Summary

- The Silicon Valley Bank (SVB) failure and US regional banks under pressure: The SVB bank failure is the third after Signature Bank and Silvergate Bank, and it is the largest bank failure since the 2008 financial crisis, with SVB being the 16th biggest US bank. The failure was mainly due to an asset-liability mismatch, which resulted in the materialisation of losses from sales of quality bonds that were trading down amid rising yields over the last year.

- Fed intervention: The Fed stepped in to support liquidity by creating a Bank Term Funding Program to offer loans (of up to one year) to lenders pledging high-quality securities such as USTs, agency debt and mortgage-backed securities. These assets will be valued at par. While systemic confidence will take a bit to be fully restored, the announcement is an important step in this direction.

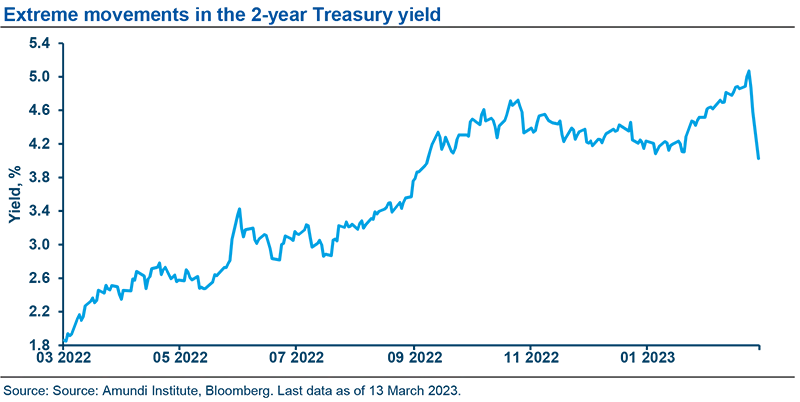

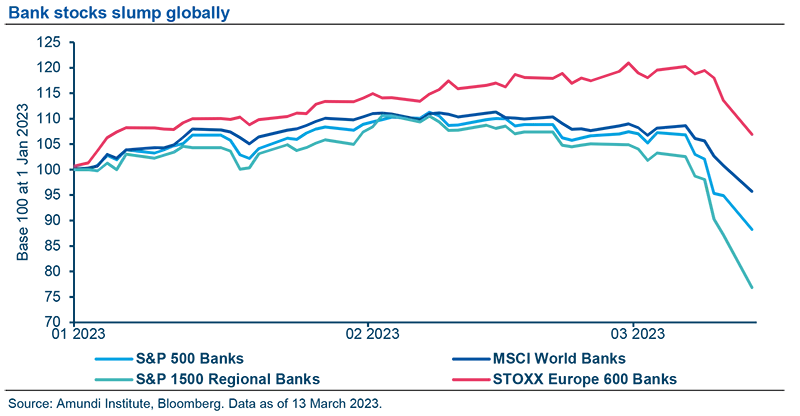

- Market reaction: bond markets have been extremely volatile with extraordinary movements in the 2-year yield, with its biggest 1-day drop since 1982. Equity markets also sold off, particularly in the banking sector, including in Europe where we believe the move was mainly due to profit-taking after strong performance since the start of the year.

- Why we believe this is not a systemic risk: while being a negative for the market, the SVB failure is more of an idiosyncratic story rather than a systemic issue. Compared to the Lehman crisis, the bank is not leveraged, has no big derivatives exposure and no relevant global connections. Yet, this event highlights the need to carefully assess the lagging impacts of higher rates, particularly when it comes to non-systemically important financial institutions and some other non-banking financial institutions, which lack strict regulation.

- View on the banking sector: since the Great Financial Crisis, the big systemic banks are well capitalised and highly regulated. Overall we favour large banks versus small banks. Particularly in Europe, the sector is in far better shape compared to the previous crisis and we don’t see any risks, such as the one the US regional banking sector is exposed to, amid its better management of duration risk and stringent regulatory requirements. The effect on banks could be more connected to their earnings trajectory, which is our focus at the moment. Overall, this event adds to the case of selection and differentiation among banks.

