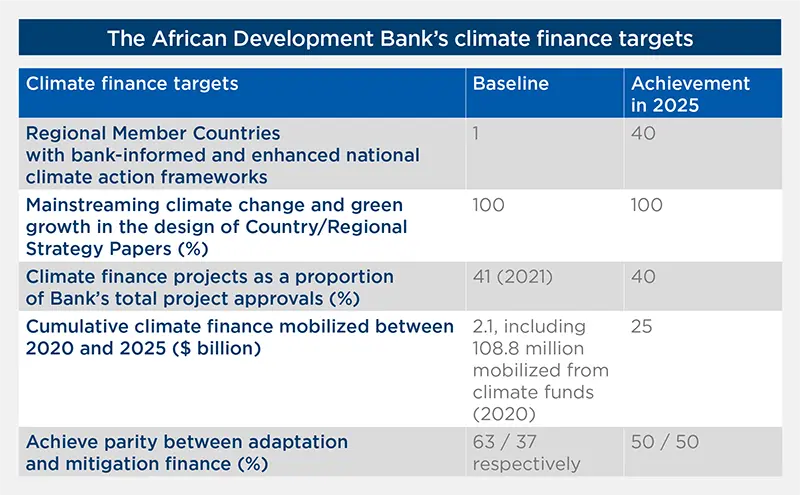

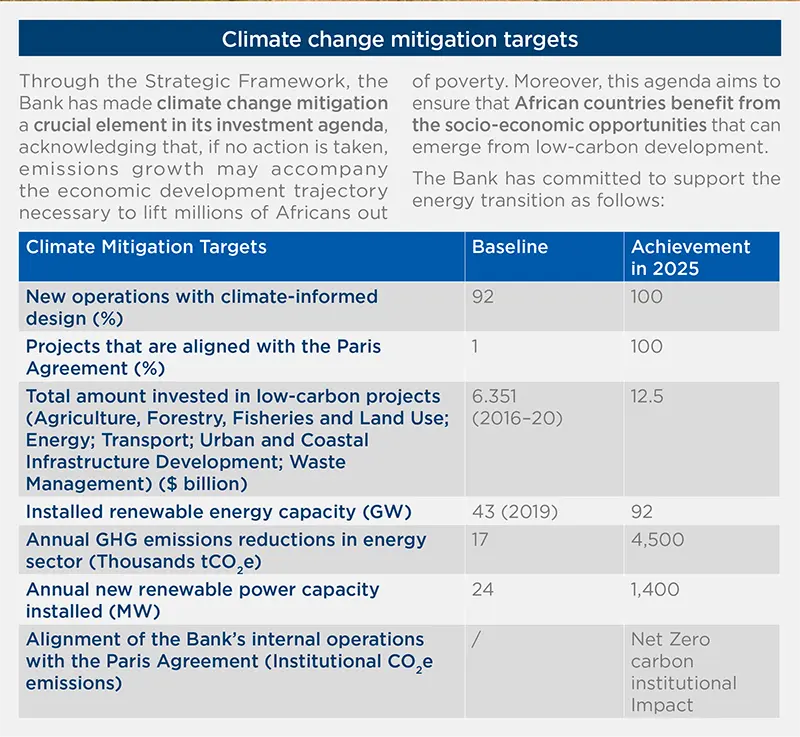

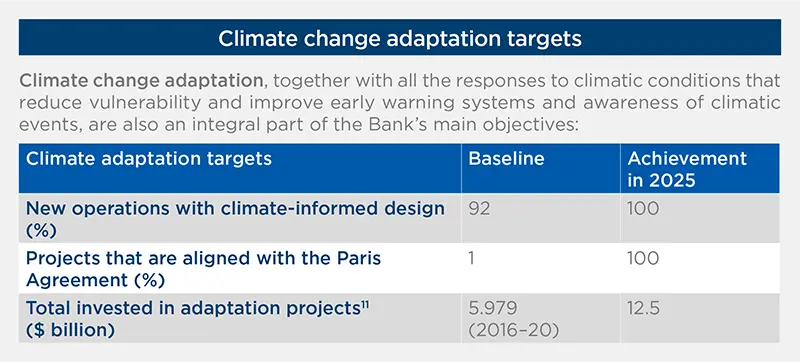

The African Development Bank (hereafter “the Bank”) has committed to reducing climate change through its lending and financing practices, and has formulated specific quantitative targets to increase its funding for climate change programmes. The Bank has recently adopted a Climate Change and Green Growth Strategic Framework comprising10 : a high-level policy, a 10-year strategy 2021-2030 and 5-year action plan (2021 -2025) which emphasize the role and importance of green growth. Through this Framework, the Bank will systematically align its future investments and operations with the Paris Agreement and the UN Sustainable Development Goals (SDGs), while positioning green growth as a key priority area and delivering on its ambitious climate finance targets. This includes the provision of $25 billion as climate finance by 2025.

It is clear that research, long-term policy and infrastructure planning are critical to prepare for the consequences of climate change on the African continent. However, African economies are clearly constrained by a lack of finance despite an increase in financing pledges from public institutions. The next section will explore the main hurdles faced by African countries to access private capital, as well as the role of institutional investors in financing climate mitigation and adaptation at scale.

Financing the Energy Transition and Climate Adaptation Efforts

A. GROWING DEBT BURDENS AND THE NEED FOR A JUST TRANSITION

Tight public finances in many countries

Following the Covid-19 pandemic and the consequences of Russia's invasion of Ukraine, public finances in many countries are scarce. At the same time, there is an urgent need to accelerate adaptation to climate change. The African Development Bank expects the average debt-to-GDP ratio in Africa to stabilize around 70% in 2022, up from an average of 60% in 2019. In this context, beyond the promised funding from most advanced economies, private sector financing – which was quite low up to now – needs to be enhanced.

