Weekly Market Directions

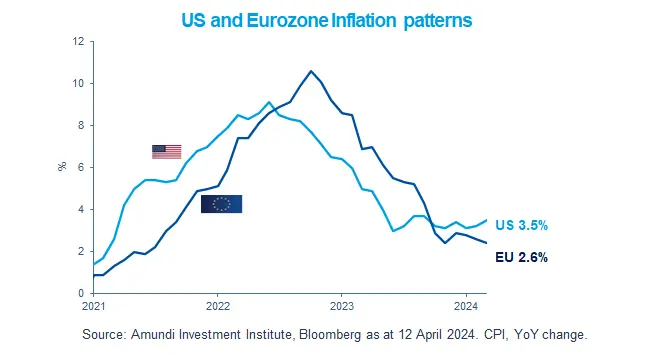

ECB's next move should be a rate cutExplore how ECB's anticipated rate cuts in June could fuel European bond interest amid global inflation and rate decisions. A pivotal move for the markets.

Latest insights -

AllView 1

Latest articles

Most read

Unveiling the value of EM debt Institutional investors’ approaches to responsible investing Global Investment Views - April 2024 Five insights on institutional investors’ approach to Responsible Investments ESG Thema #15 - Measuring the Biodiversity Footprints of Investments: An Assessment of the Metrics

Most viewed articles