- Possible impact on Central Bank policy: While we believe the Fed will remain committed to fighting inflation, it will have also to assess the impact of the current crisis and its potential spillovers, as the macro scenario remains fragile and the overall assessment is not easy given the lagging effect of policy actions on the economy. The tightening of financial conditions stemming from the SVB crisis may lead to a less aggressive Fed than expected only one week ago and could force the ECB to reassess its policy path. Yet market moves have been extreme and we believe now is not the time to fight the Fed, as inflation remains a key factor to watch.

- Overall investment stance: overall we confirm a cautious stance as with the inversion of the yield curve suggests some cracks may start to appear. We remain cautious regarding equity and high-yield credit, with a regionally diversified approach, including exposure to Chinese equity, which appears more insulated from the epicentre of the recent turmoil.

What happened to Silicon Valley Bank?

Silicon Valley Bank (SVB), a commercial bank that specialises in serving start-ups in Silicon Valley, has been shut down by regulators.

The bank relied on wholesale funding, was heavily concentrated on the tech industry, and had lower capital requirements and lower regulatory scrutiny than larger banks, all of which contributed to its failure. Early indications are that the actual bank failure was initiated by an asset-liability mismatch as opposed to any issues derived from the mispricing of underlying assets.

Specifically:

- On 8 March, the bank announced plans to raise $2.25 billion in capital to fund deposit outflows and shore up losses from sales of securities that were underwater due to the rise in yields over the last year.

- The outflows were primarily due to the bank’s unique customer base, namely venture capital (VC) funds and VC-funded start-ups. Historically, cash burn rates on the deposit balances were offset by additional venture capital (VC) funding, but VC funding has dried up in this environment. Hence, these start-ups increasingly relied on their deposits.

- The situation was aggravated when some VCs suggested that companies should move money out of SVB into other banks, resulting in an old fashion run on the bank as depositors asked for their money back. Investors, in turn, dumped SVB shares which collectively created funding issues for the bank.

How did the regulators respond?

On 10 March, late morning, the California Department of Financial Protection and Innovation ordered the bank to close and put it under the control of the Federal Deposit Insurance Corporation (FDIC). This was followed by the Fed announcing the creation of a Bank Term Funding Program to address liquidity issues.

“The additional funding will be made available through the creation of a new Bank Term Funding Program (BTFP), offering loans of up to one year in length to banks, savings associations, credit unions, and other eligible depository institutions pledging US Treasuries, agency debt and mortgage-backed securities, and other qualifying assets as collateral. These assets will be valued at par. The BTFP will be an additional source of liquidity against high-quality securities, eliminating an institution's need to quickly sell those securities in times of stress.”

The regulators’ actions are positive because they should help stabilise the markets. We are also starting to see calls for strengthening regulation further.

What is your view on the financial system, is this a systemic issue?

While the SVB is definitively a negative market event and adds to an already uncertain backdrop, we don’t’ see a systemic risk stemming from it, but we will likely continue to see cracks in the system.

We believe this is not a systemic event such as Lehman Brothers. The latter was a credit problem (tremendous impairment in risky MBS holdings). However, SVB faces an asset-liability mismatch, with quality investment holdings of government bonds and agency MBS. The extent of the losses is far less than the one experienced by Lehman. Moreover, Lehman was highly levered and completely interconnected with the financial system through a vast network of derivatives. SVB (and others) are far less levered. It has no huge derivative exposure and is less interconnected.

This is more of an idiosyncratic event, and we do not see any large systemic banks in a similar situation. Overall, we think systemic banks are in a much better condition than in 2008 and we are not worried by them, per se, in terms of solvency and their capacity to absorb shocks.