According to the Bank’s analysis, the Nationally Determined Contributions (NDCs) developed by African countries represent an estimated $3 trillion investment by 2030. The Bank recognizes that the private sector’s ability to contribute to Africa’s climate-resilient and green recovery agenda is constrained by its limited technical capacity, lack of bankable projects, inability to raise climate funds and the poor availability of reliable climate information. To address this, the Bank opened a dialogue with Africa’s private sector to create an enabling environment for private sector participation in climate actions. The role of the private sector will be further elaborated on in the next sections of this paper.

International public funding pledges

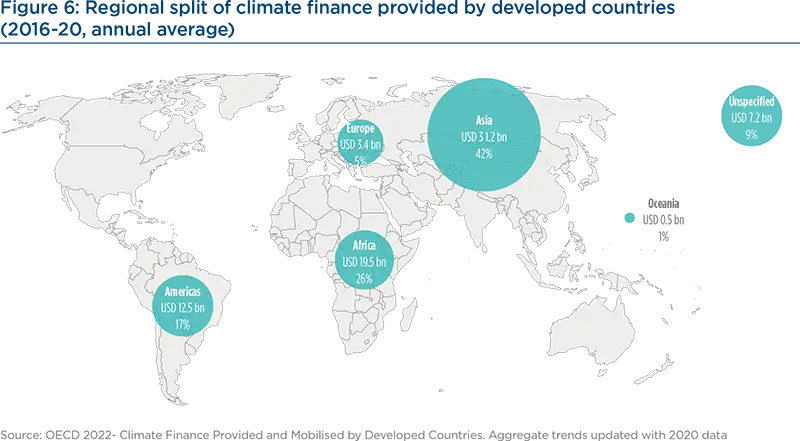

Developed countries committed during COP15 in 2009 to mobilise $100 billion every year in climate finance to support developing countries for adaptation and mitigation. This goal has not been reached so far, although progress has been made (from $58.5 billion in 2016 to $83.3 billion in 2020). At COP27 in 2022, on top of reiterating the commitment to the $100 billion goal, new financial pledges were made to the Adaptation Fund totaling over $240 million, and to the Least Developed Countries Fund (LDCF).

The mobilization of funds from international public sources will be critical for developing countries and notably for Africa, which suffers from a lack of funding in all areas of adaptation, including for developing research on climate-related risks (see Figure 6 below).

In light of this, the African Development Bank has set an objective to raise the proportion of global climate finance coming into Africa. It has notably committed to significantly expand its own climate finance, as well as to increase funding from external climate funds including the Climate Investment Funds (CIF), the Green Climate Fund (GCF), and the Global Environment Facility (GEF). As further explained below, developing and capitalizing on more thematic funds and instruments, and catalysing climate finance to unlock domestic and international capital will also be essential to reach this objective.

Moreover, the African Development Bank is leading an initiative aiming at rechanneling a portion of the USD650 billion issued in Special Drawing Rights (SDR) through MDBs. This will help allocate more resources to tackle climate issues thanks to the multiplier effect – up to 3 to 4 times the initial amount allocated – MDBs can generate, their triple-A ratings and their strong track record in capital markets.

It is also worth mentioning the launch of the Africa Adaptation Acceleration Program12 (AAAP): a joint initiative of the African Development Bank and the Global Center on Adaptation (GCA), it aims to mobilize $25 billion over five years, until 2025, to scale climate adaptation action across the continent. The AAAP is being implemented through two mechanisms. First, the AAAP Upstream Financing Facility, which provides support on knowledge, project design and preparation, and policy work needed for the success of AAAP operations. Second, the Africa Development Fund (ADF) has created a new Climate Action Window (CAW) with $429 million being earmarked as seed money to reach up to $13 billion from partners, both from the public and private sectors. This window is structured around three components: adaptation (75% of resources), mitigation (15%), and technical assistance (10%) and covers six sectors: agriculture and food security; water security; climate services and information; transport and resilient, low-carbon infrastructure; green energy; and green finance. The window’s resources will notably provide access to climate-resilient agricultural technologies to some 20 million farmers in 30 ADF-eligible countries.

Financing a just transition in Africa

Moreover, the transition to a green economy needs to include plans to soften the social impacts it triggers, which requires support from most developed countries, multilateral institutions and investors.

Following the Just Energy Transition Partnership (JETP) between South Africa and international donors which was made official at COP26, the creation of JETPs in other African countries were discussed at the European Union-African Union (EU-AU) Summit in February 202213. The two main objectives of the partnerships are:

- Accelerating universal access to electricity at reasonable cost and create massive job opportunities for the youth;

- Enhancing NDCs and developing a decarbonised energy mix compatible with the Paris Agreement, which does not lock countries into unsustainable development paths and limits their exposure to rising carbon prices.

B. MOBILIZING INSTITUTIONAL INVESTORS THROUGH THE DEVELOPMENT OF CLIMATE AND TRANSITION FINANCE FRAMEWORKS

Asset managers and institutional investors have a crucial role to play in redirecting capital towards projects that are aligned with climate mitigation and adaptation objectives.

The Net Zero Asset Managers Initiative, launched in December 2020 has catalyzed asset managers’ interest to supporting the goal of net zero greenhouse gas emissions by 2050 or sooner. This initiative combined with other financial sector alliances – such as the Net Zero Asset Owner Alliance and the Net Zero Insurance Alliance, to name a few – have the potential to encourage financial institutions to accelerate financial flows in line with global climate objectives.

Moreover, the emergence of regional initiatives, such as the Glasgow Financial Alliance for Net Zero (GFANZ) Africa Network14, testify of the pressing need to develop climate finance at scale across the African continent. This Network is meant to work closely with African banks, asset owners and managers, policymakers, regulators and multilateral development banks, to catalyze financial flows for climate investment in Africa.

Towards harmonized taxonomies and investment frameworks

Importantly, climate and transition finance in Africa will need to be transparently monitored and reported on, for investors to credibly track financing associated to the transition. However, Africa currently lacks harmonized definitions and investment frameworks which can help ensure deployment of climate finance solutions. The work of the GFANZ Africa Network is encouraging and should, going forward, provide country-specific guidance to financial institutions to enable financial flows for climate investment opportunities on the continent.

For now, the country that is most advanced on this front is South Africa, which has developed a Green Finance Taxonomy published in March 202215. The South African National Treasury is also currently working on a taxonomy for transition finance, which aims to structure financial support to activities which are following a Net Zero trajectory, even if these contribute highly to carbon emissions today.

Additionally, British International Investment (BII), along with NinetyOne, the Oxford Sustainable Finance Group and the Blended Finance Taskforce have developed a Practitioner’s Guide to Transition Finance in Africa16, which presents a framework for investors to qualify and deploy transition finance in Africa. This could serve as the basis to develop more formal taxonomies, which will ultimately be crucial to catalyze investments from African and international investors to the continent.

As stated above, the Net Zero transition and objectives of sustainable development must go hand in hand. Consequently, the Just Transition must be a key feature of these financing solutions and local and regional policy frameworks. If the challenges encountered for workers, communities, and populations at large, including food and water security, are not taken into account, the low-carbon transition will surely not be successful.

Developing Sustainable Bond Frameworks

In particular, sustainable bond market development can work as an important channel to scale up climate finance in African countries.

Although green and sustainable bond markets are still nascent in Sub-Saharan Africa, developments in 2022 have been encouraging. For example, green bond issuance followed a positive trajectory in Sub-Saharan Africa in the past year, having increased by 20%, to $600 million. Still, almost all of these issuances came from South Africa, with the exception of Namibia and Nigeria17.

To accompany the development of climate finance and attract international green bond investors, a supportive policy and regulatory environment is crucial. In this regard, some policy initiatives can be highlighted. For example, the West African and Monetary Union (WAEMU) has developed a sustainability bond framework, published in January 2021, aiming to pave the way for the issuance of Green, Social and Sustainability Bonds, aligned with the international standards of the International Capital Markets Association (ICMA)18. This has notably led to green and sustainability bonds being issued, such as a green bond in Côte d’Ivoire aiming to finance a low-carbon property development project, as well as Africa’s first sovereign sustainability bond issued by Benin in July 2021.

Moreover, signs of progress include Kenya’s draft green fiscal incentives policy framework which is intended to encourage private sector investment in green projects. Financial regulators in Ghana also unveiled new guidelines for listing and trading green and sustainable bonds, while Nigeria’s stock exchange is working to deepen the country’s market for sustainable products.

Focus: The African Development Bank’s Green Bond Program

The African Development Bank has developed a Green Bond program which falls within the Bank’s 10-year strategy of supporting African countries’ transition to green and inclusive growth. These programs address a great number of the UN SDGs and support Africa’s drive towards sustainable development.

The Bank’s Green Bond framework is aligned to the ICMA Green Bond Principles (GBPs). Within these frameworks, the proceeds of the Bank’s green bonds are used to finance eligible green projects that have been carefully selected and evaluated.

Below are some examples of Green projects that have been financed by the Bank’s Green Bond issuance.

#1: TANZANIA - MALAGARASI HYDROPOWER PROJECT

Sector: Renewable Energy – Climate Change mitigation

Project cost: USD 144 million

Bank financing: USD 120 million

Year of approval: 2020

Kigoma Region, where the project is located, has numerous opportunities emanating from the vast agricultural, water and mineral resources, as well as tourism, trade and transportation. These opportunities are not fully exploited due to the lack of adequate basic infrastructure, such electricity access, which is a significant barrier to the socio-economic development of the region.

The 49.5 MW grid-connected hydropower plant (with an average annual energy production capacity of 181 GWh) will mainly serve the local demand in Kigoma and surrounding regions comprising households and social services amenities (namely education, health and water supply facilities) including SMEs.

Coupled with the ongoing transmission network expansion projects in western Tanzania, the Malagarasi hydropower plant will provide a clean, reliable and affordable source of supply to foster economic growth and industrialization, human development and social transformation, as well as improving the environment for private sector development in the Kigoma Region. Besides improving the reliability and quality of service, the project will increase the use of renewables in the electricity generation mix thereby contributing to abatement of GHG emissions.

The project will help to achieve three Sustainable Development Goals: 3, 7, and 13; the expected development outcomes include 4,250 new last-mile connections, 25% increase in availability of electricity supply for the region, 86,400 tCO2e annual GHG emissions reduction and 500,000 trees planted.

For more information, visit the Projects Portal19 of the AfDB.*

#2: RWANDA - MUVUMBA MULTIPURPOSE WATER RESOURCES DEVELOPMENT PROGRAM

Sector: Sustainable Water and Wastewater Management - Climate Change adaptation

Project cost: EUR 124 million

Bank financing: EUR 122 million

Year of approval: 2020

Rwanda’s water resources are highly sensitive to climate variability and change and to environmental pressures, given the highly seasonal and often unpredictable rainfall. Inadequate water storage already causes large and avoidable economic losses from droughts and constrains long-term economic growth. The lack of sufficient water storage infrastructure is resulting in the sub-optimal utilization of water resources and foregone multiple benefits.