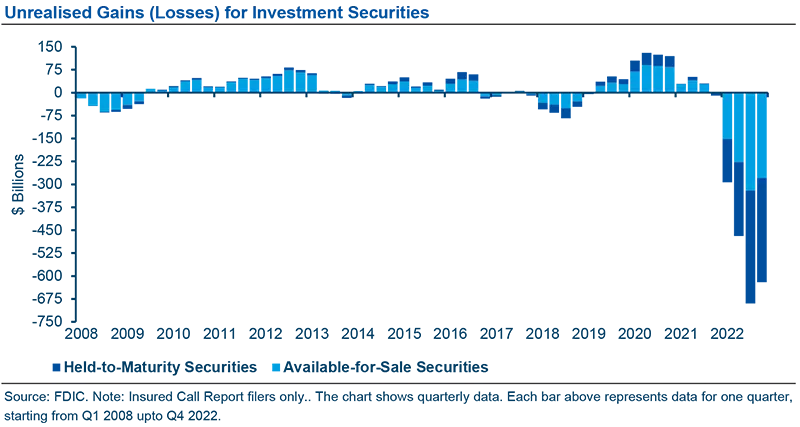

For smaller banks, however, there are some risks. For instance, smaller banks have less stringent capital rules which may fail to prevent such situations. We particularly need to closely monitor the non-systemically important financial institutions and some other non-banking financial institutions. This is because we could see some lagging effects of higher policy rates on their balance sheets and ability to access funding, resulting in some imbalances built here and there, which is also visible in the potential losses for US banks of around $620 billion, according to FDIC (see following chart).

What is your view on the banking sector?

We are selective on banks and we are cautious on mid-cap financials.

We are positive on the banking sector, overall, in the US but we have a cautious stance regarding midcap financial equities. We favour banks with meaningful valuation support and a diverse deposit base. We are avoiding banks with credit risk as these are more exposed to recession risk. Similarly, in credit, our preference was and remains in favour of systemically important US and non-US banks which have built up capital and liquidity, improved their funding profiles and demonstrate lower leverage post the Global Financial Crisis. These banks are highly regulated with stringent capital and liquidity requirements and demonstrate less concentrated deposit profiles and more diversified business models than smaller, regional banks.

While we expect heightened near-term volatility, the SVB event could ultimately have a positive impact on large banks, in three respects:

- SVB customers, and perhaps customers at smaller banks, are likely to move deposits to larger, more established institutions.

- Industry lending standards will likely tighten further, which will constrain economic growth, reduce inflation and make it less necessary for the Fed to continue raising interest rates. As a result, customers will have less incentive to move deposits into higher-earning assets as interest rates plateau.

- A risk-off environment due to concerns about the financial system could result in a shift out of equities back into cash, which would increase industry-wide deposits.

What is your view on the European banking sector?

In Europe the sell-off is mainly driven by profit taking. We still favour EU banks vs US.

On the European banking side, there is very little contagion risk and the money market is pretty stable, which doesn’t signal any material tension. The big sell-off has been driven by positioning and profit taking after the strong market performance since the beginning of the year. Relative to US banks, EU banks seem attractive and we have a preference for Europe, as well for larger banks versus smaller ones.

We favour banks with solid balance sheets and profitability. On the balance sheet front, it’s important to understand the quality of capital and solvency levels. Since the Great Financial Crisis, the sector has deleveraged and reduced assets while growing deposits, so the imbalance in liquidity in terms of the loan-to-deposit ratio (which was very high in the past) has been corrected.

Markets and regulators also now place a big focus on Liquidity Coverage Ratios and the regulator has made European banks do a lot of intensive stress testing over the last few years, including stress tests for interest rate shocks. The European sector appears resilient in this respect as European banks don’t take big duration bets, they hedge interest rate components and mostly hold short-dated securities. So they don’t face the same risks as SVB or other small US regional banks.

Do you expect this event to change the Fed’s tightening monetary policy stance?

The tightening of financial conditions stemming from the SVB crisis may lead to a less aggressive Fed than expected only one week ago.

In recent weeks, markets had started to price a more aggressive Fed policy to fight inflation, but the spectre of a crisis has driven this trend into reverse, which has been visible in the extreme moves in the 2-year Treasury yield. While we believe the Fed will remain committed to fighting inflation, it will also have to assess the impact of the current crisis and potential spillovers, as the macro scenario remains fragile and the overall assessment is not easy given the lagging effect of policy actions in the economy.

We believe SVB’s failure will contribute to tighter financial conditions and will add to the liquidity issue. With greater pressure on bank equity valuations, banks may become increasingly conservative in their lending practices and place greater emphasis on liquidity.

This could lead to a less aggressive Fed than expected only one week ago in its hiking path, as financial conditions have already tightened, and this has a lagged impact on growth which is not yet completely visible. The Fed has taken the situation seriously and acted to protect the bond market and avoid a major meltdown.