The program includes the construction of a 35 million m3 multipurpose dam for water supply, which will improve water, energy, food and nutrition security by harnessing water resources for irrigation, domestic, livestock use and an annual hydropower generation of 5,700 MWh, while ensuring sustainability of the resources and building resilience against climate change through catchment protection, forest management and capacity development.

The program will contribute to irrigation development for the project area (approximate population 500,000), estimated at 7,380 hectares, and provision of a municipal water supply, and estimated at 24,000 m3/day for 300,000 people, in addition to livestock use.

For more information, visit the Projects Portal20 of the AfDB.

C. A STRONG NEED FOR PUBLIC-PRIVATE COOPERATION

As public sources of funding will not be sufficient to achieve climate and sustainable development objectives in Africa, there is a strong need for cooperation between the public and private sectors to catalyzing financing from institutional investors.

Innovative strategies can typically include instruments structured around public-private partnerships that can lower the cost of financing, while allowing institutional investors to allocate capital beyond their usual boundaries and to stay within their risk frameworks.

As stated for example in the context of the EU-AU Summit mentioned above, a Just Energy Partnership in Africa should rely on the acceleration of “financial and technical resources through appropriate instruments (…) including concessional loans, guarantees and grants to reduce the cost of the energy transition for the populations and modernize power grids. New EU instruments will increase significantly its capacity to crowd-in the private sector through the European Fund for Sustainable Development (EFSD+) that will provide guarantees and blending instruments with a strong leverage effect.”

While the Just Energy Transition Partnership for now involves South Africa and Senegal only, dialogue has been initiated on the ground to launch pilot-projects in Egypt, Côte d’Ivoire, Kenya and Morocco.

To meet the challenge of increased needs for climate finance in Africa, multilateral development banks (MDBs) and development finance institutions (DFIs) will continue to be crucial contributors to blended finance transactions across the developing world, alongside private sector investors. In fact, MDBs, national development banks and development finance agencies are actively engaged in the JETP donor coordination group21.

The Alliance for Green Infrastructure in Africa (AGIA) announced at COP27 is an example of a recent public-private partnership that was set up with the objective of scaling financing for green infrastructure projects22. Its objectives are twofold: generate a pipeline of transformational bankable projects and catalyze financing at scale. For this, the African Development Bank is working with several development finance partners that will provide the needed de-risking instruments to facilitate investment from institutional investors and leverage African and international capital markets.

Another example is the African Financial Alliance on Climate Change (AFAC), in which development finance institutions are working with private sector actors to positively contribute to global net zero efforts by financing or subsidizing relevant carbon mitigation projects23.

AFAC is a platform developed by the African Development Bank which fosters climate action by promoting knowledge sharing, green financial instruments, climate risk disclosure and climate finance flows among African financial institutions lending to the African private sector. The Alliance notably works with stock exchanges, institutional investors, treasuries, development finance institutions and others to raise awareness of the importance of catalyzing green investments.

Through AFAC, the Bank is raising awareness of the need to move away from fossil-fuel investments and those that are prone to climate-related risks, and to encourage the African financial sector to invest in low-carbon and climate-resilient assets.

At COP 26 in Glasglow, AFAC launched a flagship report on climate risks regulation in Africa’s financial institutions24 and has initiated partnerships with several key organization such as the UN Environment Programme’s (UNEP) Finance Initiative, the Global Center on Adaptation, the Bank’s Financial Sector Development Department (PIFD) and the African Insurers Organization. AFAC has also carried out sector training of the Association of African Development Finance Institutions (AADFI).

These public-private partnerships will be key in raising awareness of such topics across African capital markets, in order to raise the necessary funds to finance climate change mitigation and increase resilience.

Focus: Amundi’s Blended Finance Partnerships in Emerging Markets

Amundi has partnered with several MDBs and DFIs to help scale climate investments where it is most needed. Through these blended finance partnerships, Amundi aims to catalyze interest from a broad investor base by providing de-risking mechanisms thereby lowering barriers to invest in emerging markets and developing economies (EMDE).

Leveraging on the growth of EM sustainable bond markets, Amundi has partnered on two occasions with the International Finance Corporation (IFC). First, Amundi Planet Emerging Green One (AP EGO) was lauched in 2017 to develop the issuances of green bonds across emerging markets25. The objective of this partnership is thus to finance solutions contributing to the lowcarbon transition and to climate change adaptation.

Second, in 2021, the Build-Back-Better Emerging Markets Sustainable Transaction (BEST) was launched with the IFC to mobilize private investment into emerging market sustainable bonds, to promote a green and inclusive recovery from the Covid-1926 pandemic. This strategy is meant to develop the EMDE social, sustainable and sustainability-bond market and disseminate best practices in sustainable fixed income issuances.

Amundi has also partnered with the Asian Infrastructure Investment Bank (AIIB) to scale up climate investments across the Emerging Economies of AIIB Members through the development of the Climate Change Investment Framework in 202027. This Framework aims to provide investors with a benchmark tool for assessing issuers’ exposure to climate-related risks and opportunities, thereby channeling capital towards companies that have a holistic approach to climate change-related risks and opportunities.

D. THE IMPORTANCE OF ENGAGEMENT AND SHAREHOLDER DIALOGUE

Beyond their capacity to accelerate financial flows towards sustainable development solutions, asset managers and asset owners can also play a role through their engagement and voting policies, by conducting an active dialogue with their investee companies. Engaging with companies is critical, in the short, medium and long-term as it is an efficient way to encourage corporates to act and set ambitious yet credible climate objectives.

As part of its ESG Ambition 2025 Plan28, Amundi has committed to expand its engagement and voting practices on companies' strategies to align with the objectives of the Paris Agreement. This will notably be done by increasing the scope of engagement to more than 1,000 companies, including many operating on the African continent, in order to accelerate the transition to low-carbon and climate-resilient economies.

We provide below a concrete example of engagement that Amundi has conducted with a Food sector company operating in Ghana and Côte d’Ivoire. Our engagement has particularly focused on discussions around the issue of deforestation, which is an important driver of climate change.

Case Study: Amundi’s engagement with a Food sector company operating in Ghana and Côte d’Ivoire

In 2022, Amundi began an engagement with a food sector company, precisely a major supplier of chocolate and other confectionary and syrups. As a result, the company has major exposure to two commodities that are highly important from a deforestation risk perspective; cocoa and palm oil. The majority of the company’s cocoa supply is sourced from Ghana and Côte d’Ivoire.

From internal research, Amundi became aware that while the company has a “No Deforestation” pledge in place, the latter does not cover all commodities and geographies. Instead, the pledge is applied only to the palm oil supply chain. Cocoa is instead only covered by a pledge for no new deforestation, a standard that falls below Amundi's view of best practice. Amundi therefore sought to engage with the company on this issue, in order to help them accelerate more quickly towards a universal pledge of No Deforestation across all commodities and geographies.

During this engagement, Amundi witnessed the challenges of applying a “No Deforestation” pledge to the cocoa supply chain, namely down to transparency and traceability issues. As a result, the company has introduced a target to achieve 100% traceability, to the farmer group level, for all of the cocoa volume coming from Ghana and Côte d’Ivoire, by 2025. This is a positive first step towards reducing environmental and social risks related to biodiversity loss in these countries.

Further, the company is a founding member of the Cocoa & Forests Initiative (CFI) which was launched in 2017 and focuses on cocoa communities in Côte d’Ivoire and Ghana. The initiative is a framework for industry, governments and non-governmental organizations (NGOs) to work together to take action and protect the delicate ecosystems where cocoa is produced.

However, much more is still to be done. The company has pledged to end deforestation along their entire supply chain by 2030, but until this is achieved, rates of forest loss in these countries remain high.

In the next engagement with them, Amundi will be following up on the journey towards traceability in the cocoa supply chain. Amundi's ESG analysts will also be following up on some of the targets and plans set by the Cocoa & Forests Initiative that focus on landscaping and habitat restoration. This includes KPIs related to the number of hectares of forests restored, and the number of trees planted outside of plantations. Amundi will also strive to encourage regular comprehensive assessments of biodiversity risks close to farmer cocoa sites in these countries.

Creating the right environment to catalyze climate finance in Africa

Beyond the aforementioned pledges, initiatives and partnerships to attract global private capital, the right institutional environment also needs to be put in place to encourage stakeholders to adopt best climate mitigation and adaptation practices, and for the private sector to access climate finance at a large scale.

A. CLIMATE CHANGE MAINSTREAMING TOOLS

First, multilateral development banks, development finance institutions, and financial institutions at large can play a key role in the mainstreaming of climate considerations in financing flows to Africa.

In this regard, the African Development Bank has committed to mainstreaming climate change considerations in the design of all of its country and regional strategies. The Bank notably accompanies its Member Countries in the evaluation of their carbon and climate risk exposure through climate change mainstreaming and policy support. This is key for them to implement climate-resilient and low-carbon risk reduction strategies.

At the project level, the Bank screens all its operations for climate risks and builds adaptation, resilience and mitigation measures into projects, in order to protect its investments from climate risks and to promote opportunities for climate action and green growth. For adaptation and resilience building, the Bank uses the Climate Safeguards System (CSS). For climate change mitigation, the Bank uses a “mitigation potential” module within the CSS, through which a Greenhouse Gas Accounting and Reporting Tool can be accessed. The CSS is now being updated to incorporate Paris Alignment procedures for mitigation and adaptation goals. Like other MDBs, the Bank undertakes an ex ante analysis of climate finance contribution for each project using the Joint MDB methodology on climate finance tracking and reporting. The Bank has indeed started to report on climate finance since 2011, using a joint MDB methodology for tracking climate finance. This is based on harmonized principles and agreed-upon methodologies for tracking adaptation and mitigation climate finance. It includes both greenfield and brownfield renewable energy and transport modal shift projects.

As the Bank enters its new commitment period by 2025, all of these tools will be fully and widely used across the Bank’s operations.

Another way in which the Bank mainstreams climate change considerations into its activities is through the AAAP’s African Infrastructure Resilience Accelerator, which aims to integrate climate resilience solutions into $7 billion worth of infrastructure investments across the continent29. The accelerator builds resilience by delivering upstream analysis and support to develop metrics on climate hazards, exposure and vulnerabilities. By providing technical assistance, it addresses key barriers to integrating adaptation and provides innovative nature-based solutions to increase resilience.

B. DEVELOPING A LOCAL INSTITUTIONAL SET-UP TO BOLSTER CLIMATE FINANCE

Beyond mainstreaming climate change in its approach to project financing, the African Development Bank is also working to develop the local institutional set-up needed to mainstream climate change considerations within the African financial sector at large.

For example, the Bank has launched the African Green Bank Initiative to help financial institutions in Africa increase their access to global climate financing30. This will involve raising and blending capital from a variety of sources – including concessional climate finance and domestic funds – to invest in green projects. Recipients of these funds will include micro, small and medium enterprises (MSMEs), which make up most of the African economy.

Key areas of investment will be climate-resilient agriculture and, closely related, off-grid and mini-grid energy solutions, including solar for agricultural use, such as water pumps and the processing and storage of produce. These interventions build resilience in households, communities, and economies, thereby greatly improving quality of life.

The Bank will also support the creation of new Green Banks, to develop and implement a range of green finance instruments that are suited to the needs of the national economy and can facilitate fundraising and lending in the local currency.

Focus: The African Green Bank Initiative and the Green Finance Facility Fund (AG3F)

The African Green Bank Initiative was launched at COP27 to support the implementation of African countries NDCs. As part of this initiative, the African Green Finance Facility Fund (AG3F) was set up as an innovative mechanism aiming to mobilize external and domestic funds through a blended finance model. It will leverage and increase private sector climate-related investments through de-risking instruments to fund climate adaptation projects in particular.

Through its three pillar-approach, AG3F will support the provision of:

- Technical assistance to help in the design and setting up of Green Finance Facilities (GFF);

- Equity capital to replenish local green finance facilities;

- Co-financing of green finance facilities’ sustainable transactions by providing de-risking mechanisms and concessional resources.

The African Development Bank has been working closely with its partners on a number of joint initiatives:

- Raising awareness about Green Banks by organizing several meetings and webinars around this subject;

- Launching a joint CIF-African Development Bank scoping report evaluating Green Banks’ potential in six African countries (Ghana, Tunisia, Zambia, Mozambique, Uganda and Benin) at COP 26;

- Mainstreaming green finance facilities into the African Adaptation Acceleration Program’s (AAAP) Pillar 4 on Developing Innovative Financial Initiatives in Africa.

C. BOOSTING THE AFRICAN PRIVATE SECTOR'S ACCESS TO CLIMATE FINANCE

Beyond developments in the regional and local institutional frameworks, many initiatives have recently flourished across the continent to boost access to climate finance.

The Africa SME Programme is also worth highlighting, as it aims to help African financial institutions and SMEs access climate finance in a more systematic way across the continent31. The overarching goal of the programme is to boost private sector participation in the implementation of NDCs through green investments. This will be achieved by mobilizing concessional and non-concessional resources and channeling them into African SMEs through financial institutions. Its purpose is precisely to handle transactional engagements, target strategic financing challenges and enable SMEs’ connection to finance in areas such as energy, circular economy and food security in adaptation and mitigation, whilst deploying appropriate solutions to overcome the financing barriers in African countries.

Another noteworthy mechanism for mobilizing private funds is the Adaptation Benefit Mechanism (ABM)32. Expected to launch in 2023, the ABM seeks to engage the private sector in financing climate adaptation. The ABM is designed to help African MSMEs invest in adaptation projects by providing credible and transparent means through which developed countries and consumers can provide finance to make adaptation technologies bankable.

Precisely, the Mechanism invites international organizations, corporates, philanthropies and governments who are spending money on mitigation activities, to spend an equal amount on the purchase of Certified Adaptation Benefits (CABs) through the ABM. These CABs can be used to report contribution towards genuine adaptation needs in developing countries. CABs will be purchased from adaptation projects implemented by large scale private sector enterprises in African countries. The Bank and other African financial institutions will work to put in place financing products and guarantees that will enable African private sector actors to develop, finance and implement projects in advance of delivering CABs and receiving cash flows.

The ABM is a good example of an initiative developed by development finance institutions to address challenges associated with financing small-scale, context-specific adaptation projects.

Focus: An implementation of the Adaptation Benefit Mechanism, the Cocoa Livelihood Resilience Program

The Africa Climate Change Fund (ACCF)- funded project “Cocoa Livelihood Resilience” is the first demonstration project in a pilot phase of the African Development Bank’s Adaptation Benefit Mechanism33.

This project implemented by World Agroforestry (ICRAF) aims to promote sustainable and climate-resilient cocoa farming through agroforestry. The overall objective of the project is to help cocoa smallholders to become more resilient to climate change in the south-western part of Côte d’Ivoire and in three other cocoa-producing countries: Ghana, Togo, and Cameroon.

Côte d’Ivoire is the largest producer of cocoa beans in the world, accounting for 40% of global production. Moreover, cocoa is the country’s largest agricultural commodity, representing 15% of Ivorian GDP and contributing to one third of export income. However, the sustainability of cocoa production is threatened by a host of factors, such as depleted soil fertility, diseases affecting cocoa beans, ageing plantations and unsustainable agriculture practices. These factors are further exacerbated by the effects of climate change, making farmers increasingly vulnerable to bad quality yields.

As a first phase of the project, consultations and workshops will be organized with public and private sectors, non-governmental organizations, cocoa smallholders, women’s and youth associations on the implementation of the Mechanism. The Adaptation Benefit Mechanism will enable stakeholders to evaluate the benefits of agroforesty for climate adaptation in the cocoa sector, based on a transparent measurement and reporting methodology.

The Bank is targeting to complete the operationalization of the ABM activity cycle and delivering an operational mechanism to the international community for wider use in 2023.

Developing Carbon Markets in Africa and the Role of the African Development Bank

In this section, we will discuss the role that carbon markets can play in filling the finance gap in African countries. Carbon markets are trading systems in which carbon credits are bought and sold. Carbon credits or offsets can come from private entities that develop carbon projects or from governments that develop programs certified by carbon standards to generate emission reductions or removals34.

In Africa, the potential of carbon markets is still far from being realized. To tackle the fundamental challenge of the climate financing gap in Africa, the African Carbon Markets Initiative (ACMI) was launched at COP27, led by a 13-member steering committee of African leaders, company executives and industry specialists35. ACMI’s ambition is to produce 300 million carbon credits annually by 2030 and 1.5 billion credits annually by 2050, aiming to unlock $6 billion in revenue by 2030 and over $120 billion by 2050. Several countries have signed up to the initiative, including Kenya, Gabon, Malawi, Mozambique, Togo, Nigeria, Burundi and Rwanda.

This initiative stems from a recognition that carbon markets have a significant potential to unlock the needed capital to finance climate mitigation and adaptation efforts in Africa. On top of that, they can also contribute to creating millions of jobs, thus providing development opportunities for communities which are at the forefront of the fight against climate change.

BUILDING THE INFRASTRUCTURE FOR AN EFFICIENT CARBON MARKET IN AFRICA

Article 6 of the Paris Agreement, which sets the rulebook on global carbon markets, was approved in November 2021 at the COP26 climate summit in Glasgow. This gave the green light to a market where countries can trade carbon credits generated by the reduction or removal of GHG emissions, such as by switching from fossil fuels to renewable energy, or by increasing or conserving carbon stocks in natural ecosystems. A similar mechanism was already introduced back in 1997 with the signature of the Kyoto Protocol, namely the Clean Development Mechanism (CDM). By 2014, the CDM supported investments worth around $90bn in emissions reduction projects.

It is expected that carbon markets can help reduce the cost of implementing NDCs by more than half – by as much as $250 billion by 2030 according to some estimates36. Globally, more than two thirds of countries are planning to use carbon markets to meet their NDCs.

For countries to benefit from carbon markets, efficient infrastructure and institutional capabilities need to be implemented. In this regard, Multilateral Development Banks have the potential to support countries in building up their capabilities and setting up their strategy to contribute to carbon markets.

In 2017, a Multilateral Development Bank Working Group was established to support the design and implementation of Article 6 of the Paris Agreement. The group aims to facilitate knowledge sharing based on MDB’s extensive experience in supporting the development of climate market/pricebased mechanisms at both the domestic and international levels. One of its objectives has notably been to pilot the creation of an initial supply of Mitigation Outcomes (MOs), which essentially replace most forms of international carbon credits as outlined in the Kyoto Protocol.

In Asia, the Asian Development Bank (ADB) has worked in the past years on the operationalization of Article 6 of the Paris Agreement. The Bank has developed a Carbon Market Program (CMP) which supports the development of emission mitigation projects in developing countries in Asia and the Pacific that fall under the Clean Development Mechanism of the Kyoto Protocol. As part of this Program, the Bank has established the Article 6 Support Facility (A6SF) to help develop a policy and legal framework of emissions trading schemes in the region. Moreover, ADB has set up a Climate Action Catalyst Fund (CACF) in 2019 aiming to support its developing member countries to scale up mitigation actions through the purchase of post-2020 MOs.

The box below provides an overview of the African Development Bank’s contribution to the MDB work on carbon market development.

Focus: The African Development Bank’s Support to Carbon Market Development in Africa

The African Development Bank has been working on carbon markets since the times of the Clean Development Mechanism (CDM) and hosted, back in 2010, the Africa Carbon Support Program with funding from the Fund for African Private Sector Assistance (FAPA). More recently, the Bank has supported the African Group of Negotiators at the COP negotiations and secured a grant from FAPA to help build capacity for private sector engagement in Article 6 activities in West Africa.

As part of the World Bank-led MDB Working Group, the African Development Bank has contributed to the development of guidance and warehousing mechanisms to underwrite the development of carbon markets.

Specifically, the African Development Bank has been leading work on nonmarket approaches under Article 6.8 of the Paris Agreement, including work on the Adaptation Benefit Mechanism. The Working Group's 2023 program includes further work on the development of non-market approaches to finance the deployment of mitigation technologies for high global warming potential (GWP) greenhouse gases, which otherwise have potential to distort markets.

The Bank is also supporting work on the transition of CDM tools and methodologies into Article 6.2 and 6.4 methodologies, in order to avoid the loss of a substantial body of technical work that has already been conducted on the topic.

The Bank is now planning to create a new initiative, leveraging off the African Carbon Support Program to provide further help to both voluntary carbon market and Article 6 activities.

Finally, the aforementioned African Financial Alliance on Climate Change (AFAC) has also been working on the development of carbon markets through capacity building for financial institutions to harness existing international climate finance opportunities. In one training conducted in June 2021, the modules introduced DFI participants to developing successful Green Climate Funds proposals, including REDD+ results-based projects37. While the legitimacy of REDD+ carbon credits have recently been put in question, they are still viewed as as an enabler for participation in carbon markets. To increase confidence into carbon markets, including across the African continent, underlying methodologies will have to be reviewed and re-assessed regularly by third-party auditors, to better account for these projects’ benefits on climate, community and nature.

While carbon markets will not be sufficient to reach climate objectives, they can play a credible role in the fight against climate change by generating funding to reduce greenhouse gas emissions and strengthen natural or technological carbon sinks.

Conclusion

Climate change threatens sustainable development in Africa, particularly among poor and vulnerable countries which are the smallest contributors to global greenhouse gas emissions. As a result, financing climate mitigation and increased climate resilience has to be done in a way that is economically empowering and socially inclusive for all African citizens.

Moreover, the scale of the climate crisis is such that public sources of funding will not be sufficient to reach climate objectives. The African Development Bank is committed to deploying a range of means, including mobilizing Africa’s private sector and harnessing financial and technological innovation to ensure a more climate-resilient future. This is done by leveraging the Bank’s partnerships to ensure a multiplier effect, and drawing on its understanding of Africa’s governance and institutional systems to strengthen capacity. In this regard, partnering with asset managers through blended finance partnerships that provide de-risking mechanisms for private sector investors can significantly increase capital flows to climate-friendly assets on the continent.

While the roadmap for achieving climate neutrality by 2050 is ambitious, we believe that development finance institutions alongside institutional investors have powerful tools at their disposal to reach global climate objectives, provided they work together in a way that reflects principles of a just transition towards a decarbonized future.

Sources

1. UNDP, February 2022.

2. https://www.un.org/africarenewal/magazine/february-2023/one-year-later-impact-russian-conflict-ukraine-africa

3. African Development Bank, 2022

4. IEA Africa Energy Outlook 2022 https://www.iea.org/reports/africa-energy-outlook-2022

5. World Meteorological Organization (2021) “State of the Climate in Africa 2020” https://library.wmo.int/records/item/57682-state-of-the-climate-in-africa-2020

6. IPCC, Sixth Assessment Report

7. IPCC Sixth Assessment Report Chapter9 https://www.ipcc.ch/report/ar6/wg2/

8. https://www.naturebasedsolutionsinitiative.org/

9. https://napcentral.org/submitted-naps

10.https://www.afdb.org/en/documents/climate-and-green-growth-strategic-framework-projecting-africas-voice-strategy-2021-2030

11. Agriculture, Forestry, Fisheries and Land Use; Health; Human Development; Water, Sanitation and Hygiene, Infrastructure and Urban Development, Disaster Risk Management

12. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/africa-adaptation-acceleration-program

13. https://www.elysee.fr/en/emmanuel-macron/2022/02/18/just-energy-transition-partnerships-in-africa

14. https://www.gfanzero.com/africa-network/

15. https://www.treasury.gov.za/comm_media/press/2022/SA%20Green%20Finance%20Taxonomy%20-%201st%20Edition.pdf

16. https://www.bii.co.uk/en/news-insight/insight/articles/transition-finance-for-africa/

17. https://www.ifc.org/en/insights-reports/2023/emerging-market-green-bonds-report

18. https://www.boad.org/wp-content/uploads/2021/01/FrameworkBOAD.pdf

19. https://projectsportal.afdb.org/dataportal/VProject/show/P-TZ-FAB-004

20. https://projectsportal.afdb.org/dataportal/VProject/show/P-RW-EA0-015

21. International Institute for Sustainable Development (November 2022) “Making the Leap: The need for Just Energy Transition Partnerships to support leapfrogging fossil gas to a clean renewable energy future”.

22. https://www.afdb.org/en/news-and-events/press-releases/cop27-african-and-global-partners-launch-multi-billion-alliance-greeninfrastructure-56403

23. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/african-financial-alliance-on-climate-change-afac#

24. https://africandchub.org/sites/default/files/2021-11/211103_ANDC%20Hub_Africa%E2%80%99s%20NDC%20journey%20and%20climate%20finance_.pdf

25. https://www.amundi.lu/professional/Local-Content/Producsheet/Amundi-Planet-Emerging-Green-One/Amundi-Planet-Emerging-GreenOne

26. https://pressroom.ifc.org/all/pages/PressDetail.aspx?ID=26688

27. https://www.amundi.com/institutional/article/aiib-amundi-climate-change-investment-framework-1st-report

28. https://www.amundi.com/globaldistributor/Responsible-Investing/Amundi-s-ESG-Ambition-2025

29. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/africa-adaptation-acceleration-program

30. https://www.afdb.org/en/news-and-events/african-development-bank-launches-model-deploying-green-financing-acrosscontinent-56903

31. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/access-to-finance-for-smes-through-fis

32. https://www.afdb.org/en/topics-and-sectors/initiatives-partnerships/adaptation-benefit-mechanism-abm#

33. https://www.worldagroforestry.org/project/cocoa-livelihoods-resilience-enhancing-resilience-smallholder-cocoa-farmers-cote-divoire

34. For more details on the potential and the limits of carbon offsets, please refer to Amundi’s ESG Thema 5: https://research-center.amundi.com/article/esg-thema-5-carbon-offsetting-how-can-it-contribute-net-zero-goal

35. https://climatechampions.unfccc.int/africa-carbon-markets-initiative-announces-13-action-programs/

36. https://www.worldbank.org/en/news/feature/2022/05/24/countries-on-the-cusp-of-carbon-markets#

37. REDD+ encourages developing countries to reduce emissions from deforestation, to foster conservation of forests, and to enhance forest carbon stocks

Contributors

African Development Bank:

Stephanie Simon, Principal Treasury Officer, Treasury Department

Raymond Seager, ESG Consultant, Treasury Department

Gerald Esambe Njume, Principal Climate Change & Green Growth Officer, Climate Change & Green Growth Department

Fatima Moussas, Young Professional, Climate Change & Green Growth Department

Davinah Milenge Uwella, Principal Program Coordinator, Climate Change & Green Growth Department

Julia Lacal Bereslawski, Young Professional, Climate Change & Green Growth Department

Andinet Woldemichael, Principal Research Economist, Economic Governance and Knowledge Management Vice Presidency Department

Amadou Boly, Special Assistant, Office of the Chief Economist & Vice President, Macroeconomics Policy, Forecasting And Research Department

Amundi:

Joan Elbaz, Business Solutions and Innovation, Institutional Division

Tom Deneke, Business Solutions and Innovation, Institutional Division

Gaëlle Blanchard, ESG Analyst

Lucy Acton, ESG Analyst